Club Vistara has been dipping their toes in measured aggression, taking on the market that Jet Airways sort of left open for them after its temporary grounding which hasn’t ended eleven months hence. There is always the demand for credit card issuers to be able to convert their points into airline miles. JetPrivilege no longer remains the attractive option there, and Air India has withdrawn from almost airline transfer partnerships over the years for some strange reason.

In the process, everyone has left the market open for Club Vistara, who now has partnerships with the following banks/transfer partners:

- Axis Bank eDGE Rewards

- American Express Membership Rewards

- HDFC Bank Diners Club Reward Points

- Yes Bank Reward Points

- IndusInd Bank Reward Points

Club Vistara Bank Points Conversion Bonus

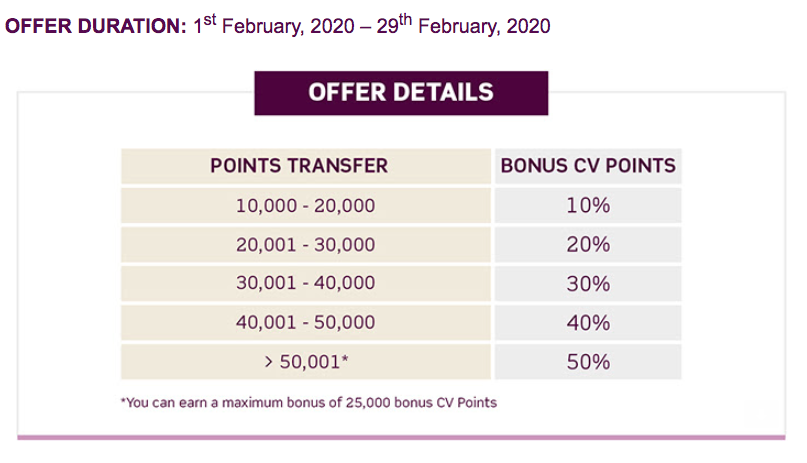

Club Vistara is now offering a new promotion for February 2020, where they are encouraging members to get up to 50% bonus on their transfer to Club Vistara, as long as they are converting them up into 50,001 Club Vistara Points or more.

- Convert into 0-9999 Club Vistara points = No bonus

- Convert into 10,000-20,000 Club Vistara points = 10% Bonus

- Convert into 20,001-30,000 Club Vistara points = 20% Bonus

- Convert into 30,001-40,000 Club Vistara points = 30% Bonus

- Convert into 40,001-50,000 Club Vistara points = 40% Bonus

- Convert into 50,001+ Club Vistara points = 50% Bonus

Since there are five bank transfer partners, you can get the bonus of 25,000 points from each bank one time each, making it a total of 125,000 points.

The offer is capped at receiving a maximum bonus of 25,000 Club Vistara points in total, which means you can transfer in a maximum of 50,001 points to receive the full 50% bonus points. Remember, different programmes have different conversion ratios:

- Axis Bank eDGE Rewards (4 eDGE Rewards = 1 CV Point)

- American Express Membership Rewards (3 MR=1 CV point)

- HDFC Bank Diners Club Reward Points (1 Point = 1 CV Point)

- Yes Bank Reward Points (4 Yes Bank Points = 1 CV Point, for Private Card 1:1)

- IndusInd Bank Reward Points (2 IndusInd Bank Points = 1 CV Point, for Premium Card 1:1)

To be clear, this promotion is not valid on co-brand card partners where you anyways earn Club Vistara points which directly bank to your Club Vistara Account.

Club Vistara Bank Conversion Bonus eligible Cards

The following cards are available for transfer:

- American Express

- The American Express Centurion Card

- The American Express Platinum Card

- The American Express Gold Card

- The American Express Platinum Reserve Credit Card

- The American Express Platinum Travel Credit Card (currently free)

- The American Express Platinum Corporate Card

- The American Express Corporate Card

- The American Express Green Card

- The American Express Membership Rewards Credit Card (now free)

- Axis eDGE: All Axis Bank customers eligible for Axis Edge Programme

- HDFC Bank Diners Club

- HDFC Diners Black Credit Card

- HDFC Diners ClubMiles Credit Card

- IndusInd Bank

- Premium Credit Cards

- IndusInd Bank Indulge Credit Card

- IndusInd Bank Crest Credit Card

- IndusInd Bank Pioneer Heritage Credit Card

- IndusInd Bank Pioneer Legacy Credit Card

- IndusInd Bank Legend Credit Card

- IndusInd Bank Pinnacle Credit Card

- IndusInd Bank Signature Credit Card

- IndusInd Bank Iconia Credit Card

- IndusInd Bank Platinum Credit Card

- IndusInd Bank Platinum Select Credit Card

- Non-Premium Credit Cards

- IndusInd Bank Platinum Aura Credit Card

- IndusInd Bank Platinum Aura Edge Credit Card

- Premium Credit Cards

- YES Bank

- YES Prosperity Credit Cards

- YES Premia Credit Cards

- YES FIRST Credit Cards

- YES PRIVATE Credit Cards

Important Things to note

The offer needs you to convert points in a single transaction, so multiple smaller transactions from various banking partners will not get you one big bonus. You are eligible to get the bonus one time from each bank’s transactions. For instance,

- A member can convert his Bank Reward Points to 10,000 CV Points from one partner and another 25,000 CV Points from another Partner. In this case, the member will be eligible for 1,000 bonus CV Points on the first conversion & 5,000 bonus CV Points for the second conversion.

- However, if a member does a conversion of 6,000 CV Points and 7,000 CV Points respectively through two different partners or from the same partner, he/she will not be eligible for the bonus since the valuation of each conversion request is less than 10,000 CV Points.

All the points that you will receive will be valid for 36 months from the date of transfer.

Here are the important T&C to keep in mind:

- This offer is valid on successful conversion request/s placed with your bank/s between 1st Feb 2020 & 29th Feb 2020 (both days inclusive).

- Bonus CV Points will be credited within 45 working days once the base CV Points have been credited into the Club Vistara account of the member.

- Under this offer, CV members can earn a maximum of 25,000 bonus CV Points when converting their Bank Reward Points to more than 50,000 CV Points in a single transaction.

Analysis

Club Vistara is not JetPrivilege, and with JetPrivilege, I used to maintain a big balance to encash on international flights for upgrades and redemptions. Vistara, on the other hand, tends to follow a very Emirates Skywards kind of approach towards upgrades and redemption flights, keeping their Economy cabin very much accessible for all, but keeping their Business Class cabin very aspirational and not in the reach for those who want to try their product upfront with their hard-earned miles.

Vistara also does not have a massive network outside India. But it is all coming up, and if you’d like to bank a bonus hoping to get redemptions to a long-haul network flight later in the year, this may be a great bet then but not by much. For instance, if a 4-hour Mumbai Singapore flight costs 75,000 CV points one way in Business Class, how much would it cost to fly to London in Business Class? I’d imagine nothing less than 1,50,000 CV Points.

However, if you intend to use your CV Points for upgrades and domestic travel, then it is an idea to take the bonus as well. But if you are an HDFC Bank Diners Club Black customer, you could just directly use your points for INR 50,000 worth of travel on Vistara.

Bottomline

Vistara’s new promotion is good on the headline level and takes off the sting on the high pricing of Club Vistara redemptions, but only by so much.

What do you make of the Club Vistara Points Transfer Bonus?

It may prove useful for DCB also as DCB shall always remain at a risk of devaluation or imposition of limits of redemption of miles for a particular transaction, which is very unlikely for Vistara

10 more days (until Feb 15) to go for 2x points on Axis Bank Vistara Credit Cards

https://www.airvistara.com/trip/partnership-exclusives/axis-bank-vistara-credit-cards

I use HDFC Diners Black and will use to book tickets by redemption directly . No fun in converting to Vistara and using 50% bonus

yes, it might not profitable for DCB. good for clubmiles.

Is it still on?