I woke up this morning to a newspaper advertisement that shouted out about the announcement of Go Air becoming Go First. Their new tagline is You Come First. I won’t mince my words saying this took me by surprise.

Go Air transforms into a ULCC Player.

Go Air, in March 2021, brought on board Ben Baldanza, the former CEO and President of Spirit Airlines, a US-based Ultra-Low-Cost Carrier, as the Vice-Chairman of the Board of the airline. With that, the Wadias, promoters involved in the day-to-day operation of the airline, stepped back from management roles. One of the first statements Baldanza made was about transforming Go Air into a ULCC.

What is an Ultra Low-Cost Carrier?

Most airlines in India (IndiGo, SpiceJet, erstwhile Go Air, AirAsia India) market themselves as Low-Cost Carriers, while they are just No-Frill Carriers. This marketing helps their case, as in public perception, their costs are lower, and hence their ticket prices are lower than full-service airlines. However, that is not the case. 70% of the costs of a so-called LCC and FSC in India are the same in India, given everyone has to use the same airports, buy expensive fuel and so on. An FSC pays for meals, a loyalty programme and other trimmings, but mostly, airlines are spending about the same. And FSC/LCCs all charge the same fare as well, give or take a couple of hundred rupees that is looked at as the difference in the meal’s cost.

A ULCC then seeks to unbundle things in the traditional sense. You only pay for a seat when you pay for a ticket, and everything else is priced separately. For instance, you pay x rupees for a Mumbai – Delhi flight, then spend on the top for seat assignment, baggage, and so on.

However, Baldanza has different ideas for Go Air in this case. ETPrime (Paywall) talked to him, and here is what he said for Go Air,

The ULCC model is not about charging for everything…. every airline charges for everything. We will be able to be a profitable airline and make good money on those very low fares, by increasing our ancillary revenue by providing an option of bundling hotels or an adventure with their tickets. Go Air has been profitable since 2010, until the advent of the Covid, and you know that is where we draw a trend in terms of, you know, always being a profitable airline.

Go Air rebrands to Go First.

This morning, Go Air has announced the rebranding via a front-page advertisement in The Times of India. Here is the ad.

Their announcement does not reflect anywhere else on the airline’s assets. No aircraft painted with Go First yet have been spotted, which broadly signals that Go Air will operate as Go Air, the website and social media handle still reflect Go Air. There is no reference to the rebranding exercise anywhere.

Go First Vice Chairman Ben Baldanza said, on this occasion,

I am excited by the revamp of Go Air to Go First. India is a fast developing airline market. Consumers in India are hugely value conscious but are quite demanding when it comes to flying experience. The combinations of attractive airfares, a squeaky-clean flying experience, well sanitized flights and on time performance is what Go First is designed to deliver. And that is exactly at the core of our brand and service. At Go First, our Consumers Come First.

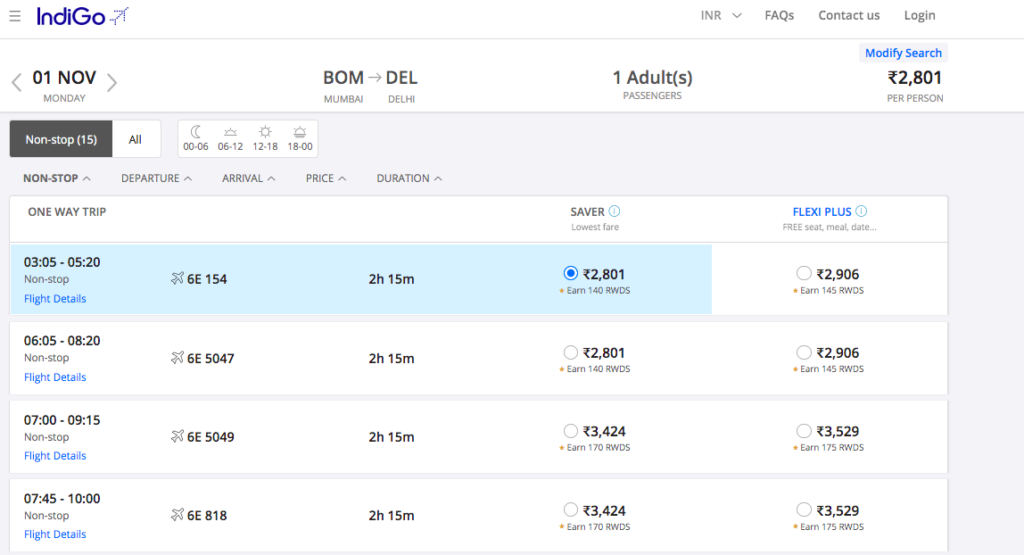

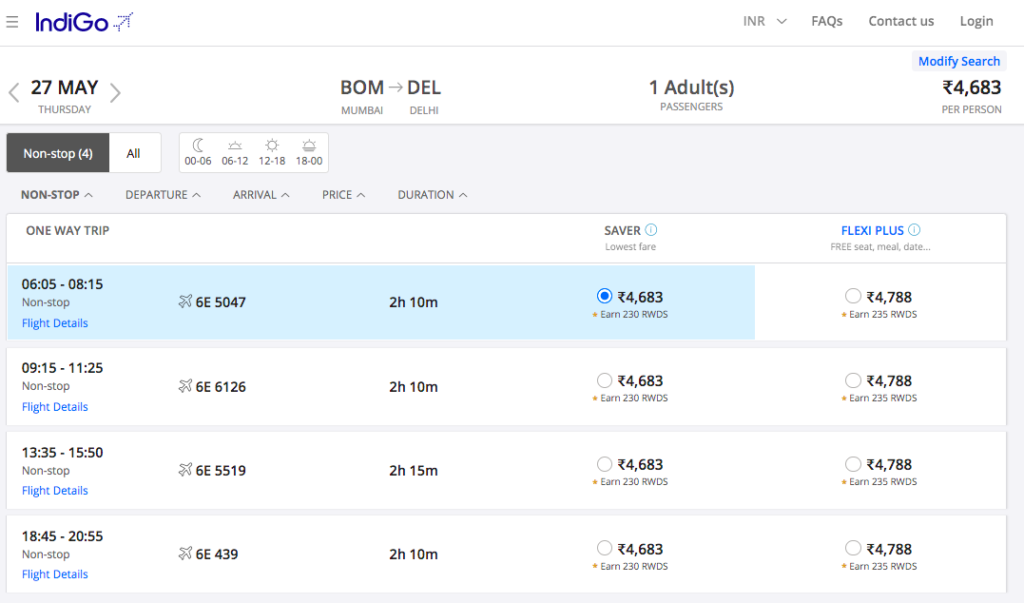

The fares do reflect anything that is a reflection of their move to a ULCC so far. For instance, I looked at far-out fares in November 2021 for Go First and IndiGo, and IndiGo turned up cheaper as long as you flew the red-eyes.

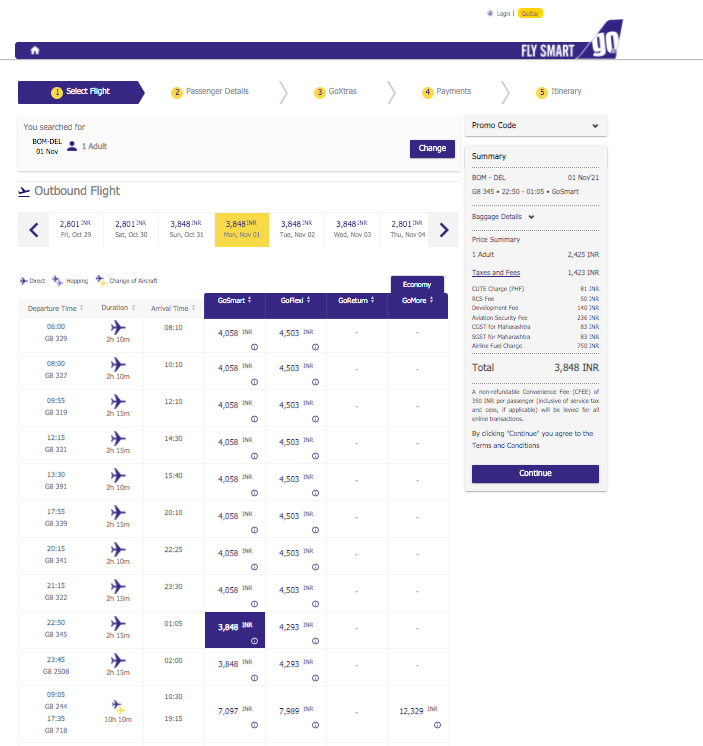

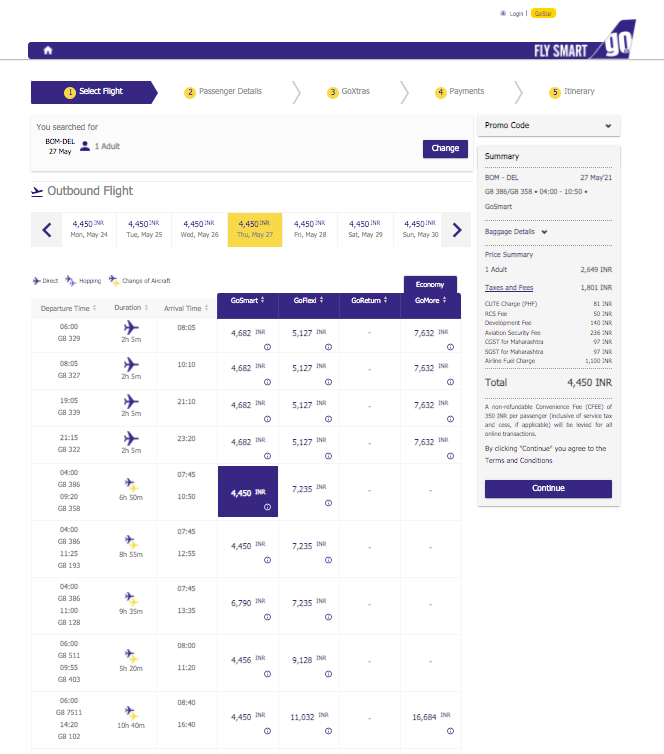

And then I went for a closer date, where again fares were mostly just 1 INR less than IndiGo.

I searched for many airlines and many dates but drew the same conclusion. Nothing changed at the airline so far, apart from the name.

In India, most people don’t care for the airline’s business strategy, as long as they get their lowest fare and 15-kilo baggage allowance. So, people will need to be well-educated about ULCCs and their bait and switch in the true sense. For instance, the lowest fare might be a hand-baggage only fare, but is it displayed in big letters that you need to buy bags separately, which will take your net outgo over and above the other airline you usually fly? You’ll be burnt once but not come back in these cases.

My thoughts on Go First: It is an Oxymoron

Oxymorons are figures of speech when contradictory terms appear next to each other. Go Air/Go First is branding to be a ULCC, but First Class indicates top-of-the-line and the best cabin on a plane. So I firmly feel the name is some oxymoron.

Coming to the part about the looks. Ben has the history of creating eye-grabbing stuff at Spirit, and the same follow through here, perhaps. Here is Spirit in its New York Taxi Yellow

Spirit Airlines A319 (courtesy Spirit Airlines)

Go Air seems to go for Go First in a similar attempt. Here is a look at their livery mockups.

Reader Harsh Agrawal, who first alerted me to Go First coming to life, tells me all the VT-WJ* series of aircraft (4 remaining being VT-WJW/X/Y/Z) are already painted in the Go Air livery and waiting for engines at Hamburg, so we might not see the Go First livery till the next set of planes get out of the paint shop of Airbus.

Why the rush?

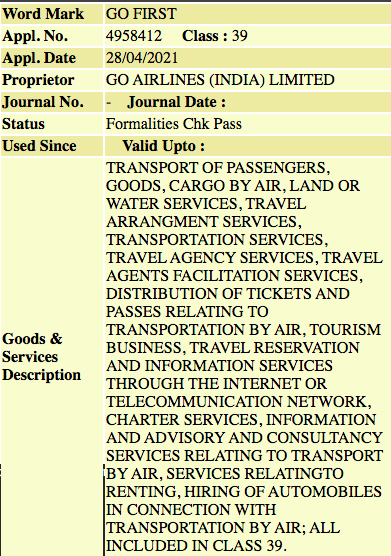

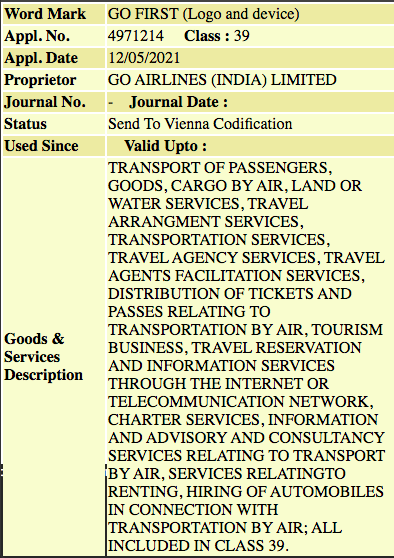

The whole rebranding exercise seems to be a rush job. Go Air went to the trademark office in April 2021 to get the name registered.

Then just yesterday, they received the approval for the Go First logo shown above in two colours (black and blue)

Go Air is scheduled to file its IPO papers for an INR 2,500 Crores (~USD 340 Million) IPO in the coming week (timeline per Mint). It might be a high possibility that Go Air/Go First prospectus might spin a big story about how India is a fast-growing aviation market and how a ULCC is the best way to address this market, and so on. And hence the rush to rebrand to showcase how they are already in action mode rather than thinking.

Bottomline

Go Air is now Go First. At least on paper. As an airline, to mould into a ULCC Carrier is an excellent strategy to go for, given Indian love for cheap fares, and no one better than Ben Baldanza to do it, given he already has the chops for this and has a seat on the table in the aviation world. Go First also has a sizeable aircraft order book to match with its order for 144 A320neo aircraft in 2017 with Airbus, out of which they have only picked up 48 till April 2021.

What do you think of Go First and its brand and strategy?

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

GoAir is a useless airlines. It’s Low cost ULTRA low quality airlines. Not a word of theirs to be believed. They are masters of false & hollow promises. Better avoided.

I wonder why the named got rechanged even if the airline has taken the ULCC model. Wont it be better to just stick to goair and adopt the same. It might become a bit cheaper as well, lest say they would not have to repaint its aircraft for the same (Though I feel even now Go First might not sign up for complete makeover of its fleet).

Or is something to get a bit more publicity, given they are going for an IPO. Go First with the saying “you come first” does look nice but at the same time, as is pointed out, it seems more like an oxymoron.

@Jai, I feel this is window dressing for the IPO.

I am avid reader of your portal. Sorry to say but I figure you got your maths all wrong on the IPO. No way can INR 2500 Crores equal $940 Mn) In fact its just about $340 Mn with today’s exchange rate of 73.53

@Sai, honest mistake. We got the 340 mio USD number too, and then taking it from the calculation to the typing I messed it up. Fixed now. Thanks for pointing it out.