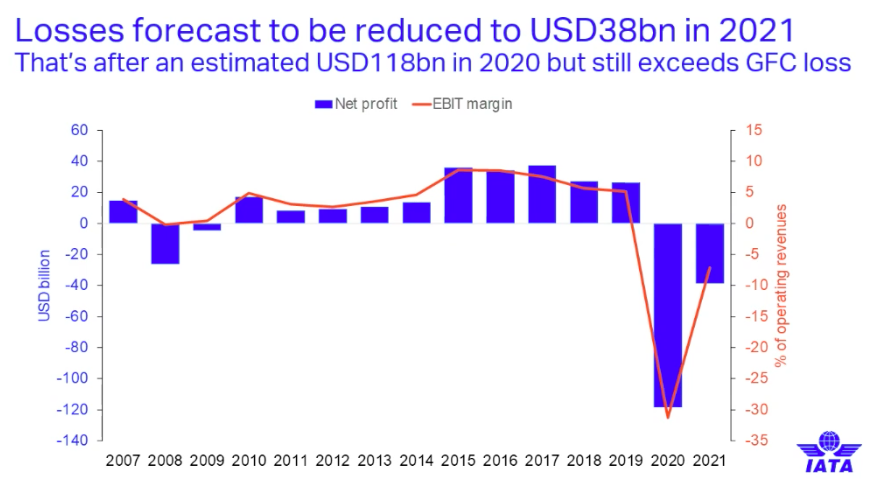

The International Air Transport Association (IATA) announced a revised outlook for airline industry performance in 2020 and 2021. Deep industry losses will continue into 2021, even though performance is expected to improve over the period of the forecast.

Performance factors in 2021 will show improvements in 2020, and the second half of 2021 is expected to see improvements after a difficult 2021 first half. Aggressive cost-cutting is expected to combine with increased demand during 2021 (due to the re-opening of borders with testing and/or the widespread availability of a vaccine) to see the industry turn cash-positive in the fourth quarter of 2021 which is earlier than previously forecast.

Alexandre de Juniac, IATA’s Director General and CEO, said,

“This crisis is devastating and unrelenting. Airlines have cut costs by 45.8%, but revenues are down 60.9%. The result is that airlines will lose $66 for every passenger carried this year for a total net loss of $118.5 billion. This loss will be reduced sharply by $80 billion in 2021. But the prospect of losing $38.7 billion next year is nothing to celebrate. We need to get borders safely re-opened without quarantine so that people will fly again. And with airlines expected to bleed cash at least until the fourth quarter of 2021 there is no time to lose.”

2020

The COVID-19 crisis challenged the industry for its very survival in 2020. In the face of a half-trillion-dollar revenue drop (from $838 billion in 2019 to $328 billion), airlines cut costs by $365 billion (from $795 billion in 2019 to $430 billion in 2020).

“The history books will record 2020 as the industry’s worst financial year, bar none. Airlines cut expenses by an average of a billion dollars a day over 2020 and will still rack-up unprecedented losses. Were it not for the $173 billion in financial support by governments we would have seen bankruptcies on a massive scale,” said de Juniac.

All major operational parameters in the passenger business were negative:

- Passenger numbers are expected to plummet to 1.8 billion (60.5% down on the 4.5 billion passengers in 2019). This is roughly the same number that the industry carried in 2003.

- Passenger revenues are expected to fall to $191 billion, less than a third of the $612 billion earned in 2019. This largely driven by a 66% fall in passenger demand (measured in Revenue Passenger Kilometers/RPK). International markets were hit disproportionately hard with a 75% fall in demand. Domestic markets, largely propelled by a recovery in China and Russia, are expected to perform better and end 2020 49% below 2019 levels.

- Further weakness is demonstrated by passenger yields which are expected to be down 8% compared to 2019 and a weak passenger load factor which is expected to be 65.5%, down from the 82.5% recorded in 2019, a level was last seen in 1993.

Operational parameters for cargo are performing significantly better than for passenger but are still depressed compared to 2019:

- Uplift is expected to be 54.2 million tonnes in 2019, down from 61.3 million tonnes in 2019

- Cargo revenues are bucking the trend, increasing to $117.7 billion in 2020 from $102.4 billion in 2019. A 45% fall in overall capacity, driven largely by the precipitous fall in passenger demand which took out critical belly capacity for cargo (-24%), pushed yields up by 30% in 2020.

“Cargo is performing better than the passenger business. It could not, however, make up for the fall in passenger revenue. But it has become a significantly larger part of airline revenues, and cargo revenues are making it possible for airlines to sustain their skeleton international networks,” said de Juniac.

In 2019 cargo accounted for 12% of revenues and that is expected to grow to 36% in 2020.

2021

Airline financial performance is expected to see a significant turn for the better in 2021, even if historically deep losses prevail. The expected $38.7 billion loss in 2021 will be second only to 2020 performance.

On the assumption that there is some opening of borders by mid-2021 (either through testing or growing availability of a vaccine), overall revenues are expected to grow to $459 billion ($131 billion improvements on 2020, but still 45% below the $838 billion achieved in 2019). In comparison, costs are only expected to rise by $61 billion, delivering overall improved financial performance. Airlines will still lose, however, $13.78 for each passenger carried. By the end of 2021, stronger revenues will improve the situation, but the first half of next year still looks extremely challenging.

Passenger numbers are expected to grow to 2.8 billion in 2021. That would be a billion more travellers than in 2020, but still 1.7 billion travellers short of 2019 performance. Passenger yields are expected to be flat, and the load factor is expected to improve to 72.7% (an improvement on the 65.5% expected for 2020, but still well below the 82.5% achieved in 2019).

The cargo side of the business is expected to continue with a strong performance. Improved business confidence and the important role that air cargo should play in vaccine distribution is expected to see cargo volumes grow to 61.2 million tonnes (up from 54.2 million tonnes in 2020 and essentially matching the 61.3 million tonnes carried in 2019). A continued capacity crunch due to the slow reintroduction of belly capacity from passenger services combined with a higher proportion of time and temperature-sensitive cargo (vaccines) will see a further 5% increase in yields. This will contribute to strong performance in cargo revenues which are expected to grow to a historic high of $139.8 billion.

Challenges to Recovery

While the industry will see improved performance in 2021 compared to 2020, the road to recovery is expected to be long and difficult. Passenger volumes are not expected to return to 2019 levels until 2024 at the earliest, with domestic markets recovering faster than international services. Several critical challenges need urgent attention:

- Debt Levels and Financial Support: Airlines are surviving on financial life support from governments. Even after $173 billion of government support of various kinds in 2020, the median airline has just 8.5 months of cash to survive. Many have far less as the industry enters into the critical winter period, which is characterized by weak demand even in normal times. While cash burn has diminished from the peak of the crisis, airlines are still expected to burn an average of $6.8 billion/month during the first half of 2021, before the industry turns cash positive in the fourth quarter of 2021.

“The financial damage of this crisis is severe. Government support has kept airlines alive to this point. More is likely needed as the crisis is lasting longer than anyone could have anticipated. And it must come in forms that do not increase the already high debt load which has ballooned to $651 billion. Bridging airlines to recovery is one of the most important investments that governments can make. It will save jobs and kick-start the recovery in the travel and tourism sector, which accounts for 10% of global GDP,” said de Juniac.

- Closed Borders/Quarantine: The biggest factors impeding the industry’s recovery are travel restrictions and quarantine measure that effectively prevent a meaningful revival of travel. The most immediate and critical solution is the safe re-opening of borders using systematic COVID-19 testing. Longer-term, the widespread availability of COVID-19 vaccinations should enable borders to remain open without testing or restriction, but the timeline for vaccine availability is uncertain.

“We have the ability to safely re-open travel with systematic testing. We cannot wait on the promise of a vaccine. We are preparing for an efficient vaccine distribution. But testing is the immediate solution to meaningfully re-open air travel. With 46 million jobs at risk in the travel and tourism sector alone because of plummeting air travel, we must act fast with solutions that are at hand. We have fast, accurate and scalable testing that can safely do the job. The airlines are ready. The livelihoods of millions are in the hands of governments and public health authorities. Governments understood the criticality of a viable air transport sector when they invested billions in keeping it afloat. Now they need to protect those investments by giving airlines the means to do business safely,” said de Juniac.

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

Leave a Reply