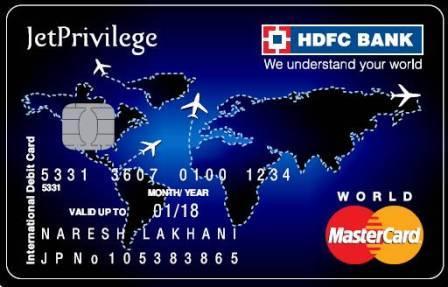

HDFC Bank partnered with JetPrivilege to launch a co-branded debit card a few years ago, and it is the only co-branded debit card in India which allows you to earn JPMiles for your debit card purchases.

So, after cracking the whip on many of its own cards and its JetPrivilege co-branded credit cards earlier now is the turn of the HDFC JetPrivilege Debit card to be reset in earning terms. The changes come into effect on November 15, 2017.

- Currently, the first-swipe bonus is 2000 JPMiles for a transaction within 90 days every year. After October 31, 2017, it goes down to 500 JP Miles every year.

- Currently, you’d earn 4 JPMiles on INR 150 spent only on buying tickets via the JetAirways website. Now, you can also earn the same rate for international shopping and online merchants.

- Currently, you’d earn 2 JPMiles on INR 150 spent everywhere except fuel. When changes kick in, these earnings will be restricted to the following merchant categories: Hotel, Air, Travel, Utility, Apparels and Restaurants.

- For everything else, you get 1 JPMile for INR 150 spent. You don’t earn anything for Jewellery, Business Services or Fuel, however.

- HDFC Bank has introduced a new milestone feature where you earn 500 Bonus JP Miles on accumulating 500 JP Miles through retail spends.(Max.1500 JP Miles per calendar year)

Now, for a debit card, the earning potential was alright. And while with Credit Cards I can say HDFC Bank is not doing enough for customers, with the cutbacks being rolled out, with Debit Cards, I would only say I understand. For someone travelling abroad, they’d most probably have access to a credit card as well so good changes but useless in my book.

The fee earned on Debit Card transactions is low and in fact, after demonetization may have even become further reduced given a lot of avenues were shut down for earning a fee on debit cards with the MDR going down.

I hardly use a debit card for making purchases because of access to credit cards, but if you don’t have any credit cards, it makes sense to still hold on to this debit card as you get your JPMiles extended for two years just for having it.

Bottomline

If you don’t have the JetPrivilege Co-brand debit card, maybe right now is a good time to get it as you would still get your bonus JPMiles as per the earlier structure for the first transaction.

Hi Ajay,

I planned to apply for this card in Dec. Had to change the plan as I will not be able to apply before that.

Currently I’m holding IndusInd Jet Airways Voyage card. In the starting, they were offering 6 miles / Rs 100 on weekday spend and 8 miles / Rs 100 on weekend spends. Now they have reduced it to half i.e., 3 miles / Rs 100 on weekday spend and 4 miles / Rs 100 on weekend spends.

Now I’m planning to shift to HDFC Jet Airways Signature / World Credit Card. Is it worth a change?