In 2023, Scapia launched its credit cards focused on the travel space. Scapia was unique because its card products, as well as the entire app and experience, are centred on travel. For instance, the company offers an app that accompanies the card, allowing users to book flights and accommodations, as well as apply for visas.

In 2024, Scapia had to stop onboarding new customers because the regulator asked Federal Bank, their banking partner, to discontinue onboarding new co-brand credit card customers. But recently, they were back.

Scapia resumes issuance of credit cards.

Scapia relaunched its credit cards in 2025. Scapia’s core philosophy is to simplify travel rewards. They shot a video, narrated by Naseeruddin Shah, to announce their comeback.

Once they were back in circulation, I had my cards approved, and they instantly appeared in the list of cards in my wallet. Since then, I’ve received a few queries about why this card is getting spent when I have access to almost all the top-tier cards. Here is why.

Instead of point systems and redemption processes, Scapia offers a different model: zero forex markup, unlimited domestic lounge access, and travel rewards through its “Scapia Coins” programme. Here is how the card works:

- Zero Forex Markup: Scapia eliminates forex markup, making it ideal for international travel and online purchases in foreign currencies. However, you don’t earn rewards on these purchases.

- Airport Privileges: When INR 10,000 is spent monthly, one can access unlimited domestic airport lounges across India. Scapia also offers the option to spend money at specific airport outlets (up to INR 1,000) and then reimburses you in the form of Scapia Coins (1 Coin is worth INR 0.2).

- Scapia Coins Rewards Programme: The card gives back 10% Scapia Coins on every transaction. Through the app, Scapia is currently offering 20% off Scapia Coins. With the current conversion rate of 5 Scapia coins = 1 Rupee, this translates to 2% on regular expenses and 4% on travel expenses. These coins can be redeemed for travel bookings, including flights and hotels, through the Scapia app.

- Lifetime Free Card: No joining fees, no annual fees.

The key draw for me is the Scapia Airport Privileges Programme.

Scapia Airport Privileges. How do they work?

Scapia Airport Privileges are activated when you spend at least INR 10,000 before the statement generation date for the current statement cycle. In the first month, it is activated the minute you have spent 10,000 INR. Once activated, you see that it is activated in your dashboard.

There are three parts to the Airport Privileges programme, and you can choose one when you are travelling domestically around the country:

- Dine at the Airport. You can dine at an airport outlet and pay with Scapia. They will return up to INR 1,000 in equivalent coins to your account if you dine at an outlet listed in the app at one of the seven major metro airports in India (Mumbai + Navi Mumbai, Delhi, Bangalore, Chennai, Kolkata, and Hyderabad). At other airports, they reimburse up to INR 500. You need to select the outlet and activate it before swiping the card.

- Buy something at the Airport. You can also use this card to go shopping at the airport. Pay with Scapia. They will return up to INR 1,000 in equivalent coins to your account if you shop at an airport outlet in one of the six major metros in India (Mumbai + Navi Mumbai, Delhi, Bangalore, Chennai, Kolkata, or Hyderabad) listed in the app. At other airports, they reimburse up to INR 500. Please select the outlet and activate it before swiping the card.

- Sign up for Lounge Access at the Airport. If you are not the shopping or eating at outlet kind, you can opt for old-school lounge access, which is available via a QR code generated in the app. At last count, 25 cities in India had lounges accessible through Scapia.

- Spa. At some airports, Scapia will also offer Spa privileges, allowing you to enjoy a quick treatment before boarding your flight. For instance, this is not available in Delhi but is available in Mumbai.

Remember, you can claim only one of the four perks per airport departure, not all four.

I signed up for the card when it reopened for applications, and it was delivered with a fairly generous limit. I’ve heard that the card is also available to existing Federal Bank customers, and the card is also now on the BOBCard platform, so you can get better chances on having the card issued. I have no shortage of credit cards that offer lounge access, but I appreciate the feature that lets me sit at a coffee shop and get reimbursed for it, rather than having to head to the lounge.

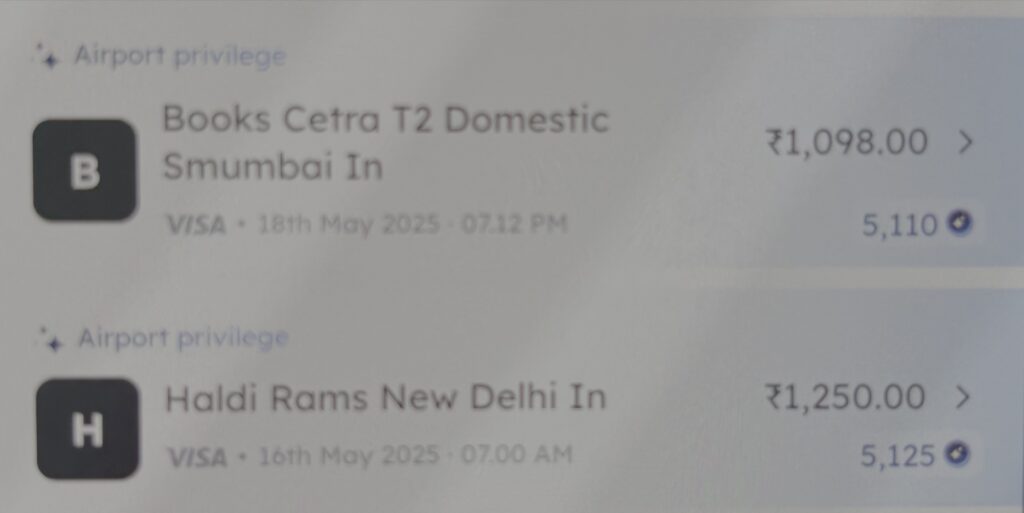

For instance, I was away for the Guns N’ Roses concert in Mumbai, and on the way out, I picked up some sweets, which were immediately reimbursed with 5,000 coins. For the return from Mumbai, I picked up some books and received 5,000 coins again. These coins are worth INR 0.2 each, so basically, I have coins worth INR 2,047 on a spend of INR 2,348, which is not bad at all.

Scapia International Spends: Zero Markup

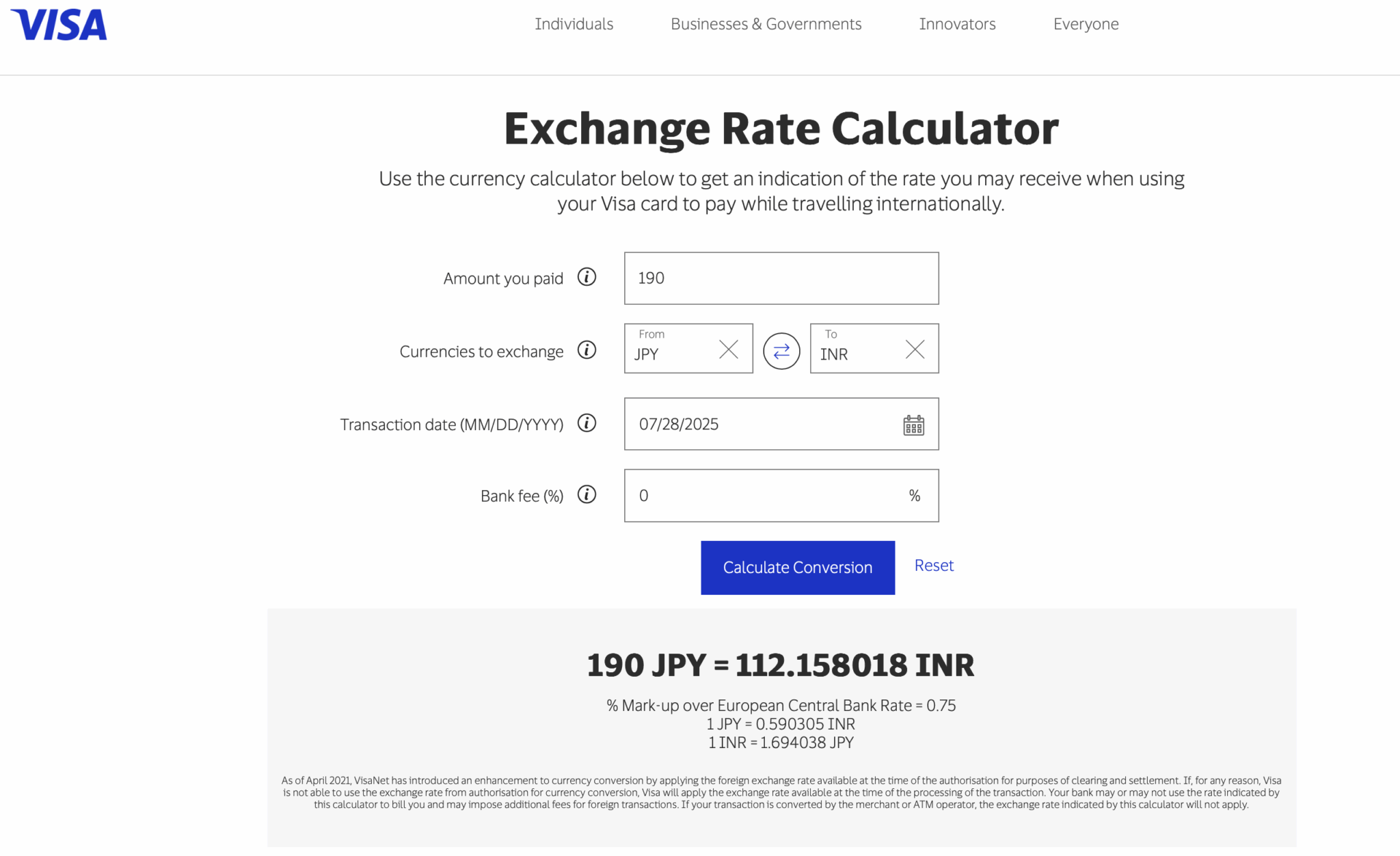

Internationally, this card is for all the pocket-change expenses where I don’t care much about points, but to keep it away from my high-value spend card —the Olympus—a soda here, a small snack there. For instance, here is a swipe I made recently at the Tokyo Haneda Airport.

Which was posted exactly as Visa would have wanted it to post.

You can go ahead with applying for the card here. You also receive 1,000 coins, worth 200 INR. Additionally, when you book your first ticket via Scapia, you get an INR 1,000 discount.

Note that Scapia will raise the minimum spend on the card to INR 20,000 per statement cycle, effective February 27, 2026. I still see enough use cases for the card.

Bottomline

Scapia has started onboarding customers again. This travel-focused credit card offers unique perks, is free for life, and features zero markup on international spending. One of the unique ones is the ability to earn coins for airport spending, which bypasses the need for lounge access altogether. Apply here.

What are your thoughts and experiences with the Scapia Credit Card? Questions? Please put them in the comments below.

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

Hey Ajay , hope youre well ! thankyou for these invaluable insights! its really weird , i have the quite a few cards primary being the magnus / infinia and amex from time to time but the scapia application just oddly denies the application as per some bank policies even with your referral link. could you advise ? Thankyou

Thanks for the heads up about the spend limit increase

While there are no points for Education/Govt spends – do they count towards the Rs 10000 milestone to unlock lounge/airport shop access?

@Suchi, yes they count. All expenses count towards INR 10K.

Thanks for the write up Ajay. Applied through your referral link.

Great to hear Scapia is back! A no-fee card with zero forex markup and airport reward coins sounds like a game-changer for travelers. Lounge access alternatives are a smart perk too—definitely worth checking out! ✈️

I wish I knew your referral code before I had applied 🙂 Got this recently and used it extensively on my Vietnam trip! A must have for all folks who are into traveling abroad.

If i make local purchases in a foreign country is there still 0% forex markup ?

@siddharth, that is the literal purpose of the card, right?

I take 15 flights a month

Applying now

Is the airport privilege limit of 1000/- per visit or per month?

@Rags per visit

Can we use the privilege at departure and arrival both ?

@Aka only at departure, at domestic departures.