HDFC Bank has long offered a large number of points to anyone who uses its white-label Smartbuy website to buy almost anything under the sun. Many years ago, they launched a white-label gift voucher service as well, along with Gyftr, where you could earn 10X points up to the card’s maximum bonus points limit, as prescribed by HDFC Bank. This effectively meant you could get up to 33% cash back on over 150 brands, as long as you purchased the vouchers before using them to make your purchase. I never thought the gift voucher business would be very lucrative, but it sure enough was, and American Express was also launching a similar site. From there, many others have launched similar businesses. Then, in 2021, HDFC Bank cut the 10X earnings to 5X.

HDFC Bank Infinia cuts down on Smartbuy Gyftr Earnings

Reward points are issued every time you make a purchase from Smartbuy and are primarily funded by HDFC Bank. This is why, as they have gained scale, HDFC Bank has capped earnings on its cards and readjusted earnings on its products as the situation evolves. I don’t hold it against them. After all, there needs to be a balance between giving away points and making money. As long as they don’t devalue points, that is.

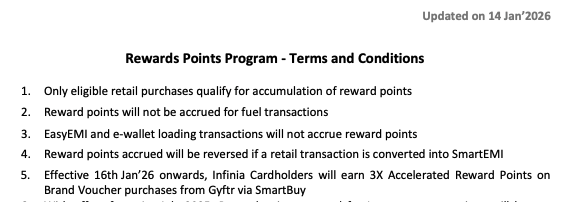

As of January 16, 2026, HDFC Smartbuy Gyftr points earning has been devalued for the Infinia cardmembers. Till January 15, 2026, one can earn 5x points by purchasing gift vouchers from Gyftr via HDFC Smartbuy (1X regular earning and 4X bonus earning). However, after that, you will see only 3X points.

This means that when you buy a voucher from HDFC Smartbuy Gyftr, you will get 3X points (1X regular and 2X bonus), which translates to up to 9.9% back in value on their top-end credit card, the Infinia. This wouldn’t be good news for those who used to buy a lot of vouchers, I’d say, especially for those who have an additional charge to buy them, like the Amazon Gift Card.

This change has been put out in a new T&C update this morning on the HDFC Bank website.

This update brings Infinia in line with the Diners Club Black Card, basically. So, that is a downgrade for the Infinia holders.

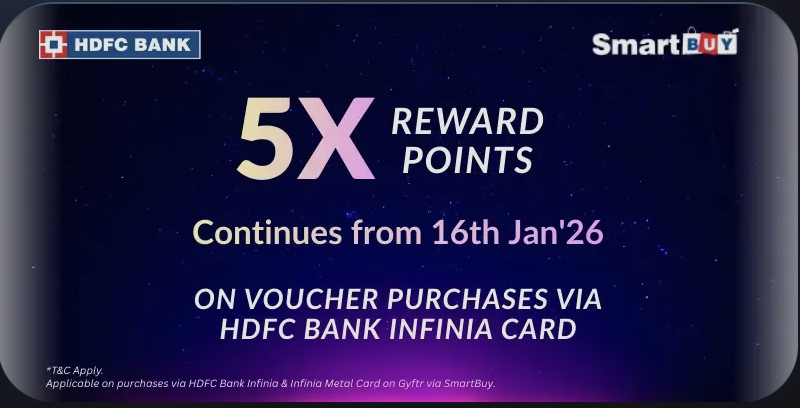

Update: On January 15, 2026, HDFC Bank posted a new update on the SmartBuy website stating that the 5X points continue, but the T&Cs reflect 3X points. No explanations offered.

Bottomline

HDFC Bank’s Smartbuy Gyftr proposition remains the most attractive way to buy vouchers for any purchase, but from now on, you will only get 3X points instead of 5X points as an Infinia cardholder. This is certainly a blow to users of the haloed card from the Bank and undermines its value proposition. (Update: This was reversed to 5X again within 24 hours)

What do you make of the changes to the HDFC Bank Smartbuy Gyftr points earning ratio on the Infinia?

(H/T to Pranav)

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

This is indeed disappointing. The biggest appeal for me in Having Infinia was this. I have to serious consider closing out my Infinia Metal relationship and stick with only Olympus for now.

Was just verifying on the Rewards 360 portal..

Seems for DCB one can still redeem the reward points for amazon vouchers..

Hi Ajay, do you expect them to launch a new card above the Infinia with the 5x rewards? Or are the days of rewards winding down?

Last year I tried upgrading my DCB card to Infinia thinking I could get 5x on gift vouchers instead of the 3x that I get on my DCB card currently..

Thank God that did not go through..

There was some other stories circulating that in order to keep Infinia one had to spend 18 lakhs annually on the card too..not sure if that is actually true ?

So basically was better off sticking with DCB for the time being..

Dare I say it but if anything, the spending 4 lakhs in a quarter that gives 10k bonus points on DCB make this card, in some cases, even more appealing than Infinia..

@Ashish, DCB is indeed better than Infinia for now.

the 18L counter is true, enforcement, not so much

In DCB, you also get annual benefits if I remember right on spending an X amount. The appeal of Infinia lies in 1. MC/Visa network 2. Unlimited Priority Pass for whole family.

Yes you are quite right..

On the plastic version of DCB, if one spends 8L in a year then one gets complentary Club Mariott, Swiggy One, Forbes memberships..

For DCBM that might not be there..

And I think the Diners / RuPay integration has definitely increased the acceptability.. atleast in India..

Abroad might still be an issue..

BTW, has HDFC DCB stopped giving gift cards as redemption option?

Was just verifying on the Rewards 360 portal.. Seems for DCB one can still redeem the reward points for amazon vouchers..