On June 2, 2020, IndiGo presented their financial results for the fourth quarter and the full year 2019-20. As the biggest Indian airline by size, and one of the bigger airlines by fleet size globally, these results were important to check out.

IndiGo had some important numbers to share. Firstly, for the quarter ended March 31, 2020, IndiGo reported a net loss of INR 8.7 billion rupees with a negative profit after tax margin of 10.5%. This included a foreign exchange loss of INR 10.1 billion due to the weakening of the rupee, primarily comprising of mark to market losses on our capitalized operating leases.

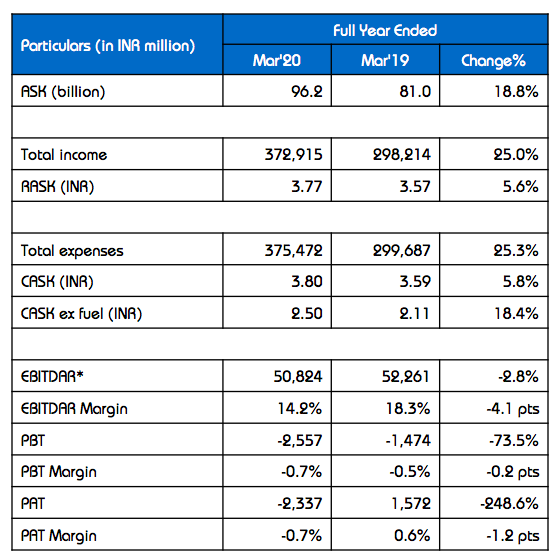

IndiGo’s full fiscal year performance was nearly break even with a net loss of INR 2.3 billion rupees and a negative profit after tax margin of 0.7%. At the end of February, IndiGo stated that the airline was still profitable with unit revenue up by 2.6% for Jan’20 and Feb’20 as compared to the same period last year. However, as the airline entered into March, the unit revenue started declining sharply and resulted in an operating loss of INR 3.8 billion for March, excluding the foreign exchange loss.

IndiGo, however, looks to be in a strong financial position, with total cash of INR 203.77 billion including free cash of INR 89.28 billion.

IndiGo’s business model, however, does not look like it is changing anytime soon. The airline, which is one of the biggest customers for Airbus, has confirmed this recently. In spite of the fact that the airline already has 262 aircraft in their fleet (114neo aircraft and 123ceo aircraft, apart from 25 ATRs), and some part of this fleet won’t come back online for a while given the dip in travel demand, IndiGo is committed to taking a large number of new aircraft deliveries as and when they can. On their earnings call, they committed to take deliveries in the April to September 2020 period from Airbus. No delays in deliveries indicated yet.

IndiGo is not happy with the higher cost of operating and maintaining the Airbus A320ceo aircraft which have been in their fleet for a while and are going to retire a number of these ceo aircraft. IndiGo’s original plan was to send these aircraft back to their leasing companies in a phased manner by 2022, but they might redeliver some of these aircraft sooner now. IndiGo has no penalty clauses, and hence it would be easier for them to send these aircraft back as and when they want to. Further, IndiGo stated they won’t match the outgoing planes 1-1 with incoming planes for the time being, which means IndiGo might come out smaller at the end of this exercise.

To cut a long story short, IndiGo will continue to be India’s largest airline by a mile for the time being. This should be good news for the airline, staffers, passengers, airports and airframe makers. Because the airline will be able to offer a full network in the coming months, and once that happens, it should mean people would not have to think twice before travelling again (of course, hoping CoVid-19 would not be a factor for air travel in the long run).

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. Even though the amount you enter has to be in INR, you may use an international card to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

Leave a Reply