Jet Airways has existing co-branded credit cards with HDFC Bank, ICICI Bank, American Express and a co-branded debit card with HDFC Bank. And now, they have launched the fifth product in the market, which is in collaboration with IndusInd Bank, called the Jet Airways IndusInd Odyssey Credit Card. There is also a lower product called the Jet Airways IndusInd Voyage Credit Card.

The product is similar to ICICI Bank’s card in the sense that IndusInd is offering a Visa Signature version as well as an American Express version, and you can choose to have either or both for the same amount of annual fees. Lets go over the benefits then for these products:

Sign-up bonus: For the Odyssey cards, you get 15000 JPMiles as a joining benefit, along with a base fare waived ticket for domestic travel on Jet Airways. For the Voyage cards, you get 7,500 JPMiles as a joining benefit, along with a base fare waived ticket for domestic travel on Jet Airways.

Renewal benefits: 5000 JP Miles + 1 base fare waiver on Jet Airways for Odyssey card holders, and 2500 JP Miles + 1 base fare waiver ticket for domestic travel on Jet Airways.

Jet Airways benefits: Just like all the other co-branded Jet Airways cards, these ones also get you priority check-in, and 10 kgs extra baggage allowance on Jet Airways flights. Also, you get 5% off on all bookings made on Jet Airways and JetKonnect websites.

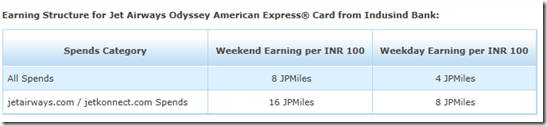

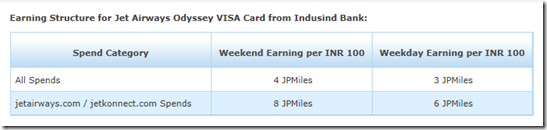

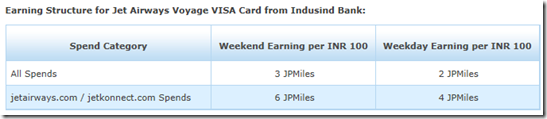

Regular mileage earnings: Interestingly, this card is aiming to give you spends basis weekday or weekend spending patterns.

On weekdays, the Odyssey Amex cards earn you the normal miles, but on weekends, they earn you much much more. I’m sure there is some study that has gone into making this feature work. With the Odyssey Visa cards, weekend earnings are good but not great.

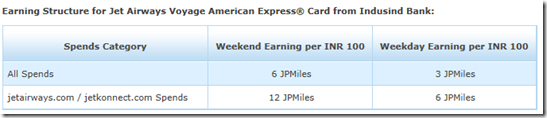

For the Voyage card, the earning structures are similar, but lesser.

The extra miles for spending on American Express are coming from the higher fees that Amex charges to merchants for transactions, which it is much despised for in the lower end of the market. Also, the mileage earning from regular spends is capped at 75000 JPMiles per annum for Odyssey Card holders, and 50,000 JPMiles per annum for Voyage Card holders.

Lounge Access: Amex Odyssey cards have unlimited access to the Altitude lounges in Mumbai and Delhi, which are also accessible by the ICICI Bank Jet Privilege Amex Cards. Voyage card holders get limited number of entries per annum. You can find my reviews of the Mumbai Altitude Lounge and the Delhi Altitude Lounge here.

You also get access to the Visa Lounge access program in case you do choose the Visa versions.

Early Bird Offer: If you achieve a spend of INR 125,000 on your Odyssey Amex within 100 days of card issuance, you get 20000 bonus JP Miles. This is valid for cards issued till December 31, 2014. Similarly, with the Voyage Amex, you get 10,000 bonus JPMiles for spending INR 75000 within the first 100 days. Also, you get 300 bonus JP Miles on every 5th transaction over INR 1000 on the credit card (Voyage or Odyssey both). Remember, this offer is only when you spend on your Amex versions, not the Visa ones.

Fees: The Odyssey card (Visa/Amex or combo) comes at a first year fees of INR 10000 plus taxes. Second Year onwards you only pay INR 4000 for the card. The Voyage card (Visa/Amex or combo) comes at a first year fees of INR 4000 plus taxes. You pay INR 2000 for the card the second year onwards. JP Platinum members get the card free till the time they hold Platinum Membership.

Bottomline: This is one more way of earning Jet Privilege miles, and I am sure hoping they hold on for the time being. I have a wallet full of JP co-branded cards, and I will get this one as well most probably. However, I am not sure how will I program my brain to use this card more on the weekends than the weekdays. But still, full marks to IndusInd for thinking up a new segmentation on how to award miles where I will be sitting with the calendar tallying up my statement every month.

Related Posts:

- Jet Airways and HDFC Bank launch a co-branded debit card

- Sunday Plastic: Jet Privilege HDFC Bank World Credit Card

- Jet Airways ICICI Bank co-branded credit Card

- Jet Airways American Express co-branded credit card

Join over 3600 people who check-in daily to find out about the best in travel.

Free emails (once-a-day) | RSS Feeds | Facebook Updates | Twitter | Instagram

is ther a Indusind credit card with one time papment of member ship fees partnering Jetairways

@Raghu The basic membership of Priority Pass (which most travel credit cards provide) requires you to pay $27 for lounge access.

Other options for you for lounge access are HDFC Diners club cards, HDFC Jet World and HDFC Regalia (last 2 offer 5 complimentary visits).

Hi,

I have applied for the voyage card. Seems like the VISA versions does not offer complimentary airport lounge visits but instead charge a usage fee of $27 per visit. Is this the case with all the travel cards or only indusind?

Hi Aj,

I got issued 20,000 miles on jet under the heading “Indusind Odyssey Amex Threshold Bonus”.

Do you know anything about this threshold limit.

Thanks,

Rohan

@Rohan last year if you spent more than INR 1.25 lakhs before end of year on the Amex version you got this bonus

Hi AJ,

A quick doubt… I have applied for the Indusind bank card.

The sales agent sold me that they will issue both Amex and Visa cards for this one.

Is it correct?

@Ankit, this is correct.

Applied for this but they rejected initially since my salary is remitted in USD every month. Have now submitted my Citi card copy and statement. Waiting for the response.

hi,

IndusInd card does seem tempting!i have the hdfc jet world card, call center is clueless about mastercard lounge access. How many annual visits are free for this card?

Can you do a ‘what’s in my wallet?’ Of all your cards and how you plan spend between them?

@NB I did a post in January called My 2014 Credit Card strategy. Will do an update in a few days as well.

Hi Ajay,

Since I am not jetprivilege platinum, I will need to pay for any of the co-branded jet card.

In case I wish to carry only one jet co-branded card which one will you recommend – Icici, HDFC, Amex or Indusind. Very small portion of my spending will be on jet airways or jet konnect. Card will used largely for regular spends.

Thanks

Vishal

@Vishal if you want to earn tier points, take HDFC. If you want access to good lounges in BOM,DEL and consistent earnings, take Amex. If you want a sign up bonus, take IndusInd.

@Varun: Good point. Although given its Jet, we could end with regular earnings for both weekdays and weekends!!

@AJ and @Deepak :- Bank website says double on weekdays, while Jet Airways website says double on weekends. Maybe take a screenshot, and ask for double on both weekdays and weekends 😉

Seems weekday earning is double, not the other way around. Pls check the website AJ – or maybe they changed it now!

thanks for the first hand info.

AJ, so do you typically take such cards for the first year benefits and not renew it next year?

or do you renew it every year?

@bluecrabs I so far have not cancelled any of my jet co branded cards. But then I am platinum as well