Last Friday, the bellwether of Indian aviation, IndiGo, disclosed their financial results for Q3FY2022. And there were a lot of interesting things to look out for in the results, where IndiGo revealed that they made a profit after many quarters of running a loss.

IndiGo declares an INR 129.8 Crore profit for Q3FY22.

IndiGo declared its results for October – December 2021, and the net profit for the quarter was INR 129.8 crores on a consolidated basis. For comparison, IndiGo had a net loss of INR 1435.7 crores in the quarter right before this one. On a year-on-year basis, IndiGo ran an INR 620.1 crore loss in the quarter ended December 2020.

The conference call with the IndiGo CEO Ronojoy Dutta had a lot of insightful nuances, however, which I thought could tell us about how the recovery of travel could work in favour of customers and the airlines. Remember, vaccination went on a high note across the country in the latter half of 2021, and it allowed for the doing away of pre-testing requirements for Covid-19, which are looked at as a cost for many.

IndiGo did most of its business during November/December 2021

Within the quarter, October ’21 was a relatively weak month, but strong momentum built up through November and December 2021, on the back of festival travel in India and the loosening up of the travel requirements. However, Ronojoy Dutta also mentioned that during the second half of December ’21, the airline started to decline in revenues as Omicron became prominent. During the quarter, however, IndiGo achieved strong pricing levels & high load factors of about 80 per cent.

IndiGo deployed approximately 45% more capacity, sequentially, reaching about 88% of pre-covid capacity for the quarter and about 97% of pre-covid capacity in December 2021. The capacity deployment did not just mean they flew more planes, but they also flew their aircraft for more time, generating more revenue out of those. IndiGo operated their plans for 10.7 hours compared to 7.7 hours in the previous quarter. The airline can further take up the capacity deployment to 13 hours per aircraft once international travel from India opens up.

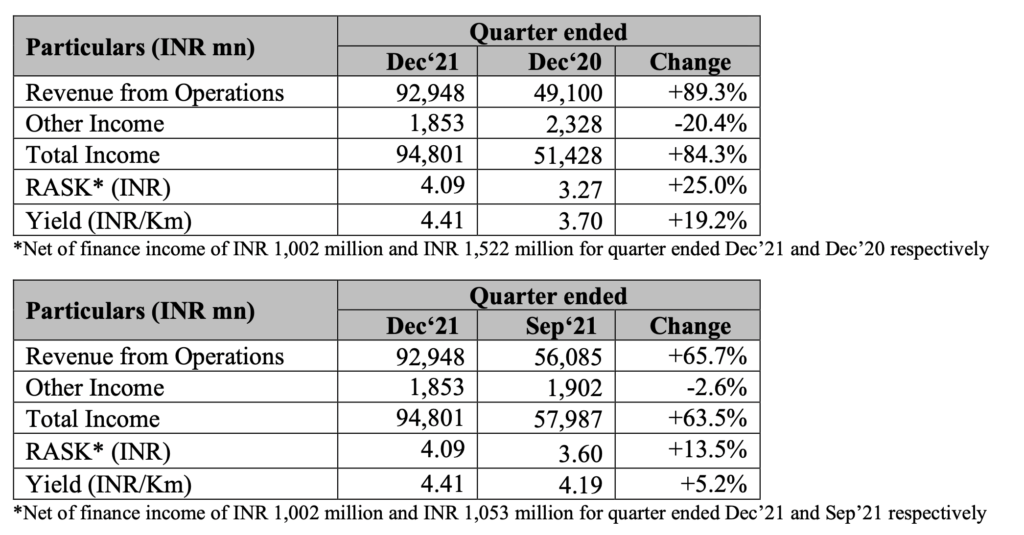

While on the one hand, the crowds at airports were troubling, for airlines, it was good news. At IndiGo, the load factors increased to 79.7% in the December quarter compared to 71.1% in September. Yields increased by 5.2%. These drivers led to a Revenue (per available seat kilometre) improvement of 13.5% sequentially to INR 4.09. Higher yields and higher capacity deployment resulted in sequential revenue growth of 63.5%.

While international capacity is still restricted for travel in and out of India, with the gradual addition of air-bubble flights, the international capacity deployed grew by almost 80%, quarter over quarter, and bookings grew by 95%.

Cost reduction on the back of increased capacity deployment

On the cost side, IndiGo reported a Cost (per Available Seat Kilometre) of 4.03 rupees, which is 10.7% lower compared to the prior quarter despite fuel costs going up. The higher capacity deployment (flying the same plane for about 50% more per day) helped reduce the unit cost. Fuel continued to be a significant headwind, and as a result, the fuel CASK went up by almost 13% on a sequential basis.

IndiGo is still replacing aircraft with NEO aircraft.

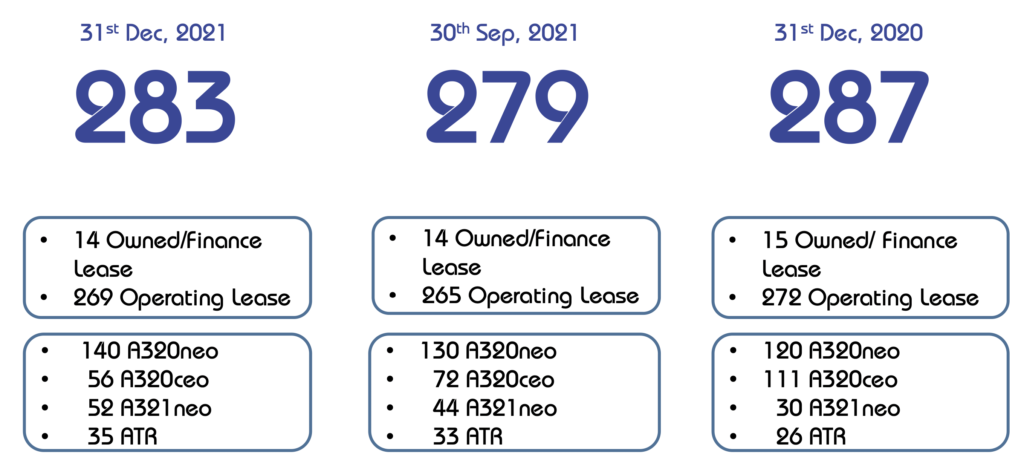

IndiGo is currently replacing the Airbus 320CEO aircraft they have in the fleet with NEO aircraft. The A320neo aircraft has 15% or so fuel savings compared to the CEO model and has been a driver of replacement orders. IndiGo was directly delivered 100 CEO aircraft from Airbus, of which they had 77 in the fleet as of December 2021 as per Airbus. This does not include second-hand aircraft IndiGo might have taken to cover capacity over time. The count of A320ceo aircraft hence differs across Airbus and IndiGo’s presentations.

IndiGo has 730 A320family aircraft (344 A320neo and 386 A321neo aircraft) on order, out of which 140 A320neo and 52 A321neo aircraft have been delivered to them by December 2021. During the December 2021 quarter, IndiGo inducted 18 NEO aircraft and returned 16 CEO aircraft.

IndiGo is committed to returning most of the CEO aircraft by December 2022.

IndiGo’s two-way codeshare with Air France-KLM signed

After sewing up arrangements with Turkish Airlines, Qatar Airways, and American Airlines, IndiGo signed a new codeshare agreement with Air France-KLM in October – December 2021. Unlike the other arrangements, this is a two-way codeshare agreement that will help IndiGo gain access to new markets when operationalised. So, expect to book a ticket to Amsterdam on IndiGo and fly KLM at some point in the future.

Cargo Business being developed

Dutta talked about the IndiGo CarGo business when an analyst asked. IndiGo had deployed ten aircraft on cabin cargo duties during the pandemic, with seats being removed. With a recovery in the passenger business, most of these aircraft were called back, and the current cargo fleet is limited to three aircraft. Cargo is a developing business for the airline, as the CEO states, there are a lot of factors working in India’s favour, including regulations changes that disallow international carriers from flying cargo around India domestically and with the shipping crisis globally, allowing IndiGo to pick up and move a lot more Cargo than pre-pandemic opportunities. IndiGo currently has signed up for four P2F conversions and will pan out a longer-term strategy in the coming times as it grows the cargo business.

IndiGo cut capacity due to the third wave.

Ronojoy Dutta, on the analyst call, also brought up the cutback to capacity in the current quarter (January – March 2022) in response to the increase in Covid-19 cases in India. The airline had announced up to 20% capacity rationalisation earlier in January 2022. Still, the CEO expects capacity deployment to be more likely in the range of 10-15 per cent compared to the previous quarter. Answering questions from analysts, he remarked that a decline in bookings had begun in mid-December 2021, and he believes that the bottom was formed by mid-January 2022. From there, there has been an upward trend observed, he stated.

In terms of revenue, IndiGo predicted a decline in revenue in Q4FY22 (Jan-Mar 2022) but a recovery in the first quarter of FY23 (Apr-Jun 2022).

Bottomline

IndiGo had a good quarter on the back of sustained growth witnessed in Indian aviation between October and December 2021. They swung a decent profit as well, which indicates just one thing: in a cut-throat aviation Industry, they are still able to eke out a profit on the back of aircraft being full after many quarters and people falling over each other to get on a plane. The structural story is then sound, and as soon as Omicron is out of the way, growth will return.

What do you make of IndiGo’s strong results in the last quarter of 2021?

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

Leave a Reply