The much-awaited Goods and Services Tax (GST) reforms were announced last night (September 3, 2025) and are scheduled to be implemented on September 22, 2025. One of the things that changes is the taxes on your travels. Here is the news!

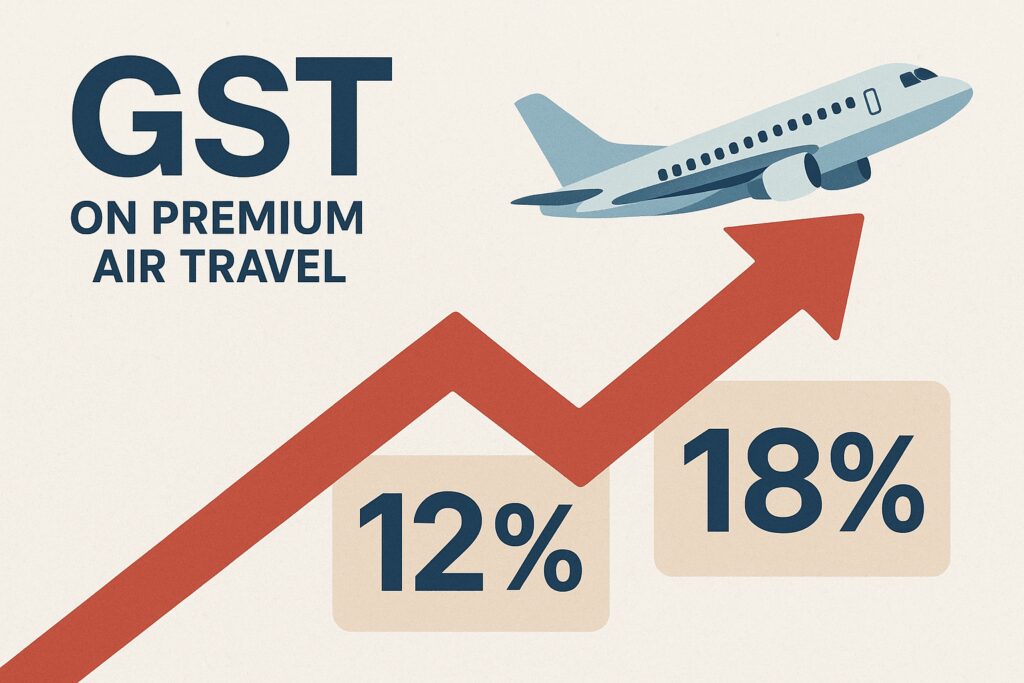

Premium Air Travel to see GST go up

The current Goods and Services Tax (GST) structure on Air Travel has been 5% and 12%, with 5% applied to Economy Class and 12% to non-Economy Class travel (including Premium Economy, Business, and First Class). This is the tax rate that has been applicable since July 1, 2017, on commercial air travel. As a part of the drive to rationalise GST, there was an intention to consolidate GST into two slabs only (5% and 18%).

Generated with ChatGPT

While initial reports suggested that all commercial air travel would be categorised as 5%, that has not been the case. It will now be revealed that the GST on premium cabin air travel will increase from 12% to 18%, a 6% rise. However, for those who use planes for work travel and have a GST Number registered for their business, they can claim the entire amount as Input Tax Credit, which they can offset against their own GST dues. The new rates go live on September 22, 2025, so if you’ve purchased air tickets before this date, you will still save a penny.

The tax is payable on all types of travel within India and outside India, provided the travel originates in India. It also applies to redemption tickets, so you’re not off the hook if you’ve been thinking you can redeem your miles without being affected by this change.

Aviation body IATA said it is disappointed with the GST hike on non-economy travel. In its statement, it said,

“In many ways, India has been an amazing aviation story with its impressive growth, record aircraft orders, and world-class infrastructure. Aviation has tremendous potential to contribute to India’s economic growth, both directly as Indian airlines grow and indirectly through increased connectivity for travellers and businesses alike. It is therefore disappointing to hear of a decision to increase the GST on non-economy travel with no clear justification.

This increase runs counter to the efforts of Indian carriers, which have been investing in their premium products to enhance the travel experience on their flights. Tax on non-economy air travel has risen dramatically – GST is at 18% after yesterday’s announcement, compared to the 8.6% rate in 2017 under the service tax regime.

For its aviation industry to thrive, India needs to take a whole of government approach in considering broader policy and consider the risks of such policies on dampening demand and undermining profitability. Asia Pacific airlines are forecast to only earn USD2.60 per passenger in 2025. Taxing premium travelers, where these customers often make a difference to a route’s viability, is counterproductive.

You can book your premium cabin air tickets on Air India here, and on all the other carriers by hunting for a deal via SkyScanner here.

Bottomline

GST on premium air travel in India is poised to rise from 12% to 18%, effective around September 22, 2025, as part of GST simplification. It’s not earth-shattering, but it’s enough to tweak budgets and booking strategies. Remember, this new hike applies to all travel booked intra-India in Premium Economy/Business and First Class, as well as to travel originating from India on any airline outside the country.

Could you let me know what you think of the changes to the GST Rates on Premium Cabin Airfares?

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

Leave a Reply