One of the biggest ask I keep getting from readers across India is for a hotel co-branded credit card. Unfortunately, no one is picking up the gauntlet to launch one in India so far, and neither are the banks getting warm about this nor are the programmes. So, the next best thing you can do is to pick a card which gets you the relevant hotel points. That leaves you with only three banks, essentially, two cards from Citibank, one from HDFC Bank Diners Club, and only one true blue bank which can get you all sorts of hotel loyalty points: American Express. Here is a great way to buy Marriott Points cheap, below.

American Express’ Membership Rewards currency, which is awarded across American Express corporate cards and personal charge and credit cards, is essentially, then, the only card issuer in India which has not one, but two major global hotel chains as a part of their programme: Hilton Hotels and Marriott. These are two of the biggest hotel chains in the world, and these hotel points come pretty handy in any corner of the world.

Marriott, for instance, has 118 hotels around India. It is India’s largest hotel chain by the network. Domestically, you can find hotels from Category 1 to Category 7.

JW Marriott Mussourie: Category 5 (35,000 Bonvoy points)

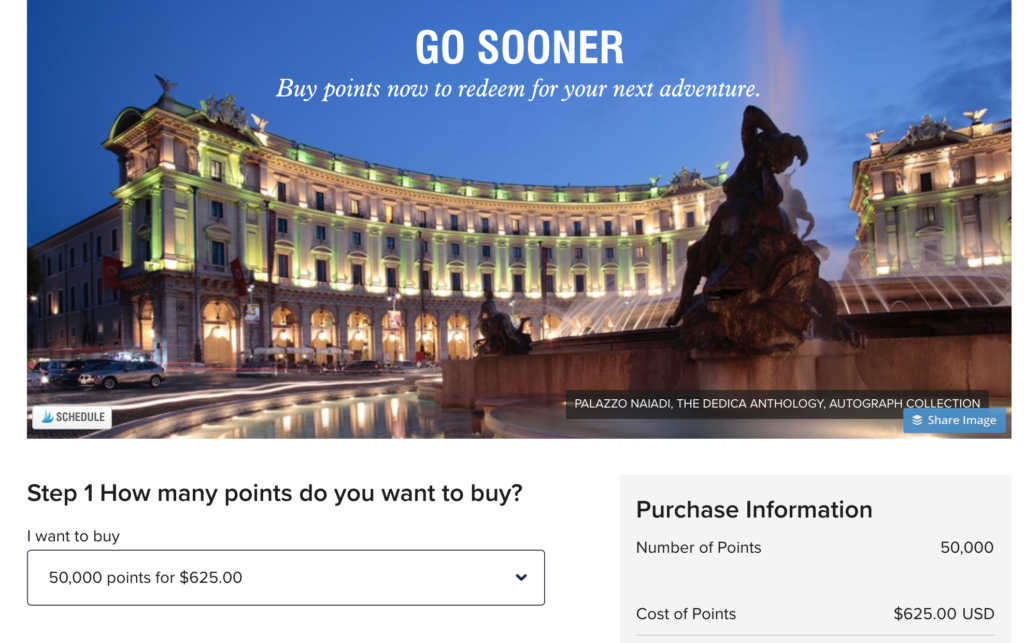

And globally, of course, there are over 7400 properties to choose from, for instance, top-end properties like the Al Maha Dubai, which is an all-inclusive resort in the desert. But, again, for all of these properties, one needs a perpetual supply of Marriott points. At the moment, if you wanted to buy points from Marriott, you have to pay US$ 625 to buy 50,000 Marriott points, which is about INR 44,000, which means the price of each point comes to INR 0.88.

Given Marriott is only partners with American Express in India, this is a great opportunity to sign up for an Amex card to get Membership Rewards points. Specifically, the American Express Platinum Charge Card. The new, shiny, metallic card now comes for a fee of INR 60,000 per annum and offers 100,000 Membership Rewards points for signup. And subsequently, you can earn one Membership Rewards point for every INR 40 you spend on the card.

The card comes with its own set of benefits, with unlimited lounge access for two using Priority Pass , travel insurance, access to the American Express lounges around the globe (Mumbai & Delhi included) and so on. However, if you consider applying for the card with this link, you get another bonus 10,000 points on top of the usual points, which means a total of 110,000 Membership Rewards points to start your account. All you have to do is spend INR 5,000 on the card. That is one way to buy Marriott Points cheap.

The card comes with its own set of benefits, with unlimited lounge access for two using Priority Pass , travel insurance, access to the American Express lounges around the globe (Mumbai & Delhi included) and so on. However, if you consider applying for the card with this link, you get another bonus 10,000 points on top of the usual points, which means a total of 110,000 Membership Rewards points to start your account. All you have to do is spend INR 5,000 on the card. That is one way to buy Marriott Points cheap.

If one looked at it this way, you get a tonne of Marriott points, and the benefits that come with American Express Platinum Charge card are coming free. These include the Marriott Gold Elite status which gets you a 25% bonus every time you make a paid stay at a Marriott hotel, Shangri-La Jade status, which gets you Taj Gold, as well as Hilton Honors Gold status.

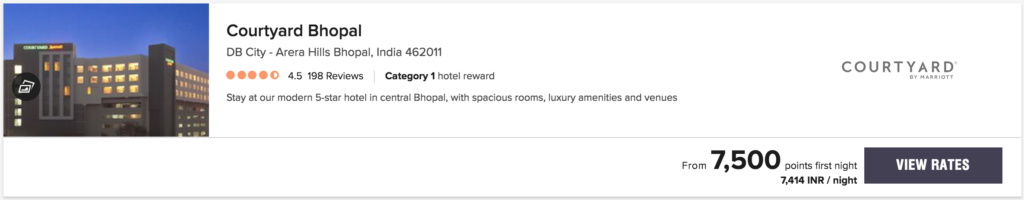

How to spend those 110,000 Membership Rewards Point? You can use them for Category 1 Marriott Hotels, where the room rates are high enough for about 1 INR value per point (by transferring to Marriott Rewards). Very handy for the entrepreneur who travels places and will basically be able to get benefits and perks over and above the cost of the card.

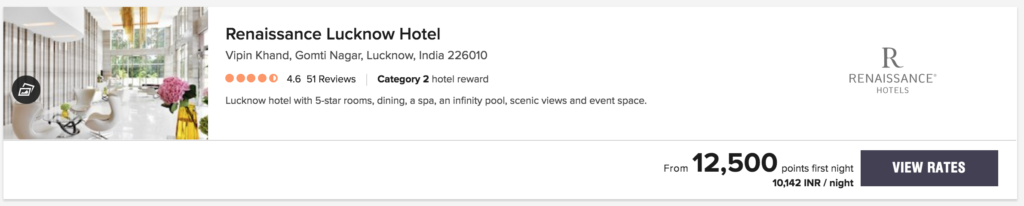

Or such as these where Category 2 gets you a 5-star hotel in the heart of Lucknow.

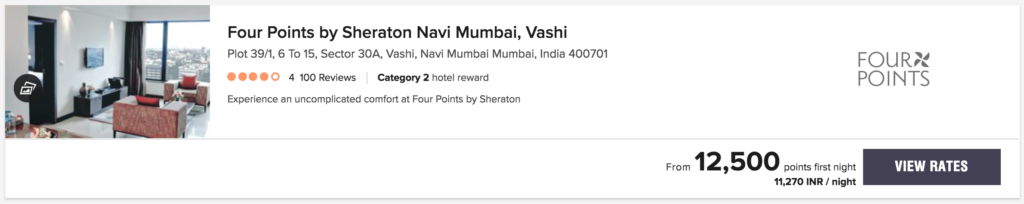

Or in Navi Mumbai.

Remember, redemptions don’t attract the 18% GST, which the regular room rates attract.

Or if you are a lifestyle connoisseur or travel geek like me, you have the opportunity to use these points at global Marriott hotels. Remember, the 5th night comes free on redemptions.

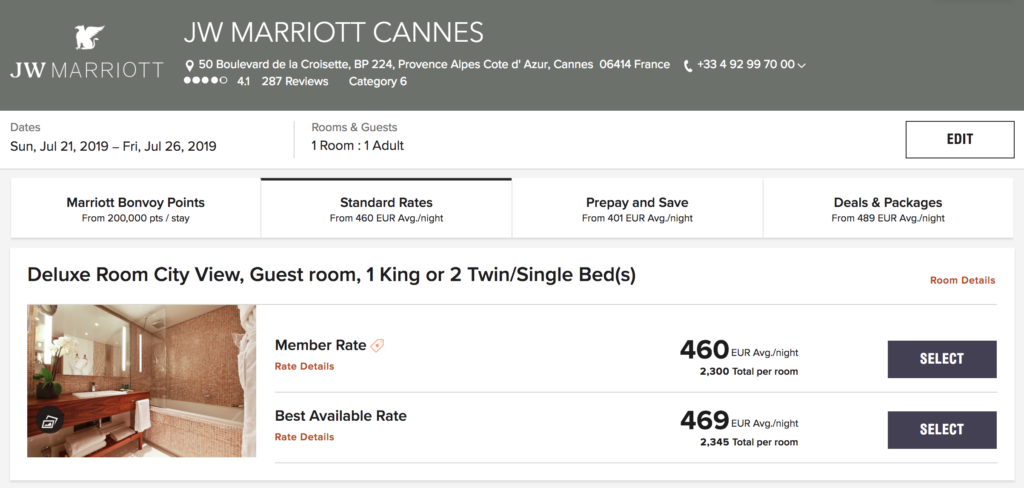

For instance, look at this fabulous JW Marriott hotel in Cannes, which is retailing for 460 Euro per night, or 200,000 Marriott Bonvoy points per 5 nights, in peak Europe Summer season!

INR 180,000 for 200,000 Marriott Bonvoy Points. Nice!

The transfer is seamless, and you will get your points in your Marriott Account usually within less than 3 days.

So, if you are planning to get the American Express Platinum Charge Card, this might be a great time to get one, given American Express has some great offers lined up for American Express card holders, and with a lot more to come in the days ahead I hope. Some of the big ones in the recent past have been:

-

- INR 4000 Hyatt Statement Credit on American Express Cards

- Marriott F&B Dining on American Express

- Double Points Promotion on Educational Spends

- American Express Centurion / Platinum members, get your Marriott vouchers!

- Amex Insurance Offer: 10X Membership Rewards points [Expired/April 2019]

- New American Express Spend Offer for vouchers worth INR 30,000 [Expired/April 2019]

- 6X Membership Rewards on American Express International Spends

- Amex Future Group Offers get you up to 20% discount through 2021

- Starbucks American Express promotion: 20% off for Amex Card members [Expired/April 2019]

So, there is a great value at this point of time to sign up for the American Express Platinum Charge Card, with this special offer, which gets you 110,000 Membership Rewards, equivalent to 110,000 Marriott Bonvoy points for 55 paise per point.

Sign up here for this exclusive offer.

Transferring bonvoy to mileageplan is a no brainer.. better value than lifemiles on asia-nam J flights

How much does Amex charge for supplementary cards? What benefits do supplementary card holders get?

Which credit card can give me Marriott gold membership and how to calculate maximum points.

Hi Ajay,

There’s another offer going on but it’s for people who upgrade to the charge card from the Platinum Reserve card. You get 125k points on joining this way. No option to opt for the hotel vouchers when upgrading like this though.

Ajay,

You have mentioned that we can get Marriott points at 55p so it looks like there won’t be any GST if applied from your referral link i.e. we pay only 60k rather than the usual 72k odd with GST. Please confirm

@Ashish, GST is payable.

Hi Ajay,

Arent we actually paying 77K for 110K points (60k + GST + 5k spends) which makes the value as 0.77 INR ?

Do let me know if this logic is flawed.

regards

Neo

@Neo, nope. you are only paying 60K + GST. Also, when comparing with the Marriott buying price, we’ve disregarded the GST/applicable taxes, so the apple-apple comparison is purely the price. When you pay 5K towards spend you get something for your money, right?

To be fair, thats still around 64p/Marriott point once you have in GST.

Just couple of queries:

Understood the advantages of Marriott points from Amex. Love it.

But what about the value on let’s say Hilton?

And any other hack of getting great value in Marriott points?

@Rahul, Hilton is available as well.

I personally value Hilton points at Rs. 0.3, but with hotels of Category 1 and Category 10, you can push them to almost Re. 1, a bit easier if you’re using Gold (see: upgrades at Cat 10) and 5th night free on redemption.

I personally will never transfer from Amex to Hilton. Hilton points are very easy to earn on regular stays and give a lucrative return on Cat 10 when earned the normal way. I’m earning 38 points per dollar currently.

Here’s an example — Let’s say you’re staying at Conrad Rangali, you’ll spend 380K points for 5 nights. That’s 3 lacs worth of hotel assuming no upgrade. Assuming my regular earning rate currently, I get it after spending around 7 lacs on Hilton hotels. That’s over 40% back. 70% back if I get upgraded to over water villa.

Hope this helps.

Hi Amex Guy,

Can you pl explain a bit more on how you are earning 38 HH points per dollar spent?

10 base, 20 bonus (targeted offer, until March 2020), 8 for Gold.

Hey Amex Guy, I have around 1.5L Membership Reward points, about 30k Marriott points, and 55k ANA Miles. Would love to know your take on the value maximization.

Here are the few options that I have explored:

– I have ANA 55K miles, round trip business to San Francisco is about 110k miles. Bonvoy gives a shitty 3:1 transfer rate but the ticket alone is like 2.5L.

– First class upgrades on Emirates cost about 40k miles one side. Round trip to Amsterdam in Business is about INR 140k whereas First is about INR 340k.

– Marriott Flight+Hotel package. They say you can book 5-day package by calling the helpline.

Just throwing around ideas, I usually spend my points on far fetched experiences (First class upgrades, Category 8 hotels :P).

Is the yearly renewal fee 50K ? saw this card in the website , got confused as there are many platinum cards variations

@Vinay there is only one Platinum Charge card, the rest are credit cards.

nice!

Do we get 100K MR points on renewal as well?

Nope. If you spend over 40 lacs a year or around that figure, and threaten to cancel, expect a Taj Voucher or some points your way.

Can those points be 100000?