One of the query I receive frequently from readers has been about the renewal for their Jet Airways co-branded credit cards issued by HDFC Bank, American Express and ICICI Bank. Most readers find it attractive to receive the card in the first year with 15,000 to 30,000 JP Miles as sign-up bonus, and want to cancel it after the first year because the second year renewal benefits are not as good, and they are paying the same amount of fees.

While everyone who likes collecting miles across the globe loves to look at the US banks and the ability of US residents to churn credit cards every 3-6 months for big sign-up bonuses, it is a heartbreak indeed that the same provisions are not applicable for any other market, not even developed markets such as UK and Canada. So, churning to be able to get another credit card is not exactly an option in India. If you get a card issued in India, you got to keep it for a while.

Also, while it makes sense to cancel the card after one year of holding it and taking all the sign-on benefits, it is not exactly in the best interest of your credit score. If you cancel a credit card within 2 years of opening a new credit line, it is a notation on your CIBIL score. It might not hurt you as a one-off case, but if you do it frequently, your score might go down.

The more important reason I like to see people retain their credit cards is, that these cards usually pay for themselves. The highest end HDFC Bank/Jet Airways card is priced at INR 2499 + taxes per annum, the ICICI one is at INR 5,000 + taxes per annum and the American Express one is at INR 10,000 + taxes per annum. Now, all these cards provide you a free ticket code with Jet Airways, which comes handy to make a base fare+fuel surcharge exempt booking on any one-way sector in India, as long as these are made at least 7 days out. Additionally, there are renewal miles thrown in for good measure as well.

But, these ticket codes, as long as they are used well, are by themselves a good reason to retain these credit cards over and above the first year period. Even if you counted your fees as paid towards these tickets, you’ve made savings, or at least broken even on the card. With American Express, while I know the fees is on the higher side, if you are a Delhi/Mumbai originating frequent flyer, or fly frequently to these destinations, it makes total sense to use the American Express lounge in these cities which is a personalised experience. Here is how the Mumbai American Express Lounge looks.

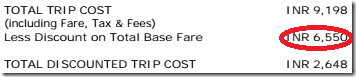

Take an example, just a few days back, I had to book my brother on a trip where he dragged his feet on making a decision for so long, that the ticket prices were high and we had not been able to make use of the various sales that had happened in India about a month back. Not his fault really, because there were other dependencies which were not clear. Hence, I used these ticket codes to book him up on two one-way tickets for onward and return travel, and that saved us a lot of money. Now, have a look at the discount we received on one of the two codes, and the other is a similar amount.

This amount is bigger than the fee on that card, so I think we are even.

Are you keeping or cancelling your Jet Airways co-branded credit cards this year?

Related Posts:

Join over 2900 people who check-in daily to find out about the best in travel.

Free emails (once-a-day) | RSS Feeds | Facebook Updates | Twitter | Instagram

I am a premier miles fan and a boarding area fan. 🙂

Can I not switch from the jet amex card to the other amex travel card, which has a lower annual fee and more miles on renewal

@kapil amex travel card is not a co-branded card. if you want to collect Jet miles that is not for you.

I am definitely retaining my ICICI Jet card but churning the Amex Jet! Whats your Jet Amex strategy?

Have the top end HDFC JP one and am seriously considering to cancel the same.

Can you point me to the source of your comment on cancelling a credit card within 2 years hurting your CIBIL score ?

In case of renewal of Amex jet card you get only 5000 Jp miles, no free tkt. am I right?

@agarwal you do get a free ticket yes.

I checked it twice today after reading your blog. . There is no free tkt only 5000 Jp miles.

I checked it twice today after reading your blog. . There is no free tkt only 5000 Jp miles. Please check.

@Ag please check the jetairways page where it states the Amex card details and you would find it there. Also I talked to Amex and they told me the same thing I am stating here.