The IndiGo Ka-Ching Credit Cards, issued by HDFC Bank and powered by MasterCard, was launched in February 2020. IndiGo Credit Card offers

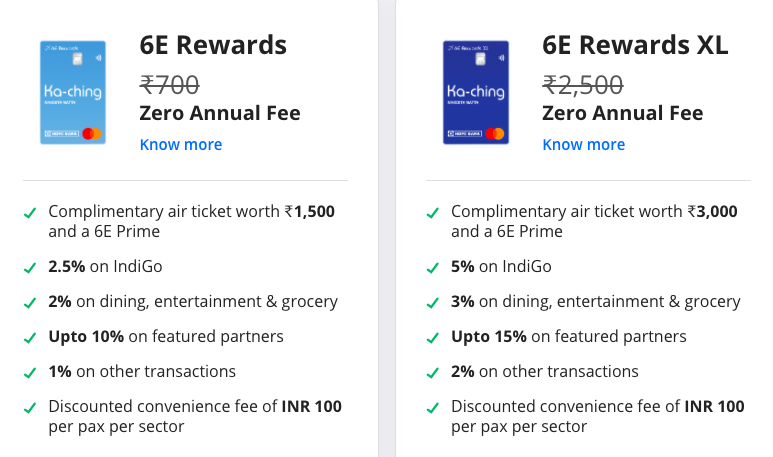

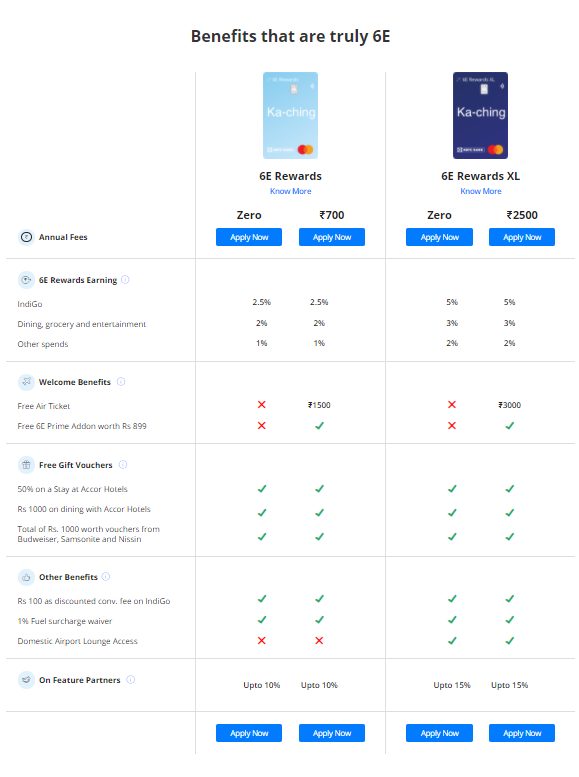

The new credit cards, in the legacy ways of IndiGo, were branded as ‘Ka-ching’, going after the sound of the money till reference. The cards were launched in two variants, 6E Rewards and 6E Rewards XL. Customers can avail of complimentary Air Tickets on activation for an amount of INR 1500 or INR 3000, depending on the variant. The credit cards allow customers to accrue accelerated 6E Rewards on IndiGo transactions. They can also earn additional 10-15% 6E Rewards on dining, shopping, transport and medical spends with Featured Partners.

Furthermore, customers have access to other benefits, including priority check-in, choice of seats, and a complimentary meal. The Ka-ching card also offers 14 travel and lifestyle benefits. This includes lounge access, complimentary expert medical opinions from global experts, freedom to play golf in some of the top golf courses in India. Cardholders will also be able to avail MasterCard concierge services, airport limousine service and enjoy premium benefits and savings on hotels, car rentals and flight bookings.

The 6E Rewards card, the entry-level card have the following features.

- Complimentary Air Ticket worth INR 1,500 on activation

- 6E Prime Add-on (priority check-in, choice of seat, and a complimentary meal)

- 2.5% 6E Rewards on IndiGo transactions

- 2% 6E Rewards on dining, entertainment and grocery transactions

- 1% 6E Rewards on all other non-IndiGo purchases (except fuel & wallet)

- Up to 10% 6E Rewards on Feature Partner transactions

- A discounted convenience fee of INR 100 per passenger per segment

- 1% Fuel surcharge waiver

- One time 50% off at an Accor Hotel

- One time INR 1000 voucher for meals at an Accor hotel

The 6E Rewards XL card, which is the higher-end version of the product, is even more power-packed and has a much higher reward on spends:

- Complimentary Air Ticket worth INR 3000 on activation

- 6E Prime (priority check-in, choice of seat, and a complimentary meal)

- 5% 6E Rewards on IndiGo transactions

- 3% 6E Rewards on dining, entertainment and grocery transactions

- 2% 6E Rewards on all other non-IndiGo purchases (except fuel & wallet)

- Up to 15% 6E Rewards on Feature Partner transactions

- 8 Complimentary Domestic airport lounge access

- 1% Fuel surcharge waiver

- A discounted convenience fee of INR 100 per pax per segment

- One time 50% off at an Accor Hotel

- One time INR 1000 voucher for meals at an Accor hotel

- Lounge Access

IndiGo Credit Card Offers: First Year Free

The 6E Rewards card is usually priced at INR 700 per annum, and the 6E Rewards XL is priced at INR 2,500 per annum. But for a limited time, IndiGo and HDFC Bank are offering the Credit Card for free. If you apply for the Ka-ching credit card between November 13 – December 31, 2020, you can get the Annual Fee applicable to Ka-ching credit card in the first year waived off.

Or you can get this card Lifetime Free

You need to ensure you pick the right version when you are making your application. You can access the application website here.

I think this is an excellent promotion for those who don’t have the HDFC IndiGo co-branded credit card and would like one. Which variant would you opt for? Getting a free ticket and paying for the card in the second year and onwards, or take it free for a lifetime?

IndiGo Credit Card offers

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

Hi,

I jave just receive upgrade my Ka-Ching XL card. There is compliment air ticket bit I am unable to book that free ticket from Indigo mobile application

I need indigo 6E reward card but without any annual fee for life time.

I am freqent flyer internationally and using indigo flight normally.

I have HDFC bank account.

Suggest me if this card available at no annual fees.

If I am already a HDFC credit card holder then I can’t get this co-branded one?

Is one regular CC and one co-branded CC allowed?

Seems some confusion regarding entry level card. The offer link provided in the Blog mentions Lounge access benefit if someone opts to go for option of paying Rs 700/- renewal fees. However if we go to credit card page on indigo website separately, it states that loung access is not available irrespective of option selected. Refer the link: https://www.goindigo.in/6e-rewards/6e-rewards-details.html

@Pratik, thanks for bringing this to my attention. Seems someone realised the crosses and ticks on the website were all wrong. No Lounge access for the lower end card and lounge access exists for the higher end card. I will fix this around our text as well.

Will HDFC allot a second card ? Already an infinia owner

No, HDFC doesn’t allow this. I had applied for the card in the earlier offer period but didn’t take it as they said my existing DCB will be cancelled. There isn’t also any option of splitting the limit too.

It’s a good offer to go for the XL life time free variant if one is a frequent traveler. But since most of my travel are work related & tickets books by the company, it doesn’t appease me. Sticking to the current cards works for me as I can book the flights of my choice for my personal travel.

Absolutely, especially those who have premium cards from HDFC (DCB, Infinia) would probably use Smartbuy to book flight tickets & get 10X with upto 33% return. Isn’t it?