IndiGo, India’s market-leading airline, released its financial results for the third quarter of FY2026 today. While the airline continued its streak of reporting record-breaking top-line growth, the bottom line told a story of operational turbulence and significant one-time hits that took the wind out of its sails.

The Big Picture: Highest-Ever Revenue

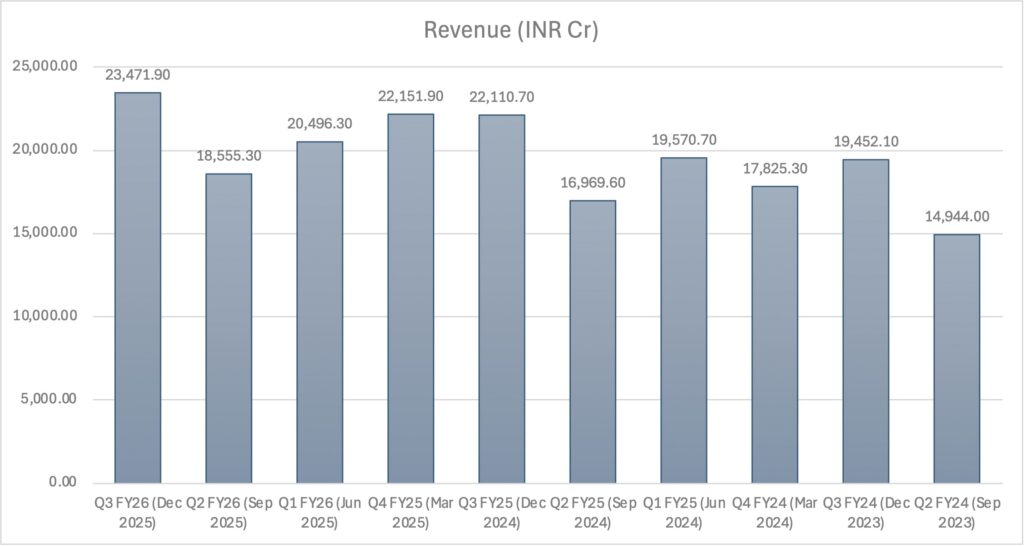

IndiGo reported its highest-ever quarterly revenue, with revenue from operations hitting INR 23,471.9 Crores (approx. USD 2.76 Billion), a 6.2% increase compared to the same period last year. Total income for the quarter stood at INR 24,540.6 Crores (approx. USD 2.88 Billion).

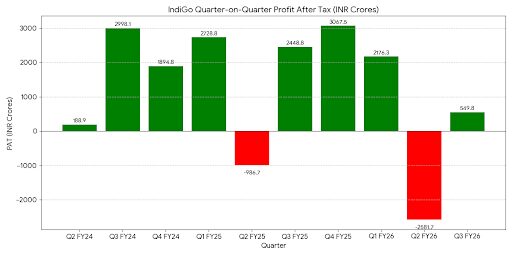

However, the headline profit number saw a massive dip. Net profit (PAT) plummeted nearly 78% year-on-year to INR 549.8 Crores (approx. USD 64.7 Million), down from INR 2,448.8 Crores in Q3FY25.

The December Meltdown

The primary reason for the profit erosion was a staggering INR 1,546.5 Crores (approx. USD 181.9 Million) in exceptional items. This was split into two major buckets:

- Operational Disruptions in December 2025: The airline took a hit of INR 577.2 Crores (approx. USD 67.9 Million), specifically due to the operational meltdown during the first week of December 2025. This period saw massive cancellations and delays as the airline struggled with the transition to new Flight Duty Time Limitation (FDTL) rules, leading to high costs for passenger compensation, refunds, and “Gesture of Care” vouchers.

- Labour Code Implementation: A provision of INR 969.3 Crores (approx. USD 114 Million) was made toward the implementation of new labour laws.

The fallout from the December disruption also led to significant regulatory heat, with a record penalty from the DGCA and internal management restructuring to address the systemic planning failures.

Capacity and Fleet: The 437-Aircraft Juggernaut

Despite the internal chaos, IndiGo’s fleet continues to grow at a blistering pace. As of December 31, 2025, the airline had in its fleet 440 aircraft:

- A320 Family: 180 A320neos, 26 A320ceo, 168 A321neo and 1 A321neo XLR

- Regional & Cargo: 46 ATRs and 3 A321 freighters

- The “Borrowed” Fleet: 2 B777s, 5 B787-9s, 5 Boeing 737s, 1 A320ceos and 3 A321neos, all on damp lease for fleet augmentation.

Yields and the Premium Push

IndiGo’s yields softened to INR 5.33. This indicates that, while the planes are full, pricing power has been diluted amid rising competition and the impact of the December cancellations.

On the product front, the rollout of IndiGo Stretch (Business Class) is now active on 12 routes, including the busy Delhi-Mumbai and Delhi-Bengaluru corridors, featuring RECARO seats and a more premium experience compared to the standard 6E offering. The airline is increasing the initial 45-plane subfleet to 65, as announced today during the investor call.

Bottomline

This quarter was a classic “tale of two airlines.” On one hand, you have a massive machine generating record revenues and inducting game-changing aircraft like the A321XLR. On the other hand, the “over-optimisation” of crew and network led to a self-inflicted wound in December that wiped out a significant chunk of profit. With the XLR starting international long-haul and the FDTL issues hopefully in the rearview mirror, 6E will be looking to regain its operational reputation in the final quarter of the fiscal year. However, this is also a quarter when travel is subdued due to exams and other life events.

What do you think of IndiGo’s “meltdown” quarter? Did the service recovery vouchers make up for the chaos? Let us know in the comments.

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

Leave a Reply