Jet Airways has been in a lot of financial trouble over the past few months. In September, they were in a liquidity crunch, so they started to implement measures to save money, a lot of which included cutbacks from the passenger experience. Here is the latest news of Jet Airways.

- Jet Airways cuts meals for Deal and Light passengers

- Jet Airways passengers denied Lounge Access in Mumbai Airport

- Jet Airways meal cutbacks start

- Jet Airways lounge access withdrawal for Gold & Platinum Members

- Jet Airways will drop meal service on most Domestic Economy Fares in 2019

- Jet Airways revises Change and Cancellation fees on domestic flights from February 2019

All of this, apart from apparently not paying their salary dues in full, and cutting out on various flights. Here is an update on the routes that are gone.

- Jet Airways massive International route consolidation coming December 2018

- Reading into Jet Airways Q3 Results 2018

- Jet Airways Middle-East Network changes

- Jet Airways Domestic Route network being cut back

- Jet Airways’ shutting down another 7 stations including 4 North-East stations

There is a funding gap of nearly INR 8,500 crores, roughly equivalent to USD 1.2 billion. After the airline skipped a deadline to pay their loans in December 2018, however, the banks had to sit up and take notice. Missing a bank loan payment in India is not cool.

There has been much speculation about what would happen going forward, but now there seems to be clarity coming in. It will be a two-step process to convert the debt of Jet Airways into Equity, and from there, to infuse more funds into Jet Airways.

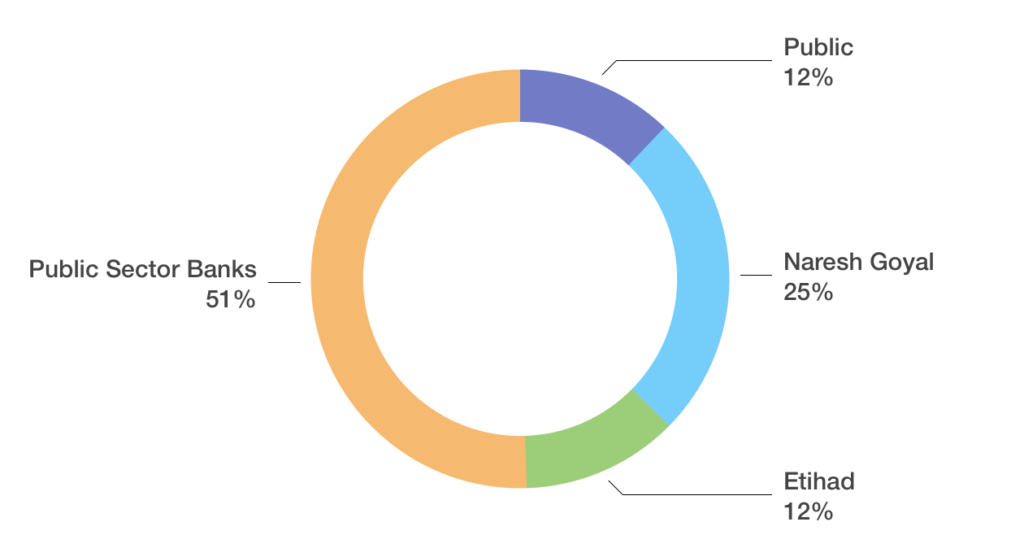

From what I could garner in the Post-Earnings call and BSE filling, Jet Airways will issue 11.4 crore fresh shares to Lenders. This fresh shares issuance will make them the largest shareholder of the airline at 50.1%. Following this, all current shareholder’s share will reduce by half. This is how the 1 Rupee transaction will change the shareholding.

Then there were several news reports of two companies performing equity infusion in Jet Airways in the near future. In the Post-Earnings call, it was mentioned that Jet Airways will close in the funding gap of INR 8,500 crores by Equity Infusion, Debt Restructuring and Sale & Lease Back. So to put it simply, there are four aspects of the restructuring plan:

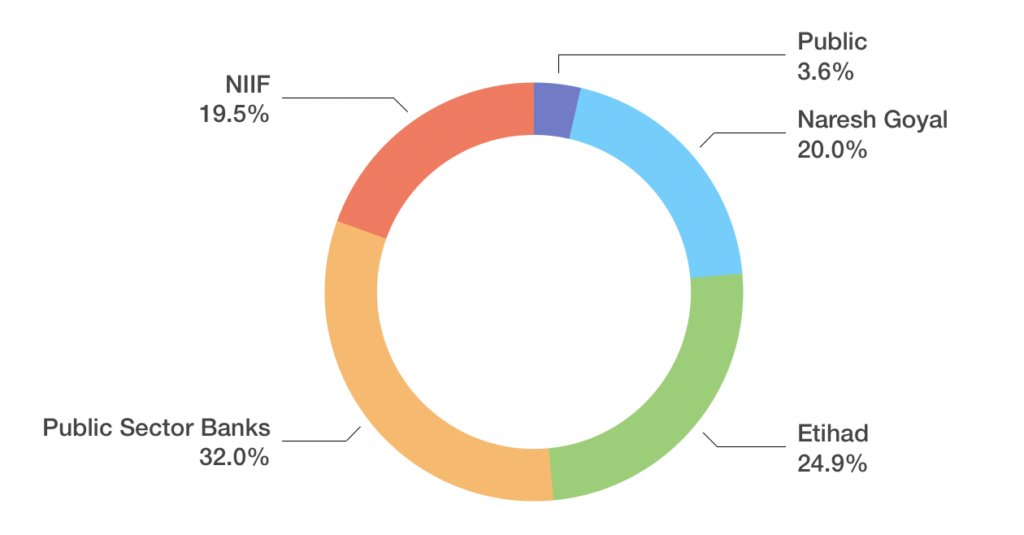

- Convert Debt to Equity: Lenders led by State Bank of India will convert INR 600 crores of debt into equity. Following this, the banks will have a 32% stake in the airline. Fresh shares will be issued for this conversion.

- Equity Infusion: The National Investment and Infrastructure Fund (NIIF), a 49% Government of India owned Sovereign Wealth Fund which is also backed by Abu Dhabi Investment Authority will invest INR 1,400 crores and take another 19.5% stake in Jet Airways. To sum up, the Government of India backed NIIF and Banks will own 51.5% of Jet Airways.

Etihad Airways will infuse INR 1,400 crores to raise its shareholding to 24.9%. Naresh Goyal, the current promoter, will invest INR 700 crores in the airline, but his share will go down from the current 50% plus to 20%. - Debt Restructuring: The INR 6,000 crores debt will be restructured to long term debt, payable over a decade.

- Sale and Leaseback of Aircraft: Jet Airways has INR 1,700 crores of Aircraft related debt on its books. The entire debt will be pared by the sale, as well as SLB of aircraft for which Jet Airways claims to have already zeroed in on interested parties. The sale of aircraft may refer to the ATRs that Jet Airways is retiring. Jet Airways has already closed it’s Bengaluru ATR base and it currently operates a few out of Delhi.

Jet Airways currently owns 16 aircraft, a mix of both widebodies as well as narrowbody aircraft. All these aircraft will be sold off and leased back to pare the debt.

The promoter and the current majority shareholder, Naresh Goyal will see his stake come down from the current 50.1% to just 20%. So in the end, the shareholding pattern may be,

A few things don’t add up though. Naturally, there will be more clarity this week as an Extraordinary General Meeting is scheduled this week to approve the plan.

Post the restructuring, Naresh Goyal may have to relinquish his seat on the Board as well as his position as the Chairman of Jet Airways. He may remain as a promoter of the airline.

A lot of questions are however still to be answered. Will Etihad Airways again get to channel traffic through Abu Dhabi? Or will Jet Airways do a combination of both, the current strategy of increased partnership with Air France-KLM-Virgin Atlantic-Delta as well as the earlier strategy of complimenting Etihad’s India route network?

As for me, I am more interested in what is the future of Jet Airways? When will they start taking deliveries of the Boeing 737Max again?

What are your thoughts on the restructuring plan? Follow along for more latest news on Jet Airways.

Is Jet Airways going to shut shop ?

With the current situation in Jet Airways, will the routes to Europe/ US/ Canada lilkely to get affected? If yes, is Jet Airways going to make some alternate arrangements for the passengers bound for those destinations?

Its has been more than 3 months since jet has credited miles on my account. Tired of mailing them

Which card do u hold…

I too have not got since 2 months

i am holding jet amex co branded card and so far no delays in anything / more over i even got my airlines miles / bigbasket / flipkart / amazon miles also on time . the diwali 2X offer in diwali, also extra miles have also been credited on time .

Roughly 1.2B USD = 8500 crores INR

@Prasanth, fixed. My bad.

The big problem here is the promotor, he does not want to relinquish his post as Chairman and yet wants the worlds money to save his airline. whoever pays money into the airline and is the majority paymaster to save the airline will control the airline. Period. Does the promotor get it?

Very true..his stubborn attitude has led to this state of affairs

And unprofessional way of doing things – check with any senior staff in Jet Management – he and his wife run the airline like a mom and pop shop. Everything is decided by them and the CEO is a puppet.

My question in all this is is it worth holding jet cobranded credit cards in future,as this is a blog for CC…is it worth collecting Jp miles after paying annual fees

I had the same thing in my head going around again and again. It seems that people are trying to fight it out to save the airlines unlike the kingfisher counterpart where no one wants to do anything about it .

I have roughly now 1.6 Lacs + JP miles [ i am not a platinum member] so i have to pay for my co-branded CC with Jet-Airways. I am thinking to change my JET Co-branded card to some other travel card such as Amex Platinum Travel card which atleast gives me more if i spend 4 lakhs or more per annum.

Hello,

Thanks for the article.

Currency conversion in following statement doesnt seems correct.

“There is a funding gap of nearly INR 8,500 crores, roughly equivalent to USD 12 billion. “

@Prakash, fixed. My bad.