While I have been hearing some murmurs about this for a few days now, HDFC Bank has finally moved the needle on points earning on their credit card portfolio. The new HDFC Bank Smartbuy points structure has been implemented from February 1, 2022. This will impact the earning potential on various HDFC Bank Credit Cards and other products such as debit cards and the Payzapp product.

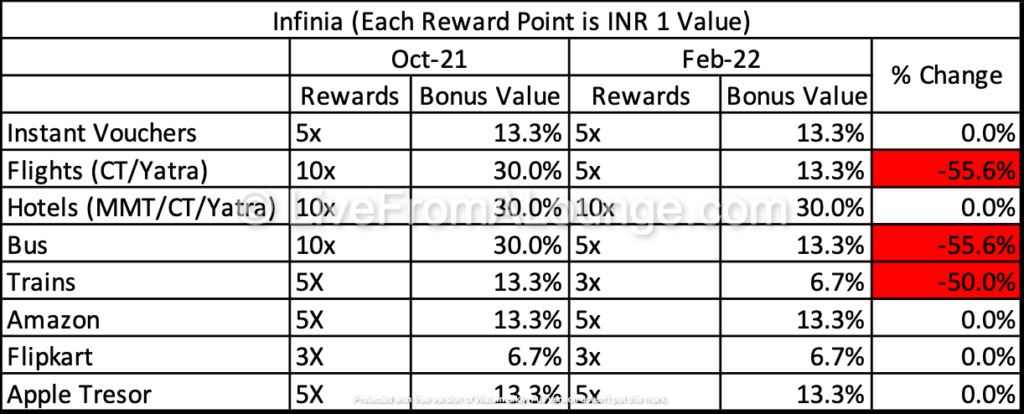

HDFC Bank’s rationalised Smartbuy proposition for Infinia Cardmembers

HDFC Infinia is the Number 1 card in the portfolio of HDFC Bank cards for now. The Bank has not moved to reduce the earnings on this card by a lot, but there is a rationalisation for sure.

The Bank is removing the 10X earning on Smartbuy flights booking and Bus bookings and reducing the earning of bonus points on Trains. In September 2021, they had already reduced the number of points one could earn on Instant Vouchers. The benefits were gone long ago for the other daily drivers of this portfolio, such as Amazon and Flipkart.

In a nutshell, this is the new earning structure for Infinia. I’ve stripped away the unlimited 1X Reward Points which will be given away always per month.

You can continue to earn up to 15,000 bonus points on Infinia per month; however, you can earn no more than 7,500 bonus points here on a per-day basis. Also, the bonus counts on the settlement date, not on the swipe date. So, for instance, if you make a transaction on February 1, 2022, and the bank settles the transaction on February 3, 2022, it counts like that. But let’s say there is a settlement holiday on account of a national holiday. The transactions of two days get lumped into one settlement, and if someone went crazy shopping that weekend, they could potentially lose points.

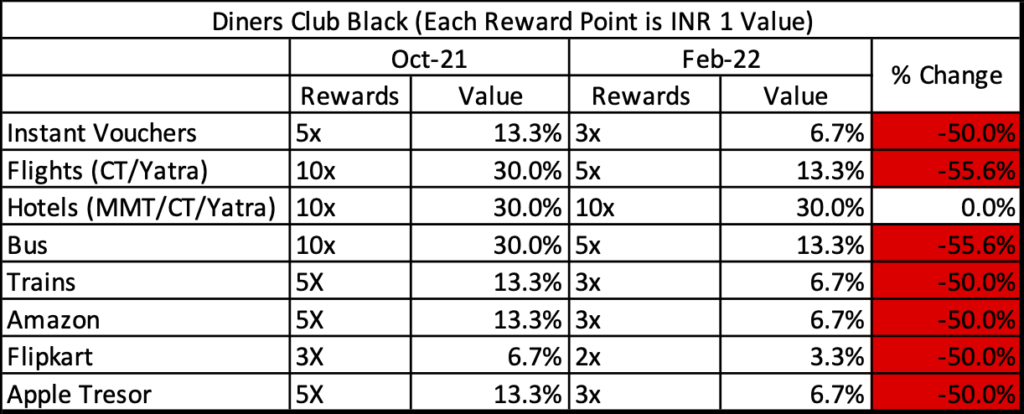

HDFC Bank’s devalued Smartbuy proposition for Diners Club Black Cardmembers

HDFC Diners Club Black is the Number 2 card in the portfolio of HDFC Bank cards, and it has been going this way for a long time now. The Bank has moved to reduce the earnings on this card by a lot, so this is an apparent devaluation.

The Bank is removing the 10X earning on Smartbuy flights and bus bookings and reducing the earning of bonus points on Instant Vouchers, Trains, Amazon, Apple Tresor, and Flipkart. In September 2021, they had already reduced the number of points one could earn on Instant Vouchers, so this takes it down even further.

In a nutshell, this is the new earning structure for Diners Club Black. I’ve stripped away the unlimited 1X Reward Points which will be given away always per month.

You can continue to earn up to 7,500 bonus points on Diners Club Black per month; however, on a per-day basis, you can earn no more than 2,500 bonus points here on. Also, the bonus counts on the settlement date, not on the swipe date, as I explained earlier.

This is a double blow for HDFC Diners Club Black Cardmembers because they already lost the 10X partner brands earlier on.

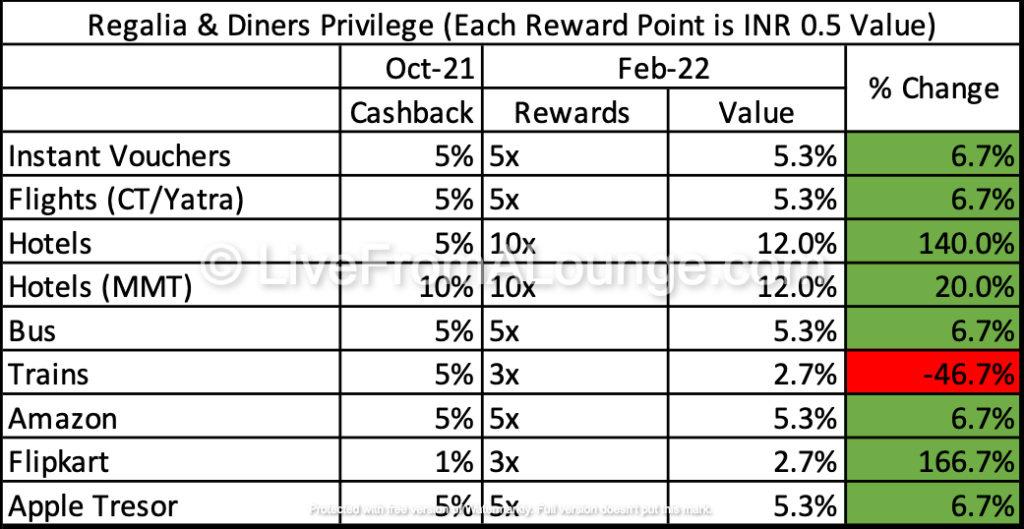

HDFC Bank’s increases rewards on the Smartbuy proposition for Regalia and Diners Club Privilege Cardmembers

HDFC Diners Club Privilege and Regalia are seeing a lot of restructuring. These cards are doled out like candy by HDFC Bank, and it has been going this way for a long time now. The Bank has moved to add the earnings on this card by a lot. HDFC Bank had been giving away cashback on these cards, and now, this is a points-based reward, where you will see a higher reward rate

This is the new earning structure for Regalia and Diners Privilege. I’ve compared the rupee value of the points and cashback to make it a more straightforward comparison. As usual, the 1X has been stripped away, and only bonus points are considered.

You can earn up to 4,000 bonus points on Regalia and Diners Club Privilege per month, however, on a per-day basis, you can earn no more than 2,000 bonus points. Also, the bonus counts on the settlement date, not on the swipe date, as I explained earlier. Earlier on, you could earn up to INR 2000 cashback, so the limit has remained the same (4000 bonus points = INR 2000).

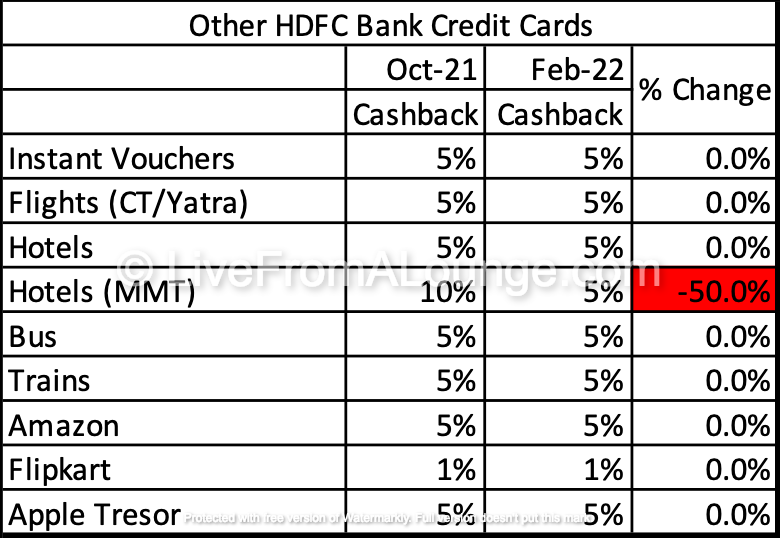

Largely stable on the lower-end credit cards

HDFC Bank continues to give out cashback on the lower-end cards, and it is largely stable. The Cashback limit of INR 1,000 per month also stays the same way.

Largely stable on the debit cards and PayZapp

On the debit cards and PayZapp, HDFC Bank continues to give out cashback, and it is largely stable. The Cashback limit of INR 1,000 per month also stays the same way.

My Take

HDFC Bank is still paying out of pocket on the Infinia but has decided to cut its Diners Club Black Card payouts. The reality is these products are giving you rewards on the back of the affiliate fee they earn from the merchants on Smartbuy. The merchants have hardly been making any money recently with Travel tanking the way it has during Covid-19.

Bottomline

HDFC Bank will rationalise earning of points on the Infinia, reduce earnings on the Diners Club Black Card and increase it for Regalia + Diners Club Privilege Cards. The changes are effective February 1, 2022. Infinia holders are still not treated very bad, but the Diners Club Black are in for a shock. Regalia & Diners Club Privilege holders see an increase on their reward potentials.

What do you make of the changes to Reward Points earning on Smartbuy for HDFC Bank Cardmembers?

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

I think the math behind these 10x points works when you have a relatively small pool of Infinia and DCB clients, being handed out reward points that are basically funded by affiliate fees from the non premium ecosystem who get pedestrian rewards/cashback. I think the last two years of the pandemic has decimated non premium CC spending and most of the affiliate fees is now coming out of premium and super premium CC spends (which obv don’t cover the accelerated rewards). In that case Ajay, you are right that even in the new structure Infinia rewards are being borne out of pocket by HDFC. I wouldn’t be surprised to see further cuts coming soon. But even after the cuts, Infinia still remains the most compelling CC product in India by a mile.

hopefully will expect galaxia card from hdfc in near future

I bought 1 lakh worth of Tanishq vouchers just yesterday, 31st Jan, with my Infinia. Was expecting around 13k points (4x).

Completely puzzled with 7.5 k daily cap along with the new settlement date thing. I guess my 31st Jan txn will most probably be settled on 1st or 2nd Feb 🙁

how did you buy Tanishq vouchers? I dont see the Tanishq voucher option on smartbuy.

Instant voucher calculation is off on diners black, 5x to 3x is more than 25% devaluation.

@piyush, thanks. the formula did not update. now fixed.

The way they were distributing LTF Infinia and DCB to corporate people, this was a matter of time. Let’s hope we have another ultra super premium CC from HDFC soon! Probably this is laying the foundation.

This is bad news… I just got my DCB 2 months back…

With this devaluation, sorry rationalisation, it’s time HDFC Bank went back to allowing 100% redemption for air travel and hotel stays. This 70% in points and the rest in cash is a joke, when you look at how rosy HDFC Bank says its outlook is in earnings calls.

Aj,

The regalia calculation looks off to me. After 5x every Rs 150 spent on regalia would earn 20 points. At redemption rate of 1 point = 35 paise this translates to Rs 7/150 or 4.67%. What am i missing?

@neil, Regalia for tickets is INR 0.5.

5% true cashback is worth a lot more than 5.3% on flights, where 15-25% discount is easily available most of the time.

Hi Ajay,

You missed to include Regalia/DCP 1x points along with 5% cb earlier.

Even if I consider 0.5 value per 1 point, then it would be:

Before 01/02/22: For every 150, 7.5 cb + Rs 2 (4 points) = 6.33%

Now: For every 150, Rs 10 (20 points) = 6.67%.

It’s a devaluation considering redemption charges and actual cashback value of points.

@Pranab, the base points have been stripped away from all the reward earnings and these are “pure” Smartbuy bonuses. So, when I am talking 10X, it means 9X bonus and 1X base. When I say 2X, it means the bonus is 1X and 1X is base and so on. So…since the base will continue to accrue, it has not been considered since you will anyways continue to accrue it.

Thanks. Time to move on. Expect more cuts across the board as MDR, and interchange, could potentially reduce further.

With this devaluation, sorry rationalisation, it’s time HDFC Bank went back to allowing 100% redemption for air travel and hotel stays. This 70% in points and the rest in cash is a joke, when you look at how rosy HDFC Bank says its outlook is in earnings calls.

I personally used to think 70% redemption is better because it brought parity if I bought a ticket with some coupons which gave 10-12% off. Now this changes it to 5% off via diners opposed to 10% earlier

Seems the time to ask for a upgrade to Infinia from DCB is now. Earlier the only difference used to be the limit of points 15000/7500….and the rest was exactly the same. The current round of devaluation changes that parity.

is the Infinia LTF still being offered after the switch to metal?

@Suchi, no.

I would have titled article as “Party is Over”….lol. Its sensible to move the normal spend from diners to else where (may be SC ultimate in my case). Post current statement year it makes little sense to renew DCB by paying fee (unless someone has DCB LTF). Daily capping on DCB of 2500 means you can’t book flights for family trip!!

@Sharad, in your head you could still cap it that way. We try and report, and keep away from sensationalism where unwarranted

@Ajay, I suppose here its quite warranted, given how Infinia / DCB were perhaps pinnacle of what consumer wanted or desired in India – this impacts everyone badly.

This really wipes out the value proposition of DCB. I suppose the stage is set for some other player to fill the gap in near future.

You’re looking for journalism from an industry-friendly blog…

@S Singh, Journalism means reporting the facts, without an opinion. Just in case you miss the difference. Oh, and if we were industry-friendly, what is this then…https://livefromalounge.com/make-vistara-great-again/?