With Citi’s exit from the Retail Banking space in India, HSBC has been making a move to become the Multinational Bank of Choice in India, refining its entire retail banking product range, including credit cards and the wealth banking proposition. Now, after adding many considerable pieces to the puzzle, such as a Travel Credit Card and the ability to transfer points into loyalty programmes, HSBC has made one more move to level up with the rest of the banks.

HSBC introduces the “Travel With Points” engine to facilitate travel bookings for Credit Card customers.

HSBC Credit Cards has launched a new product, called “Travel With Points”, which is only available within the HSBC India App, in the “Use Points” Section.

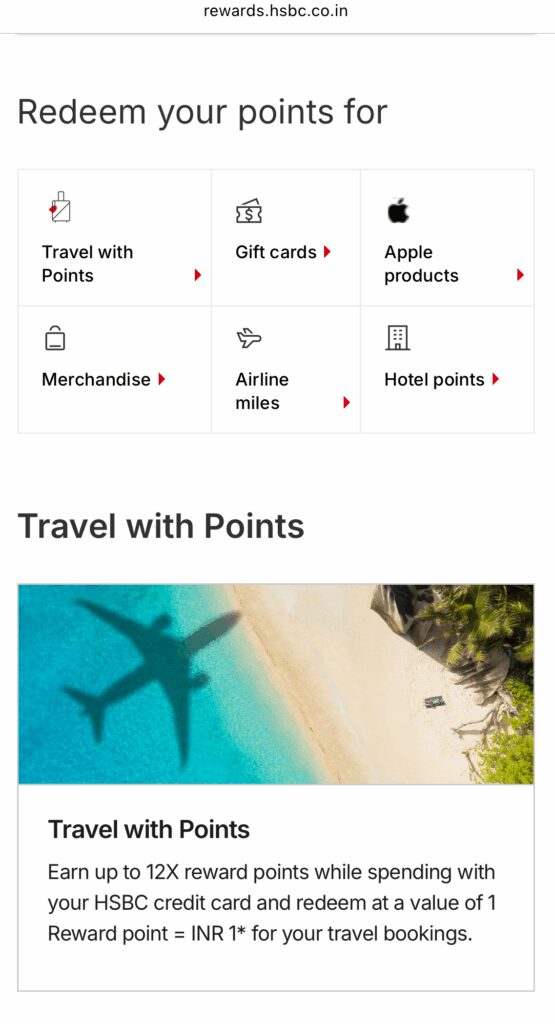

Using the new feature, you can earn accelerated points or burn points on all prominent HSBC Credit Cards in India that earn reward points and not cashback, which are:

- HSBC Global Private Banking Privé

- HSBC Premier

- HSBC TravelOne

- HSBC Visa Platinum

- HSBC RuPay Platinum

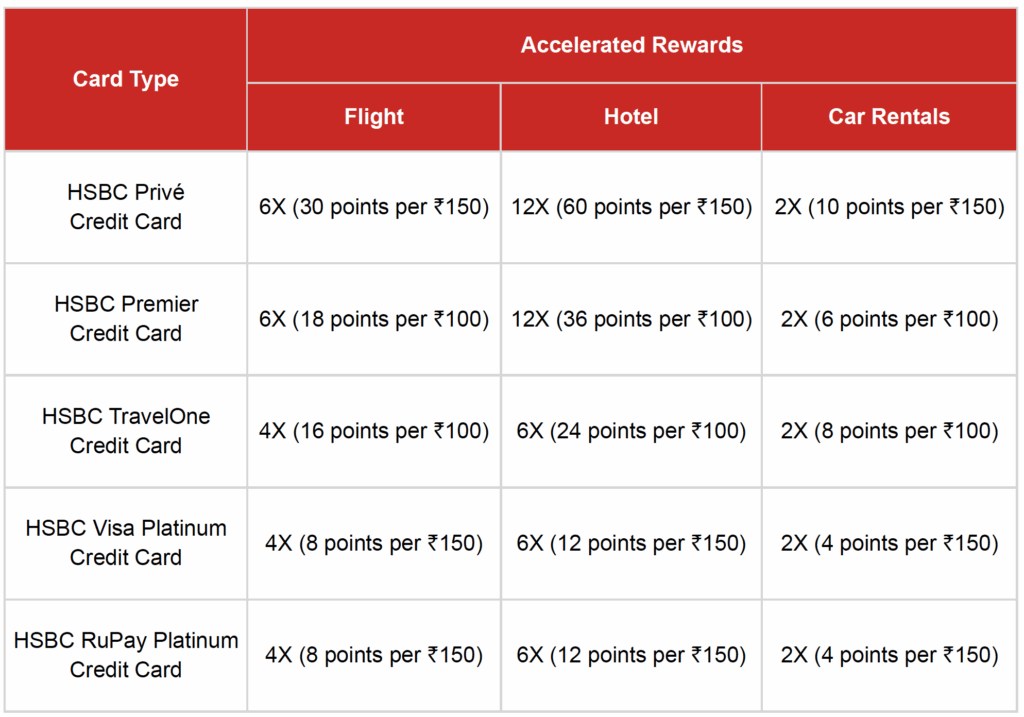

Here are the bonus points when you use your HSBC Card products to book flights via the HSBC App, which has partnered with Hopper. Mind you, these accelerated points are only earned through this method, and not the usual website swipes on airline or hotel websites.

HSBC Reward Points (accelerated points) are capped at 18,000 points per cardholder per calendar month, while base points remain uncapped. Accelerated Reward Points will be credited to the cardholder’s account within 10 days of settling the transaction, HSBC says.

The 18,000 points limit per cardholder translates into the following limits, where the accelerator stops:

- HSBC Premier

- Up to INR 120,000 per month on flights

- Up to INR 51,428 per month on hotels

- HSBC TravelOne

- Up to INR 128,571 per month on flights

- Up to INR 81,818 per month on hotels

You can also use the following HSBC Credit Cards to redeem the points for stays, hotels, or car rentals:

- HSBC Global Private Banking Privé

- HSBC Premier

- HSBC TravelOne

- HSBC Visa Platinum

- HSBC RuPay Platinum

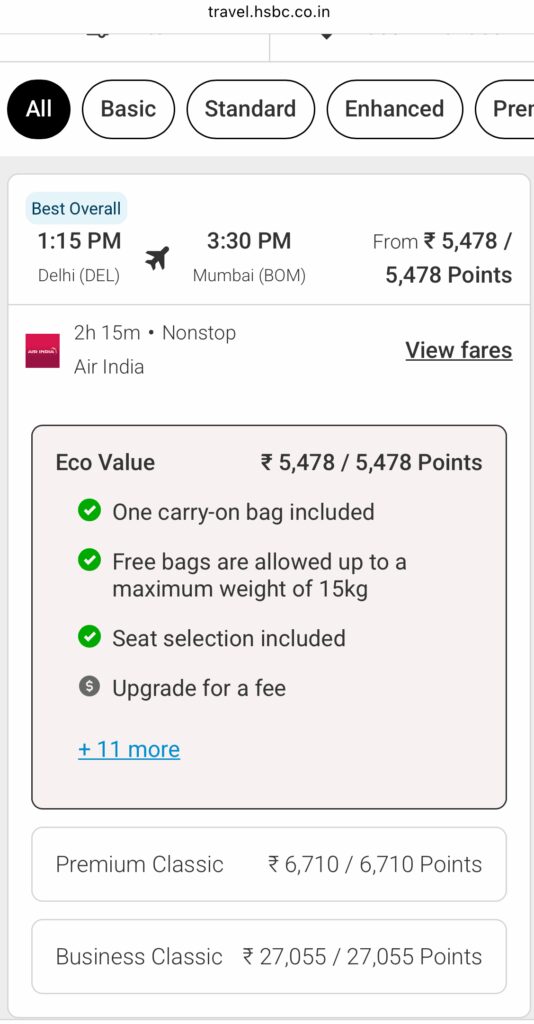

The redemption value is different for different points. For instance, the HSBC Premier, with a point value of INR 1 per point, allows you to use 100% of the points towards redemption, unlike HDFC Bank and IDFC First Bank, which limit you to 70% of the points. You can turn your credit card reward points into flights, stays or car rentals instantly on Travel with Points with HSBC Rewards Marketplace. Or pay in whole or in part with your HSBC credit or debit card.

HSBC charges a convenience fee of INR 300 per customer per leg (one-way trip) for domestic flights and INR 700 per customer per leg (one-way trip) for international flights.

Some of the features that HSBC has added to differentiate itself include,

- Best Price Guarantee: If you find a lower rate within 24 hours of your booking, HSBC will refund the difference as a travel credit in your Travel with Points wallet, which can be used on your next booking.

- Cancel for any reason: You can add flexibility to your trip with the option to cancel your flights or hotel stays up to 3 hours before departure and receive a refund of up to 100%.

- Price drop protection: Hopper will monitor the price of your flight booking for the next 10 days after booking. If the price drops, HSBC/Hopper will refund the difference to you in travel credits, up to a maximum of INR 1,500. There are T&C to this.

These points, which are worth up to 36 points per INR 100 on the Premier, can be converted into miles or hotel points at a 1:1 reward point valuation, which Accor lovers will appreciate at an INR 2 value per point.

HSBC has, for now, skipped the Gyftr/WooHoo kind of voucher ecosystem, which should keep the product protected from gamers.

Bottomline

HSBC has recently launched its bonus programme for booking travel via its app, and the bonuses on the mid- to high-end cards are substantial. The added differentiation for the Premier and Privé cards is that the points are worth INR 1 a point, and they never expire. At the top end, you can get 36% returns on your money spent on travel with the HSBC suite of cards.

What do you think about the HSBC Travel portal and the addition of accelerated rewards bonuses to their travel booking portal?

If you would like to connect with an HSBC Premier Relationship Manager, please leave your contact details (Name, Email, Phone Number, and method of opening an HSBC Premier Relationship: TRV or Salary). I will pass it along to the HSBC team (I won’t be approving the comments, so the details don’t get revealed.) This is on a no-fee basis.

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

Hi,

Thanks for the info.

For Premier, the 6X (flight) and 12X (Hotel) accelerated reward points are including the base rewards (base+5X/11X) or base rewards are additional i.e. effectively Base+6X/12X?

for eg HDFC 10X means Base + 9X.

@Harshal, a bit confusing at the moment, but I’ve concluded for now that the interpretation is that the accelerated rewards are 5X/11X until proven otherwise.