One of the most common ask for frequent and infrequent travellers has been for a payment instrument that gives you a zero per cent forex markup. Of course, the US has it, so we want it here in India too (who does not want to save money?), but hardly any bank in India has moved down that road for a simple reason; no one else did it. RBL Bank has a credit card product with zero forex charges, but it also does not reward your international spending.

Enter Fi – the free debit card with 0% Forex conversion charges

Fi is one of the neobanks that have come through in 2021 into the market. I signed up for Fi in June 2021 since I was on their early invite waitlist somehow, and I signed up somehow with a borrowed Android phone since the bank did not have an iPhone app then (it is now available). I opened a zero balance savings bank account in Federal Bank, with my KYC being done via the app itself at the backend. The free Visa debit card arrived soon after opening the account.

I did not use the app much because there was no iPhone app, but now that there is one, I’ve found some compelling use cases for it. One of their statements on the website is zero forex markup. That means an instant savings of 4.13% (3.5% forex charges plus GST).

The reason I prefer using a credit card over cash abroad is the simple fact that I have liability coverage in case something goes wrong. There is a dispute resolution mechanism even when I get back home.

So, in the past few months, I managed to get out on work trips twice, once to Dubai and once to Paris/Toulouse, and I decided to test out the new debit card product on these trips. It turns out the promise is correct, and there is no hidden charge being levied.

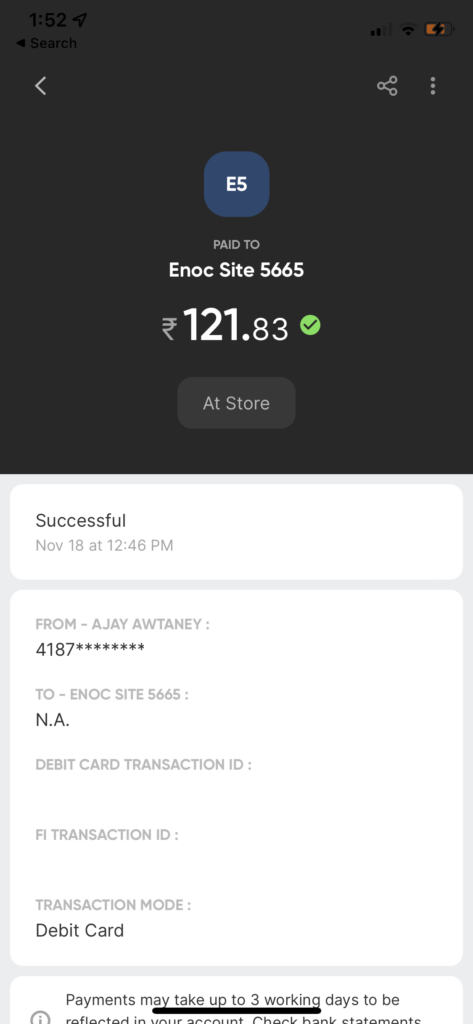

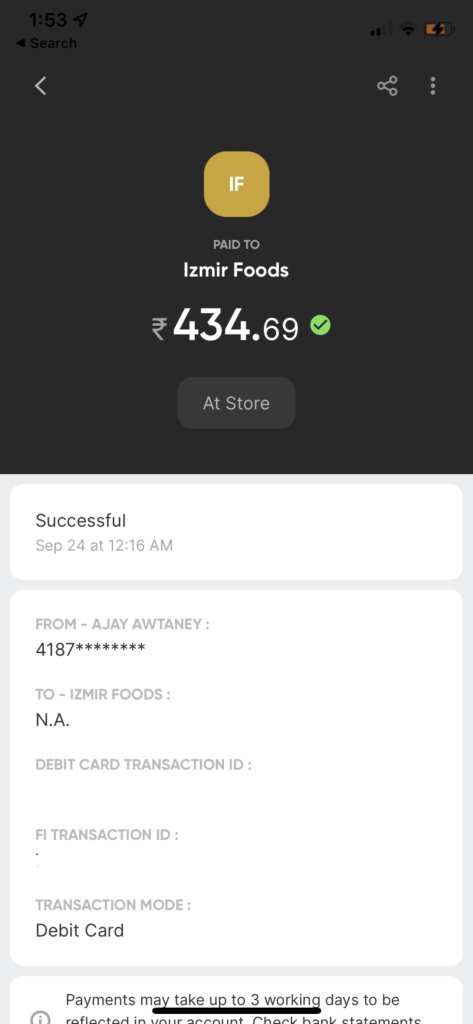

For instance, check out this 6 UAE Dirham purchase I made at a convenience store in Dubai at the Expo 2020.

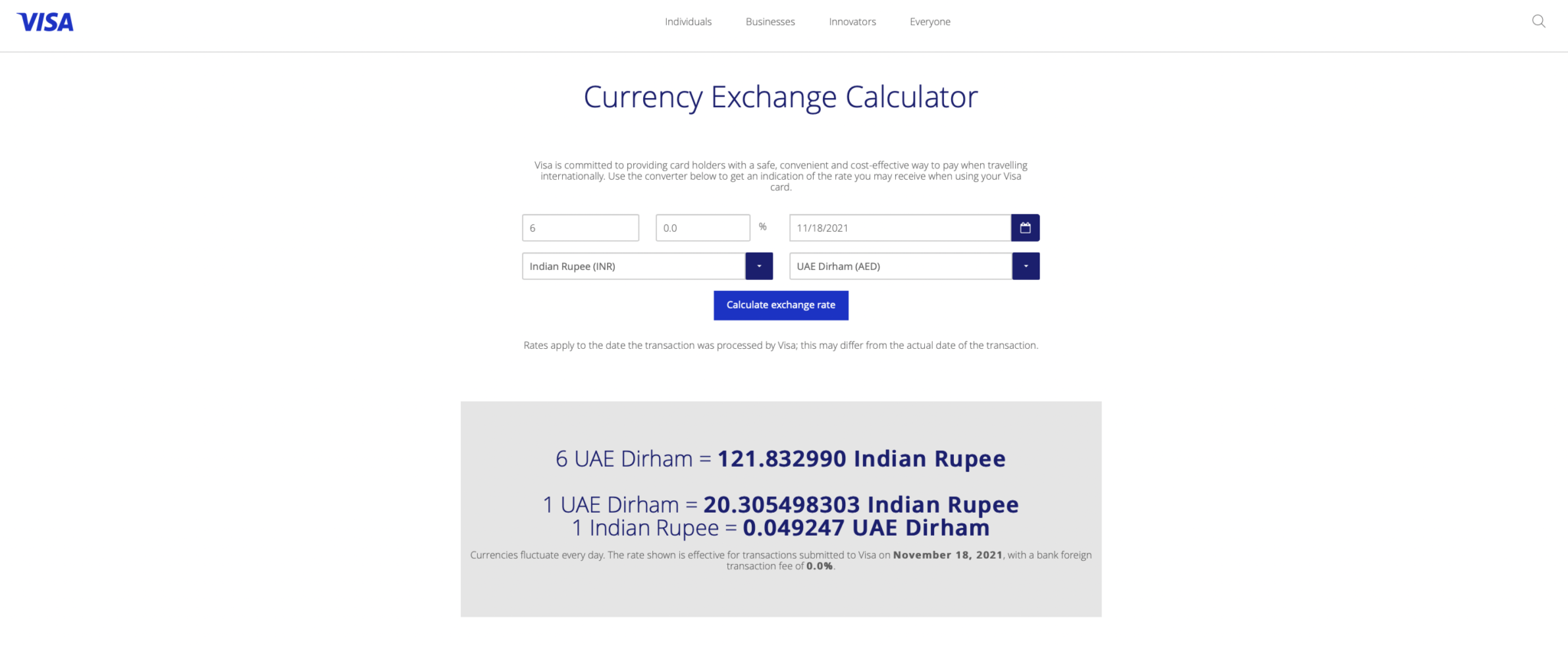

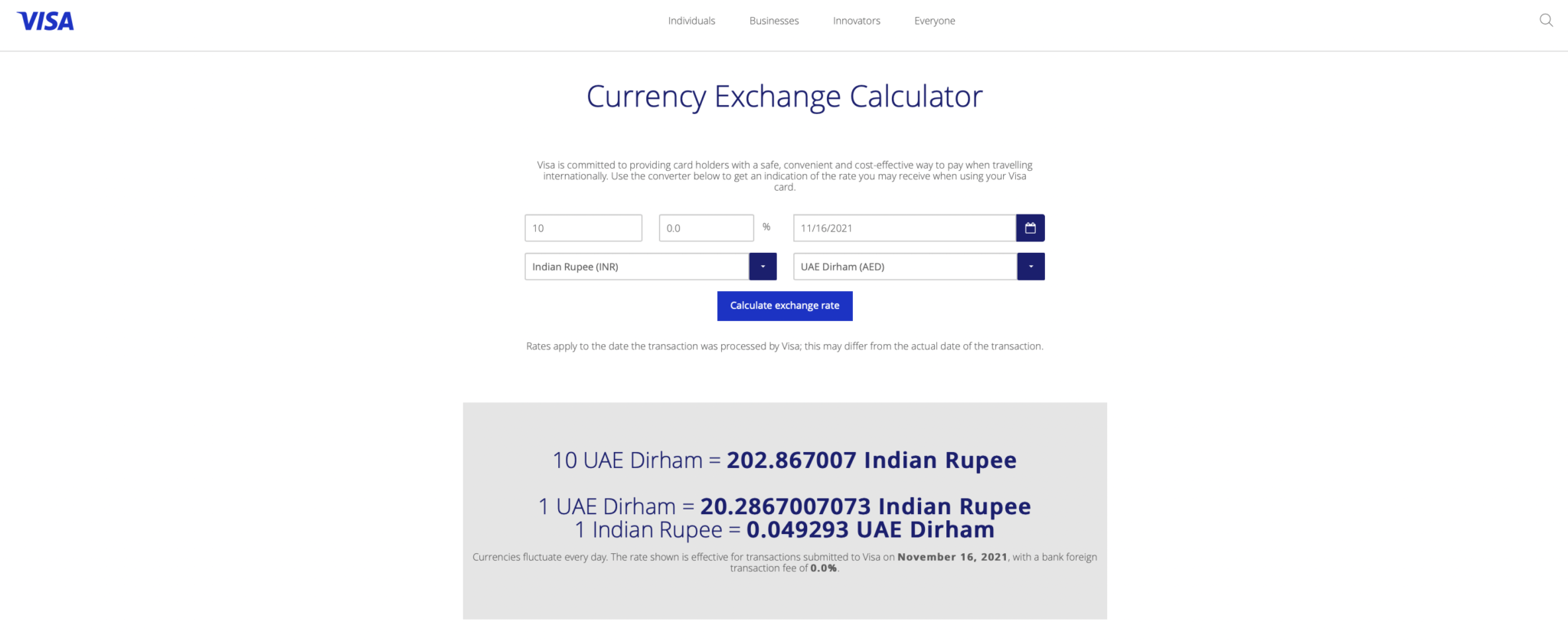

For reference, this is the Visa conversion calculator, which gives me the transaction as per Visa crossover rates on the day. It tallies to the second digit.

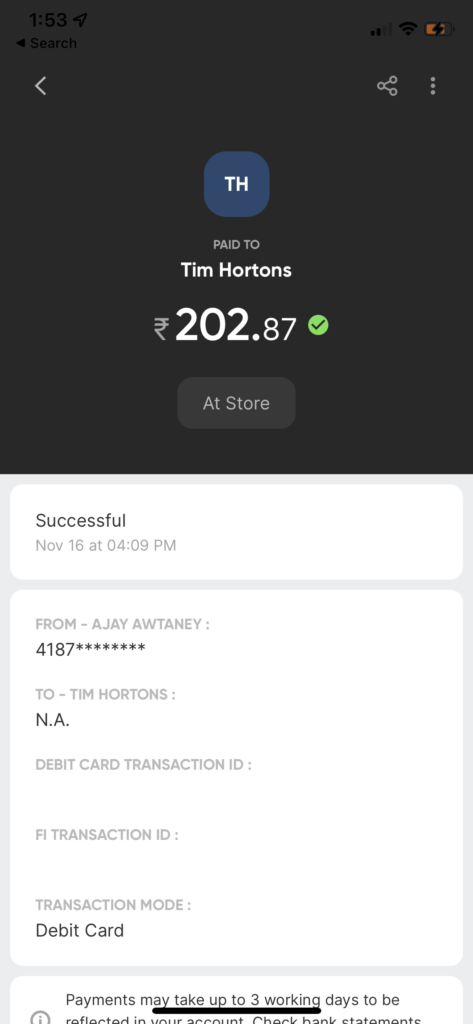

Here is another transaction from my trip to Dubai.

Again, it tallies up with the Visa Conversion Calculator. I am putting up the full-screen grab to see that all the details add up.

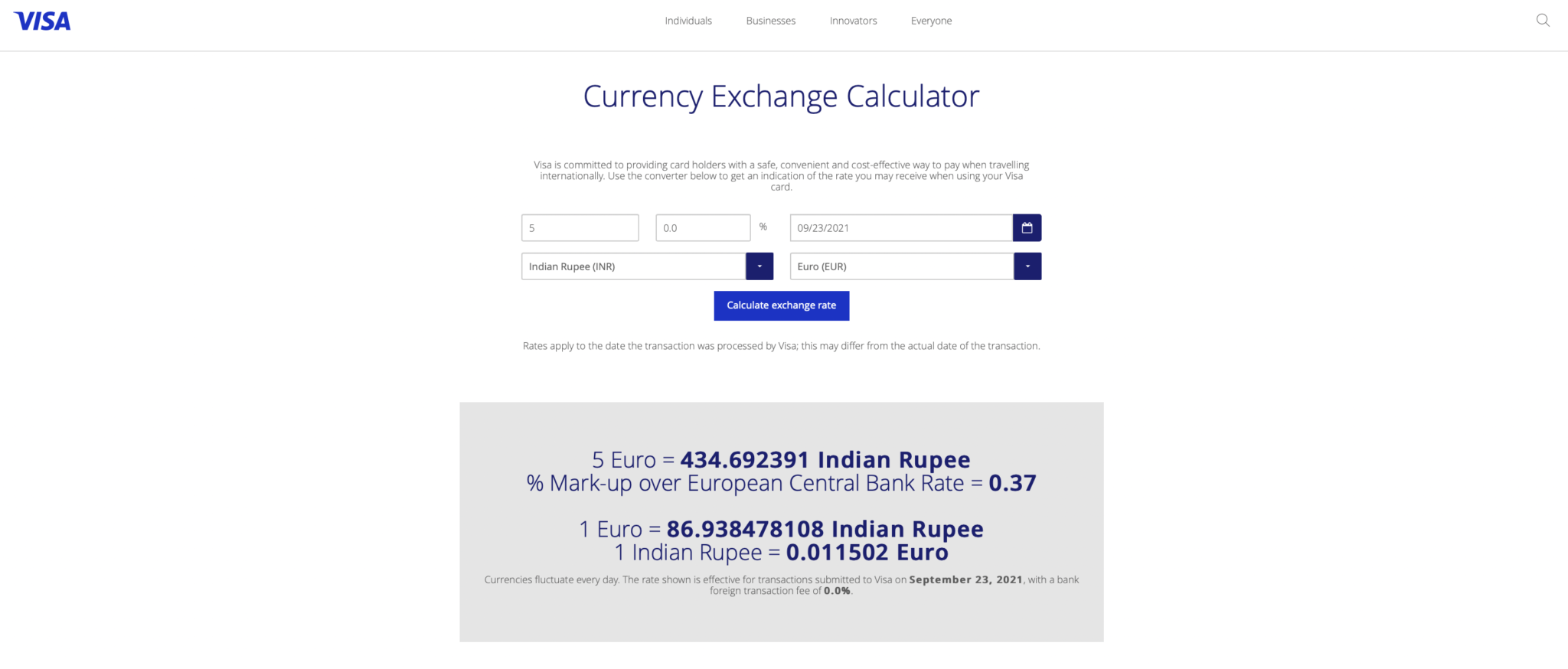

The same thing worked for me in France as well. Here is a quick 5 Euro quick bite I picked up from a roadside eatery one evening.

Here is the Visa conversion for the same transaction. There is some internal conversion markup, but that reconciles overall.

I’ve still not given up on my thesis of using credit cards for large purchases abroad where I need purchase protection (and get reward points). However, I now use my Fi debit card for the smaller ticket items, such as F&B, and it serves the purpose just fine.

I know there have been other cards in the market which have provided the zero per cent rate, but they were more on the lines of Forex prepaid cards and needed constant loading, and here, I add a fixed sum of money to be used during the trip and add or remove cash as it gets spent.

Also, the debit card can be activated or deactivated via the app in one moment, so when I am not using the debit card, I keep it off so that if I misplace it, I am not on the hook for someone else swiping it.

Sign up for Fi

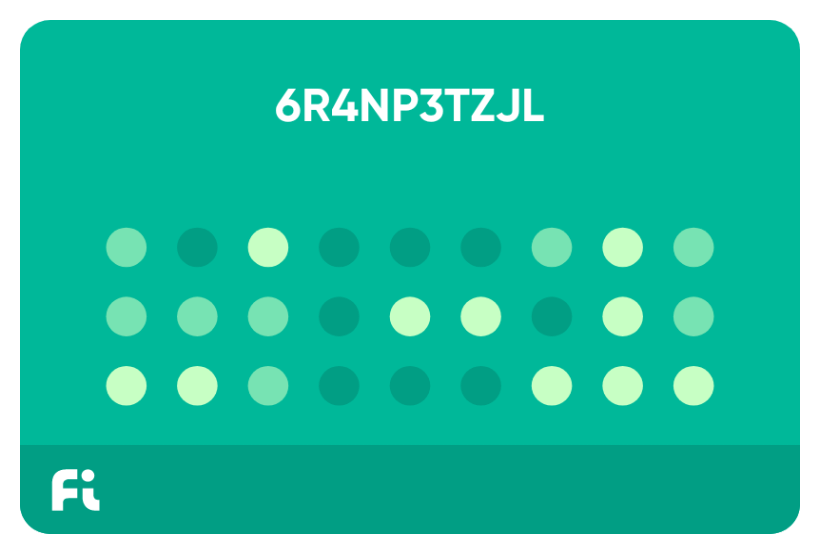

Fi offers existing members an opportunity to refer new members. You can sign up with my fi.nite code to jump the queue and get INR 200 into your account as a bonus if you add INR 3000 to your account within the first seven days. Join using the Fi.nite code 6R4NP3TZJL. All you need is your name, PAN Card, and Aadhaar Card to sign up.

Just remember, however, Fi is only available for working professionals at the moment, so they run a check on your employment status before providing you with a bank account.

Bottomline

Fi Money is offering a zero-balance free savings account, which comes with a free debit card for you. This debit card offers true zero per cent markup on forex transactions. You can open an account using the Fi.nite code 6R4NP3TZJL during signup, and you can earn rewards worth INR 200 or more.

Have you used the Fi Debit Card before? What has been your experience?

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

Hey Ajay,

Does this still work?

@Anu, what part? The signup or the 0% conversion?

0% conversion

Also, I texted Fi

They said they don’t levy charges but visa will charge some conversion charges on international transactions

@Anu, The Visa charges will be passed on to you in any card around the globe. But they are minimal if you read the full article top to bottom.

This feature has been there in the matket with Niyo for more that 2 years now. Now they are also offering lounge access also and their UI is also very smooth. Can you compare both brands?

Wow this account got approved in 3 minutes and got activated in 1.

Thanks for the update @Ajay!

How do they check employment status? What tool/platform they use, it’s new to me.

Appreciate if you can confirm it

@Daniel in my case (long ago) to put me on the waitlist I had to validate my EPFO status

@ajay, does thee 0% charges work if I’m withdrawing money from my Fi card from an ATM outside of India?

Jupiter has also revised their forex markup charge from 3% to 0%. So will that be a gud alternative?

@Raghav, I just saw that yesterday late night. Do you know when did this happen?

I noticed this change in the 5th of Dec 2021. However, it is posted under Offers, and so might be only a limited time promotion. They also mention that cross currency charges will still apply.

Yes, they removed the 5% cashback on international transactions and made the markup charges 0. Jiten mentioned on their blog that it is easier for customers because the cashback thing had certain restrictions as well.

This looks very similar to NiYO forex/debit card

@Rishi, Niyo charges money as an account maintenance fee. These guys don’t

It doesn’t charge if you transfer/transact for 10k per annum. I generally transfer 10k and then withdraw it using ATM.