Etihad Guest has disengaged with SBI Cards, and the cards will be closed on March 31, 2026. In the meantime, Etihad Guest has partnered with BOBCARDS, and the new cobrand cards have been available since January 2026.

BOBCARD x Etihad Credit Cards

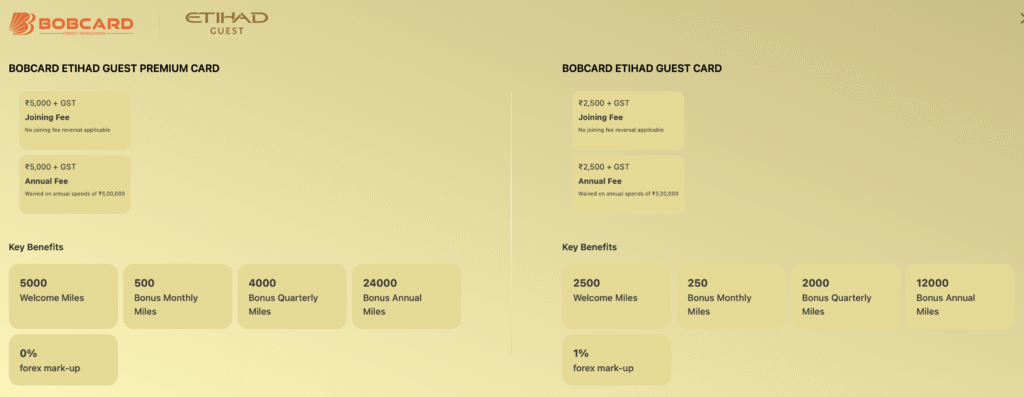

BOBCARD’s long-teased tie-up with Etihad has arrived in earnest: two co-branded cards, a standard BOBCARD Etihad Guest Credit Card and a higher-end BOBCARD Etihad Guest Premium Credit Card, that are aimed at people who fly Etihad occasionally or frequently. The headline here is simple and attractive: both cards earn Etihad Guest Miles on everyday spending, carry travel perks you would expect from a co-brand arrangement, and for a limited time, BOBCARD is offering double welcome miles on new sign-ups.

Mark Potter of Etihad Guest and Ravindra Rai M of BOBCARD at the launch party of Etihad Guest Credit Cards

The standard BOBCARD Etihad Guest card sits lower on the fee ladder and gives a base earning rate with basic travel conveniences; the Premium variant carries a higher joining fee but also a materially better miles earn rate on Etihad spends, milestone bonuses for heavy spenders, airport lounge access and other premium niceties designed to reward frequent international flyers. That positioning is textbook airline co-brand strategy: give a permission structure to convert everyday spending into miles while reserving the real travel luxuries for the premium price tier.

On the earnings side, the Premium card tilts hard toward Etihad purchases: expect accelerated miles on Etihad and partner airline spends (advertised as a multiple of miles per INR 100), while the base card offers a lower headline earn rate across general spends. Importantly for people who travel internationally, BOBCARD has positioned the Premium product with zero forex markup on international transactions — a meaningful saving when you factor in the cost of currency conversion on bank cards. For those who extract value from airline co-brands by redeeming for long-haul premium cabins, having faster miles accumulation and no forex markup can add up quickly.

BOBCARD Etihad Guest Card

- Up to 1 Etihad Guest Mile for every INR 100 you spend in India.

- Up to 2 Etihad Guest Miles for every INR 100 you spend internationally.

- Upto 3 Etihad Guest Miles for every INR 100 you spend on etihad.com

- Signup Bonus: 2,500 miles (credited within 30 days after paying your first year’s fee)

- Annual Milestone Bonus: 12,000 Miles (Awarded post spending INR 750,000 in a year)

- Fast track: Silver Tier (automatic upgrade after first transaction on Etihad’s website)

- Domestic Lounge access: 8 complimentary access to domestic Visa Lounges in India (two visits per quarter).

- International Lounge access: 4 complimentary access to international lounges (one visit per quarter).

- Monthly Bonus: 250 bonus miles will be awarded post spending 4 transactions worth a total INR 25,000 (and same offer for spending on add on cards as well, separately)

- Quarterly Bonus: Get 2000 miles every quarter on spending INR 200,000 in the quarter.

- 1% fuel surcharge waiver. Available for each transaction between INR 500 and INR 4000, up to a maximum of INR 250 per cycle.

- Annual fee refund: Spend INR. 300,000 in your first year, and your annual fee will be refunded in your second year.

- Earn 500 bonus miles for flying twice a year with Etihad

Annual fee: INR 2,500 + taxes

BOBCARD Etihad Guest Premium Card

- Up to 2 Etihad Guest Miles for every INR 100 you spend in India.

- Up to 4 Etihad Guest Miles for every INR 100 you spend internationally.

- Upto 6 Etihad Guest Miles for every INR 100 you spend on etihad.com

- Signup Bonus: 5,000 miles (credited within 30 days after paying your first year’s fee)

- Annual Milestone Bonus: 24,000 Miles (Awarded post spending INR 12,00,000 in a year)

- Fast track: Gold Tier (automatic upgrade after first transaction on Etihad’s website)

- Domestic Lounge access: 12 complimentary access to domestic Visa Lounges in India (three visits per quarter).

- International Lounge access: 8 complimentary access to international lounges (two visits per quarter).

- Monthly Bonus: 500 bonus miles will be awarded post spending 4 transactions worth a total INR 50,000 (and the same offer for spending on add-on cards as well, separately)

- Quarterly Bonus: Get 4000 miles every quarter on spending INR 400,000 in the quarter.

- 1% fuel surcharge waiver. Available for each transaction between INR 500 and INR 4000, up to a maximum of INR 250 per cycle.

- Annual fee refund: Spend INR. 500,000 in your first year, and your annual fee will be refunded in your second year.

- Earn 1,000 bonus miles for flying twice a year with Etihad

Annual fee: INR 5,000 + taxes

The rewards architecture, as you can see, includes milestone and annual spend bonuses that are common to modern travel cards: quarterly and annual bonus-mile thresholds, occasional bonuses for flying with Etihad, and a welcome bonus that kicks in once you meet a spending target after activation. What makes this from “boring co-brand” to “actually interesting” is the promotional window BOBCARD has opened—a limited period during which welcome miles are doubled for new cardholders.

Etihad Guest BOBCARD special signup offer

Customers onboarded between January 5, 2026, and February 28, 2026, are eligible: the standard card’s welcome bonus doubles to 5,000 miles on clearing the initial spend requirement, and the Premium card’s welcome bonus doubles to 10,000 miles when its higher opening-period spend threshold is met. If you were already planning to pick up one of these cards, that window materially improves the upfront value.

If you want the quickest boost to your Etihad Guest balance, the limited-time double welcome miles window (through February 28, 2026) is the clear trigger. Meet the stated first-60-day spend threshold after approval and paying the joining fee, and you’ll receive double sign-up bonus miles.

There’s also an interesting nudge toward Etihad Guest status: certain card actions and spends can accelerate tier benefits on Etihad’s loyalty ladder, which means the card is not just currency for flights — it’s a route to status and the soft benefits that come with it. For many travellers, those status perks — priority check-in, baggage allowances, lounge invitations — are the real currency, often outweighing the pure mile numbers.

Bottomline

BOBCARD’s Etihad duo lands at an opportune moment. The cards are split between accessible and aspirational users, and BOBCARD’s launch promotion — double welcome miles for a short window — makes the initial economics noticeably better for early adopters. If you’re a regular Etihad flier or someone who values lounge access and zero forex fees, the Premium card will likely pay for itself; if you want to dabble in Etihad miles accumulation without a big commitment, the standard card plus the doubled joining miles offer is worth a close look.

So will you be participating in the sign up bonus offer of Etihad Guest and BOBCARD’s joint co-branded card?

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

I have been told that Bob doesnt give 2nd card , is there a work around ?