HDFC Bank has launched a new Spend offer which is offering bonus points for Credit Card users for the Apparel, Jewellery and Insurance categories.

The new HDFC Bank Credit Card offer, launched on December encourages people to spend on their HDFC Bank Credit Cards on Apparel, Jewellery and Insurance categories, subject to the following caps:

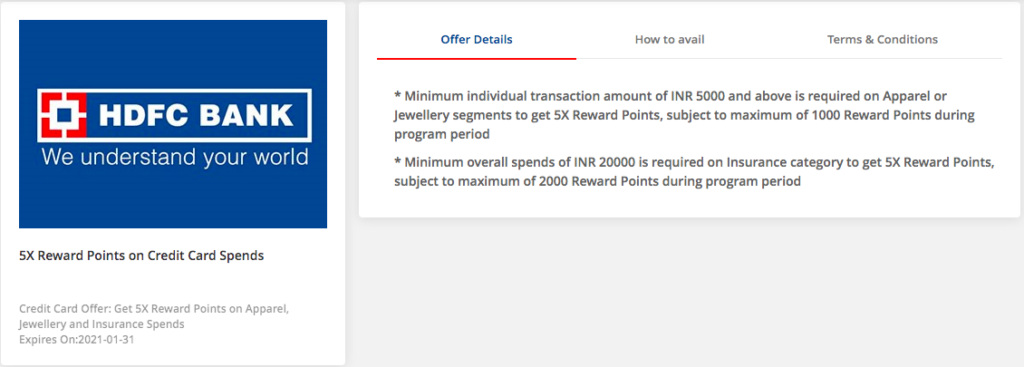

- Minimum individual transaction amount of INR 5,000 and above is required on Apparel or Jewellery segments to get 5X Reward Points, subject to a maximum of 1000 Reward Points during the programme period.

- Minimum overall spends of INR 20,000 is required on the Insurance category to get 5X Reward Points, subject to a maximum of 2000 Reward Points during the programme period.

So, if you are out buying over INR 5,000 worth of clothes, from, let’s say, Indian Terrain in the next 40 days using an Infinia, you should be getting 167 Reward Points + 668 Bonus points.

However, if you are out paying INR 20,000 towards insurance premiums, let’s say, in the next 40 days using an Infinia, you should be getting 666 Reward Points + 2666 Bonus points. This is where the insurance 5x points promotion breaks.

The offer applies to Retail and Business Credit Card customers only, and the additional reward points will come to your account by April 2021.

Classification of a retail transaction (Point of sale/Online) under a merchant category (Jewellery) will be defined by Visa/MasterCard or any other franchisee as applicable, and the same will be used for the bonus reward points posting.

What are your thoughts on the promotion?

(HT: Kunal Dani)

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

Hi,

I am new to the “maximising” credit card reward points system.

I have a 5L Insurance Premium payment coming up. I am wondering what is the best way to split the transactions to get the most number of points. I plan to pay for it using the Infinia Card.

Is the 2000 bonus cap limited to per transaction? Per day? Per month?

Because I believe Infinia caps at 5000 reward points per day on insurance spend (which is about 1.5L a day without any offers)

Appreciate your help and the blog thanks!

Is it over and above monthly reward caps?

Will NPS deposit count as Insurance Spend ?

The example you have given for insurance says 666 points + 2666 bonus whereas the condition for insurance specifies a cap of 2000

@Arjun, please read Para 4 last line.

Sir is this offer applicable for regalia credit card?

And for insurance payment through which website we’ve to get 5x points

How do we see the offer on the website?

Thanks

@Amit the link is already there.

Got it. Thanks 🙂

Hi Ajay, any idea if these are cumulative spends to reach the threshold of individual transaction needed to hit the spend target?

@Saul, it’s all written in the bullet points. read again. 🙂