I’ve been a big fan of the Citibank PremierMiles credit card, ever since it landed in my wallet almost a year back now. However, the product features have been changing and I’m not exactly impressed by all of them.

Overnight, there is a reduction in the lounge access policy, which quietly underwent a change. A reader Gagan pointed this out to me in the comments, and got me to have a look. While the MasterCard version did not have too many lounges to start with, on the Visa network, there were a lot of lounges in India and outside India to go for. However, I cannot blame, but thank Citi for having keeping the lounge access alive. This is because, the earlier benefits were offered by MasterCard and Visa networks, and while these have now been closed out by the networks themselves, Citi has approached them to make new tie-ups for PremierMiles customers.

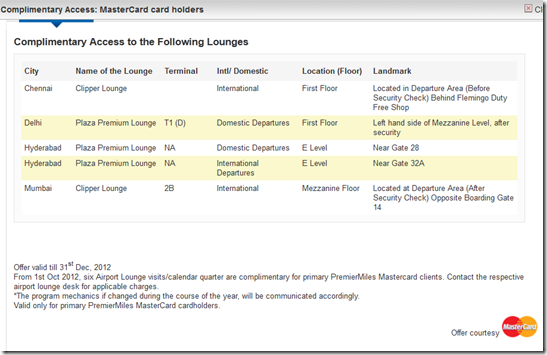

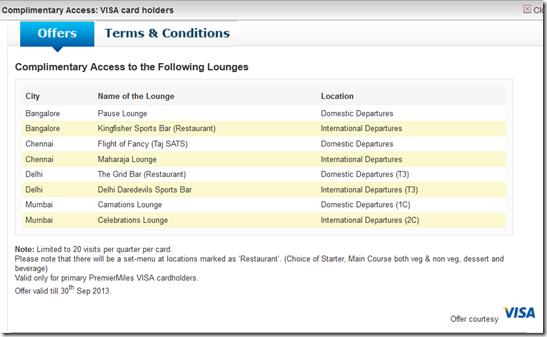

Here is a snapshot of all the lounges/restaurants which one can access using the Citibank PremierMiles as of this moment.

What is disappointing is however that there is new wording which says only ‘Primary’ cardholders may use the lounges ‘complimentary’ now. While the lounge has no way of finding out if a credit card is primary or add-on, the card company sure can charge for an add-on swipe at a later point of time. I am not too ruffled by the change at this moment however, till I don’t get to test it myself.

So, what are your views on these latest changes? On one hand, Citi is doing some fantastic promotions with the card, on the other hand, some bennies are going away…such is life!

Related Posts:

- Sunday Plastic: The ‘new’ Citibank Premier Miles Credit Card

- Citibank PremierMiles Card: more changes!

- Hang on, do not use your Citi PremierMiles for Jet Airways redemptions

- Get complimentary access to Indian lounges with your MasterCard

Live From A Lounge is present on Facebook, Twitter & available via email, RSS.

Actually, I was surprised to find that my Citibanks Premier Miles Card got me free access to Citibank Lounge and another one at Jakarta’s Airport.

I am at Dubai airport and went to Marhaba Lounge. The girl over there told me very curtly that any Indian Mastercard is not acceptable.

So much so I showed her a platinum Visa card issued by ICICI but she refused to accept. Is it worthwhile to change to Visa from Mastercard, as I guess there are no charges and it can be done easily.

@Sandip, Visa and MasterCard only make country/regional level tie-ups. All credit cards issued in India would only be able to offer you benefits for Indian lounges only.

Can someone please help me choose between the Citi Premier miles and the Amex Jet card, whic one should I go for? pls let me know soon.

Card company are suppose to intimate this to the holders by email.

I still think it’s great that you can have 20 visits per quarter for this card.

The Singapore version provides a complimentary Priority Pass membership that only has 2 visits per year…

Card companies can tell the lounges which cards are primary vs authorized user…

@josh, the approval is on a swipe system here where a dummy transaction needs to be approved before being let in. So, all cards look the same and no way to differentiate at the lounge. Even the BIN numbers are not of a different series.

I am not sure if you are of this recent development

http://www.online.citibank.co.in/portal/newgen/mailer/dec12/PM-ProductFeatureChange-Info-Mailer-portal.htm?eOfferCode=PPMPFTMLR

So effective 1st Jan, it would be fixed rate of 100 PM = Rs. 50/-

@AJJ separate post on that. my understanding is that the fixed price option is not being withdrawn. However, if someone wanted to redeem a 15K BOM-DEL ticket using 8400 PM, they will be paying 30K PM instead now.