The fintech tribe in India has been quietly levelling up for years. On September 15, 2025, CRED unveiled Yosemite, a significant expansion of its product universe that includes wealth tools, a mass-market co-branded credit card, and one area that will garner most of the headlines: Sovereign, an invite-only society and an 18-karat gold credit card aimed squarely at India’s most affluent.

What is Sovereign?

Sovereign is CRED’s premium membership programme: an invite‑only circle promising not just a payments instrument but a package of influence, access and highly curated experiences. At launch, it was described as a membership that bundles bespoke financial and lifestyle privileges — from early-stage investment syndicates to invitations to private auctions, and “white‑glove” travel services that explicitly extend to luxury mobility (yachts, jets) and curated civilian spaceflight experiences.

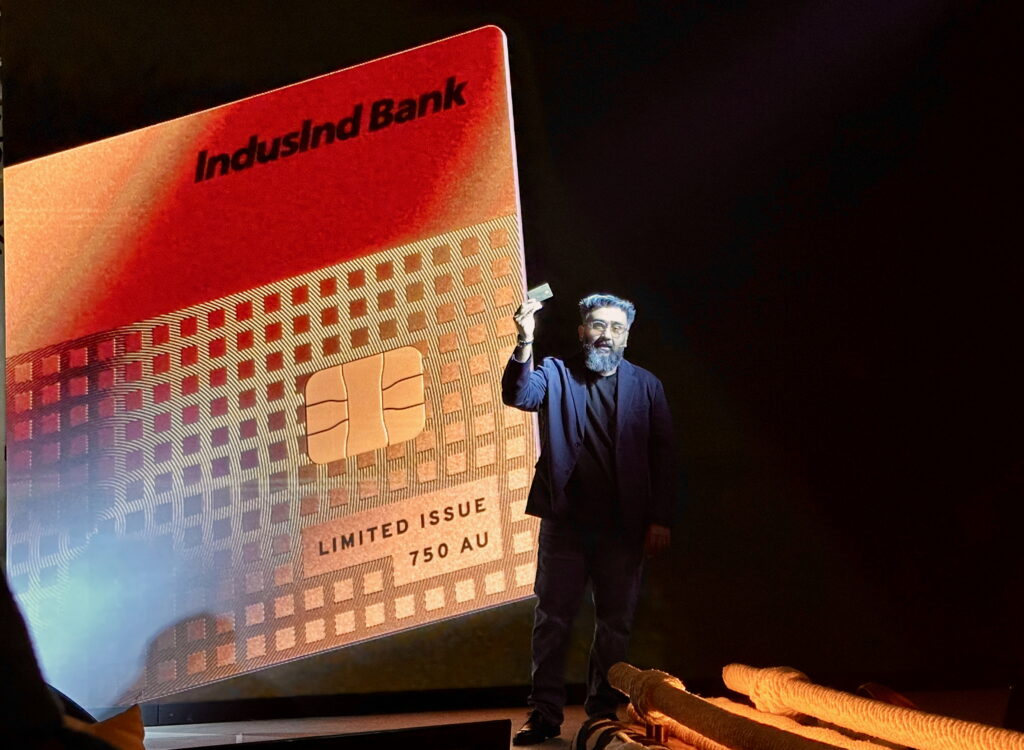

Every accepted member will receive a custom‑crafted 18‑karat gold credit card, finished with premium guilloché engraving and etched with the member’s name. The physicality and workmanship of the card are positioned as part of the status signalling — this isn’t a metal card; it’s a crafted object.

Who issues the card, and where will it work?

Because in India, only banks can issue credit cards, Sovereign is being issued in partnership with IndusInd Bank. The product has been revealed as being built on the RuPay EKAA tier — the new, premium variant in the RuPay family, designed to level with Visa Infinite and Mastercard World Elite.

That choice is essential. Ekaa provides CRED and IndusInd with a way to deliver a super-premium payments experience, utilising a homegrown rails network rather than importing the benefits architecture of Visa or Mastercard. Acceptance globally may vary with Amex, but RuPay’s deeper integrations in India will minimise onboarding and domestic friction. Ekaa is also supposed to be the network where HDFC Infinia Bharat is supposed to be launched.

Here is the video CRED put out at the event for Sovereign.

Perks and privileges (what CRED says members will get)

CRED has framed Sovereign less as a rewards card and more as a membership that confers influence and curated access. The headline privileges being talked about include those written above, and,

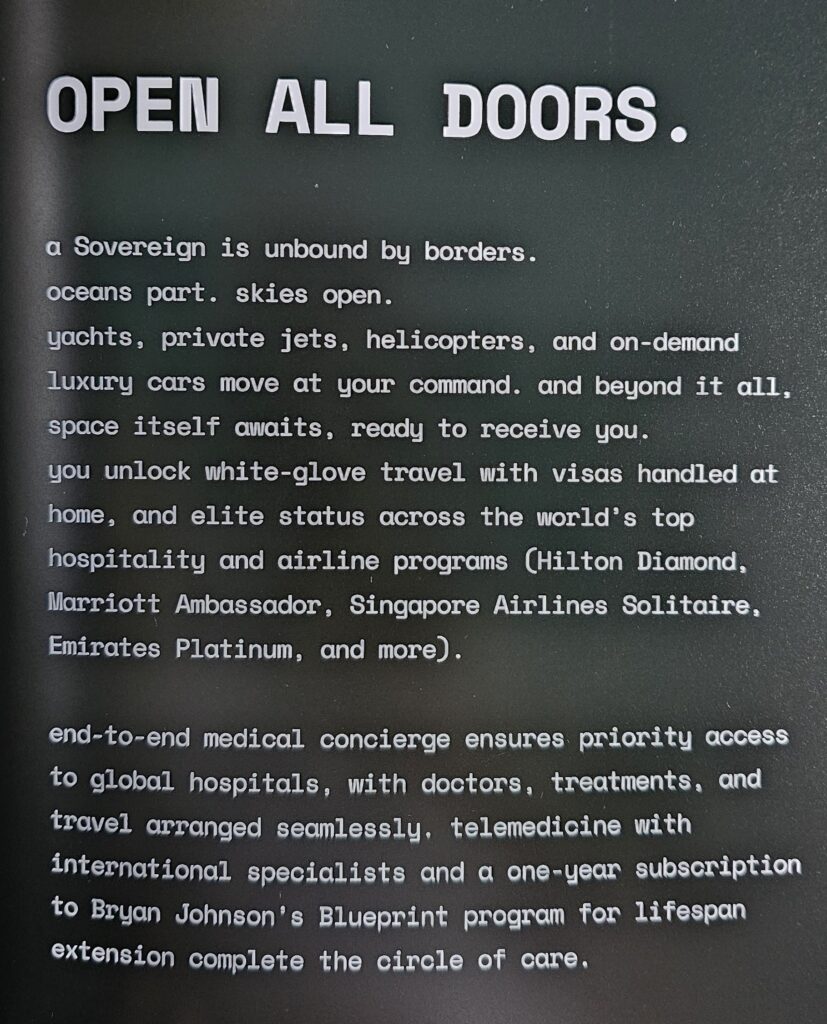

- White‑glove travel and mobility access – from priority booking for yachts and private jets to bespoke travel concierge services. CRED has even referenced access to curated civilian spaceflight experiences as part of the offering.

- Upgraded loyalty status – CRED has indicated that members will be offered top‑tier elite statuses at hotels and airlines. Exact partner lists and the route to status are yet to be published, but there is a reference to Singapore Airlines PPS Solitaire, Marriott Ambassador, Emirates Skywards Platinum and more.

- High‑touch concierge services — visa, global medical access, telemedicine and bespoke concierge assistance for high‑value needs.

- A one-year subscription to Bryan Johnson’s Blueprint programme

Taken together, these privileges resemble the mix of social access, curated experiences, and financial upside that the world’s premium charge cards sell—but packaged by CRED, not a bank card with points alone. Here is what the text on the CRED Yosemite booklet that was handed out at the end of the Monday event.

Is Sovereign India’s Amex Black?

There are obvious parallels to the American Express Centurion (Black): invitation‑only access, an aura of rarity, a bespoke physical artefact, a heavy emphasis on concierge and experiential privileges, and membership‑level benefits that go beyond simple reward rates.

Where Sovereign echoes Centurion:

- Exclusivity and an invitation‑only model. Both cards trade based on scarcity and social signalling.

- Bespoke metal (or gold) physicality. The physical object is part of the story — a crafted card, not a plastic one.

- Focus on influence, access, and white-glove services more than headline cashback percentages: concierge, events, travel, and private deals.

Where Sovereign will differ (or at least must differentiate):

- Network and acceptance. Sovereign runs on RuPay EKAA via IndusInd; Centurion runs on Amex. Amex has a decades-long global merchant footprint and an established premium partner network; Sovereign’s merchant acceptance and partner portability will depend on the new RuPay tier and the bilateral arrangements CRED/IndusInd forge with airlines, hotels, and service providers.

- Track record. Centurion’s benefits and relationships are battle‑tested over many years; Sovereign is newly launched and will need to build that ecosystem and prove the promised options actually materialise.

- Market positioning. Centurion is a global icon; Sovereign is unabashedly tailored to Indian UHNI tastes — access to India‑centric deal flow, local auctions, and a membership culture that taps into the country’s emerging wealth class.

Sovereign is plausibly India’s answer to the Amex Black in spirit — a membership for the most affluent that packages access, experiences and status. Whether it will achieve the same mythic cultural standing depends on how CRED executes the partner integrations, fulfilment and alumni network it promises. For instance, some of the benefits listed appear to have been compiled without a clear understanding of how they are achieved. SQ Solitaire is reserved for Singapore Airlines’ most prestigious customers who only spend on SQ Premium Cabins, for instance. SGD 25,000 (INR 17 Lakhs) on SQ Business and First within 12 months.

What we still don’t know about CRED Sovereign?

CRED has been intentionally tight‑lipped on key commercial mechanics that matter to anyone trying to evaluate the Sovereign Card:

- Exact eligibility criteria: invitations will be selective, but the thresholds (assets, spending, net worth, CRED behaviour) are not publicly disclosed.

- Fees and economics: there’s no confirmed joining fee or annual fee disclosed for Sovereign. Historically, ultra‑premium cards carry high initiation and recurring fees — but CRED has not published numbers yet.

- Credit limits and repayment structures: will Sovereign be a charge‑style product (full payment on statement) like many premium cards, or a revolving credit line? No confirmation yet.

- Precise partners and guarantees: mentions of auction houses, airline/hotel statuses, and spaceflight are headline-worthy; how many of these are binding partnerships versus aspirational access will only be revealed as the membership programme unfolds.

Until CRED publishes membership terms and IndusInd clarifies the issuance mechanics, a portion of Sovereign will remain an experiential promise rather than a set of legally enforceable entitlements.

Who is this for, and who should care?

Sovereign is designed for the ultra-affluent in India: individuals who prioritise influence, curated access, and the prestige of exclusive circles over incremental rewards. For HNIs, family offices, and serial investors, the marketed value isn’t cash back — it’s access to deals, events, and a community. For CRED, Sovereign is as much a brand‑building play as it is a product — it instantaneously elevates the platform’s perception of aspiration among India’s top percentile of spenders.

For travel and loyalty enthusiasts, Sovereign is an interesting option because it promises top-tier statuses and global travel facilitation — but the crucial test will be whether those benefits are delivered without onerous rules or blocked redemptions.

The business logic: why CRED is doing this

CRED has spent years building a reputation as the go-to destination for creditworthy individuals. A lot of what is being launched now was always on the drawing board, or at least Kunal Shah’s mind, in 2018, as well, when I’d talked to him before CRED was launched.

Sovereign is a logical step in monetising that curated base: ultra‑premium memberships are rarely about scale and everything about high ARPU (average revenue per user), ecosystem lock‑in and halo marketing. If CRED can deliver a small cohort of very high‑value members — and generate fees, commissions on privileged investments, travel fulfilment margins and secondary services — the economics could be compelling.

At the same time, launching an aspirational product raises the brand’s premium perception among the broader user base, which may drive adoption of the open consumer RuPay co-brand card and CRED Money services.

Bottomline

Sovereign is an audacious statement: a tech company packaging a membership that combines investment upside, cultural cachet and physical, artisanal status. It’s a product built for India that now caters to a fast-growing set of ultra-affluent consumers who seek global experiences without leaving the domestic market.

It is reasonable to call Sovereign India’s equivalent in spirit to the Amex Black card — but the equivalence is aspirational, not literal. Execution, partner fulfilment and membership economics will decide whether Sovereign becomes a cultural icon or a glossy footnote.

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

Leave a Reply