Axis Bank has been facing heat from customers across various strata for the devaluation of their very popular Magnus Credit Card, effective September 1, 2023. The card became super popular when Axis Bank started offering mileage transfer partners and a bonus of 25,000 points every month for meeting certain spending milestones every month. The transfer values have been reduced by half since September 1, 2023, and the bonus was withdrawn and replaced by a new product feature.

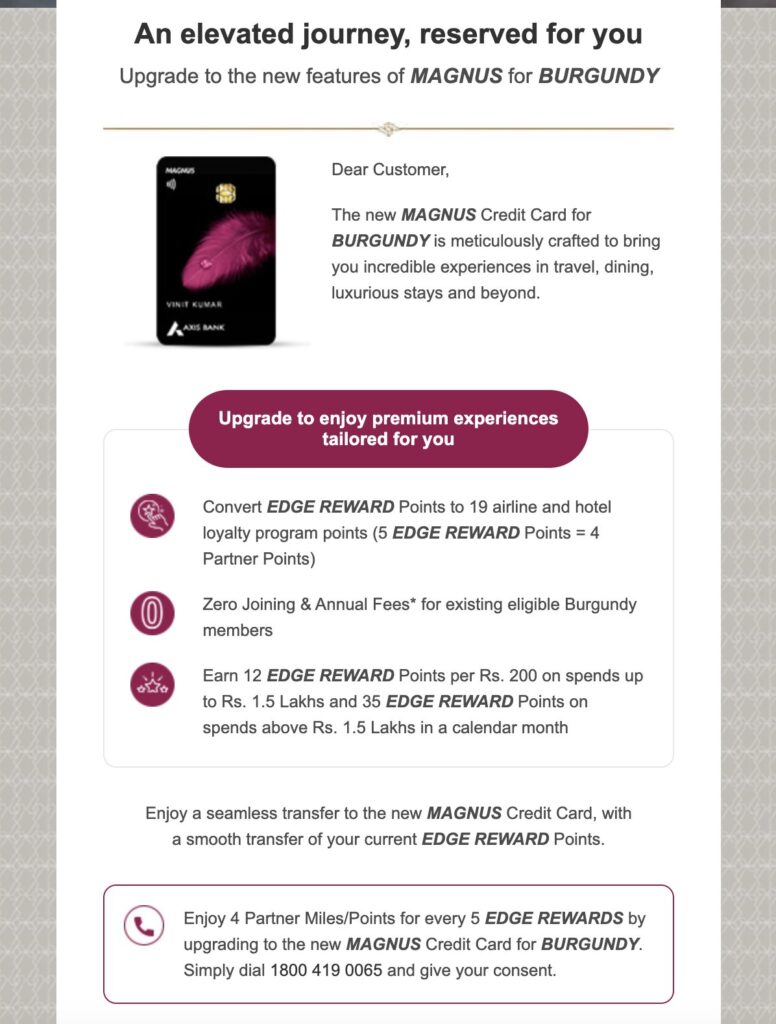

Axis Bank to offer a new Magnus Credit Card for the Burgundy programme.

Burgundy is the Axis Bank Priority Banking programme offered only to High Net Worth Individuals against specific hurdle rates with the Bank. To be considered a Burgundy customer, Axis Bank wants the following from their customer (at least one of the following):

- Maintenance of an Average Quarterly Balance of INR 10 lakhs in a Savings Account

- Maintenance of an Average Quarterly Balance of INR 10 lakhs across Savings Accounts and Current Accounts

- Maintenance of a minimum Total Relationship Value (TRV) of INR 30 lakhs

- Maintenance of a minimum Total Relationship Value (TRV) of INR 1 crore which includes Demat holdings

- In the case of a salaried customer, one should be receiving a net salary credit of over INR 3 lakhs every month in their Axis Bank Salary Account

- Foreign Inward Remittance of at least INR 40 lakhs received through Wire transfer or Remit Money in last 12 months (Only for NRI’s)

As per Axis Bank, TRV on an individual customer ID level is as follows:

- Liability Relationships: Savings Account, Current Account, Term Deposits, Recurring Deposits and/or Specified Investment Relationships

- Investment Relationships: Mutual Funds, Life Insurance, Private Equity Funds (Commitment amount), Structured Products, Discretionary Portfolio Management Service, Non-Discretionary Portfolio Management Service, RBI Bonds, PPF, NPS and other Alternate Assets

Even within family accounts, only customers who individually have a TRV of INR 30 Lakhs and above will be the folks who can sign up for the Burgundy card variant.

[Update on September 29, 2023: Axis Bank seems to have taken a view to issue these to Burgundy Cardmembers with a salary credit to Axis Bank, as long as the salary is over INR 3 Lakhs. This is on the back of the fact that they will give INR 36 Lakh worth of business/Relationship Value to Axis Bank]

At the transition to the new 5:2 transfer ratio, Axis Bank had mentioned that they would soon return to the 5:4 ratio for their Axis Bank Burgundy customers. Today, they’ve released some information about this. The proposition will be launched only on September 30, 2023. Emails have been sent out to all Burgundy Members in the hope they will hike their TRV to get the card.

As per Axis Bank, the new Magnus for Burgundy credit card will be offered to customers who will fulfil the Total Relationship Criteria on their Axis Bank Burgundy Accounts, which means that their individual relationship with the Bank should be worth INR 30 Lakhs or more for the bank. In FAQs released today, it has been made clear. It states:

All Burgundy Account holders meeting the requisite Burgundy ‘Total Relationship Value’ criteria, as depicted in the latest One Glance Statement of the Burgundy account, will be eligible for the new Magnus Credit Card for Burgundy. Customers having a Burgundy account but not meeting the requisite Burgundy ‘Total Relationship Value’ criteria, will not be eligible for the new Magnus Credit Card for Burgundy.

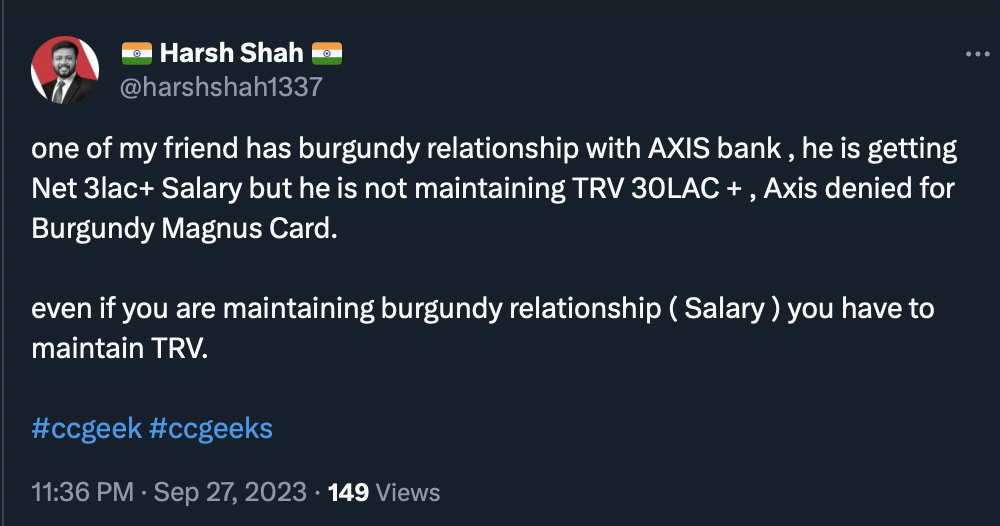

And because this invite went out to salary Burgundy and other flavours as well, people now have hopes that they will get this card. Here is one example of a salary flavour Burgundy member being denied the card.

The Bank intends to roll out new Burgundy Credit Cards, with a modified BIN Number series of the current Magnus credit cards, to indicate that these are issued as Magnus for Burgundy Credit Cards. Once they approve their Burgundy Credit Card relationship, these customers will be sent new cards, including for their add-ons, if any, and their existing EDGE Rewards points will be transferred to the new card. Two consequences of this action:

- 5:4 transfer ratio compared to 5:2 transfer ratio for all other Magnus Credit Cards

- A higher, 10 Lakh EDGE Rewards conversion limit per annum, compared to the 5 Lakh EDGE Rewards conversion limit for other Magnus Cards

Axis Bank to issue Magnus for Burgundy Credit Cards as Lifetime Free through November 2023

As a special launch offer, Axis Bank will be rolling out the Magnus for Burgundy Credit Cards as lifetime free for customers who meet their TRV criteria on their Burgundy accounts in the coming days. The promotion will be valid through November 30, 2023. Any customers who want the Magnus for Burgundy Credit Card issued after this date will acknowledge payment of INR 12,500 annual fee on their cards.

Axis Bank is also getting customers to acknowledge that if their Total Relationship Value with the Bank goes under the commitment level for the card (as reviewed by Axis Bank every six months), they will be issued the standard Axis Magnus Credit Card. The customer will be liable to pay the INR 12,500++ fee on the card (apart from getting the value of their points reduced to 5:2 for transfer).

Bottomline

Axis Bank has issued guidelines on the new Magnus for Burgundy Credit Card, which was committed by the Bank a few weeks ago. The new credit card will be the same as the regular Magnus card but with two changes (5:4 transfer ratios and a higher transfer/conversion limit). The card will be offered lifetime free between September 30 – November 30, 2023, to those who currently qualify for the Burgundy on the basis of an INR 30 Lakhs relationship with the bank (at the minimum).

What do you make of the new Magnus for Burgundy credit card proposition, and will you sign up?

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

A new update from AXIS. A customer who gets a salary of >3lacs is eligible for 5:4 redemption as the TRV is considered as >30lacs (3lacsX12 months 🙂

One needs to have only one of the 3 criteria- 3lakh+ salary or 10 lakh aqb or 30 lakh trv. For the bank 10 lakh in savings/current is actually more profitable than 30 lakh in FD. Different sentences in pdf created unnecessary confusion.

Yes, Ajay, you are correct. Axis RM and Customer Care confirmed that TRV 30lacs is mandatory for a customer to have a 5:4 ratio even if the monthly salary is >3lacs or AQB >10lacs. In my view, Axis Magnus was already hospitalised and now got killed with >30lacs TRV condition. May Magnus RIP.

Actually contrary to feedback you received, in my multiple conversations with Customer Care and RM everyone is saying if you have monthly salary is >3lacs, AQB or TRV requirement is not there. One needs to have “one” of the three. But I have also asked my RM to confirm again and even sent an email to PNO to clear the confusion. As usual everything is confusing with A-xis 🙂

Both statements are right. earlier it was one of the criteria ok like >3lac salary. But from yday, they said >30lacs TRV is mandatory.

@Rags, @Vishal, to get the Burgundy accounts, you can have 3 L Salary per month or 30L TRV or 10L AQB and so on. But to get the Magnus for Burgundy with 5:4 Transfer Ratio, you need the TRV criteria fulfilled on an individual customer ID level.

Hi Ajay,

Will accord redemption be 5:4 for true burgundy accounts?

The salary of >3 lacs also gets this card right ?

@Raghavendra, The first FAQ, which I also quoted, reads, “All Burgundy Account holders meeting the requisite Burgundy ‘Total Relationship Value’ criteria, as depicted in the latest One Glance Statement of the Burgundy account, will be eligible for the new Magnus Credit Card for Burgundy. Customers having a Burgundy account but not meeting the requisite Burgundy ‘Total Relationship Value’ criteria, will not be eligible for the new Magnus Credit Card for Burgundy.” So my interpretation is that you need the TRV criteria (referred to internally as True Burgundy) to get the card. But if you get through, that is great.

So does it mean that if you ARE maintaining AQB of ₹10 lakhs which also qualifies for burgundy BUT not maintaining TRV of ₹30 lakhs then we don’t qualify for the Magnus for burgundy?

And even if we do qualify, what happens to edge points earned from reserve card? Coz all edge points from reserve and Magnus generally pool in together.

Any clarity of all or any of the above?

@Nishank, only the TRV of 30L INR on an individual basis gets this card, no one else.

From where you got this confirmation?

Also, based on magnus tnc devaluation did they specified specially Burgundy TRV will only be eligible for 5:4? If not can we sue Axis Bank for miscommunication?

@Piyush, the T&C linked are pretty clear and hosted on the Axis website. You can read them through the link in the article

I think that is wrong interpretation. Page 2 clearly has all routes to get the card including salary account & 10 lakh savings. Page 3 table is just an example of TRV case.

@Vishal, Page 2, FAQ 1 clearly states,

“All Burgundy Account holders meeting the requisite Burgundy ‘Total Relationship Value’ criteria, as depicted in the latest One Glance Statement of the Burgundy account, will be eligible for the new Magnus Credit Card for Burgundy. Customers having a Burgundy account but not meeting the requisite Burgundy ‘Total Relationship Value’ criteria, will not be eligible for the new Magnus Credit Card for Burgundy.”

The all routes you refer to on page 2, are all routes to get a Burgundy Account, not all routes to get the card. In a different comment you stated you got invited as a Burgundy without TQV, you know you can’t trust it till you actually have the card in your hand.

In addition to what Ajay mentioned, pls. read the answer Page 7, Scenario 2.3.1, Q3.

“Newly opened / upgraded Burgundy account holders will be required to build their requisite

total relationship value required to maintain the Burgundy relationship with Axis Bank. As soon

as the requisite relationship is depicting in the latest One Glance Statement, the customer can

then call 1800 419 0065 to give their consent to upgrade to new Magnus Credit Card for

Burgundy”

This is exactly in-line with Ajay’s interpretation.

Please read page 13, Q3.

Q 3. What happens when requisite Burgundy relationship is not maintained? A. Customers holding new Magnus Credit Card for Burgundy will have to continue maintaining the requisite Burgundy relationship throughout the card tenure. Burgundy customer’s account will be reviewed every 6 months basis TRV/Salary credit. In case the requisite burgundy relationship is not maintained, a new Magnus card will be issued with a fee of INR 12,500 and miles conversion ratio will change to 5:2.

It clearly mentions Salary credit too. Further, I have confirmed multiple times with customer care on this. They said Net 3 lakh salary, 10 lakh AQB in Savings Current and 30 lakh TRV are “OR” conditions. You need to have one of them and not all. Anyways, I have also emailed PNO for confirmation.

@Vishal, this Magnus for Burgundy was for what they call “true burgundy” customers in the bank. The T&C might sound confusing, but I guess everyone will get their answer soon about who will get the card once the applications are processed.

Just an update. I am salary burgundy and received the email to upgrade Burgundy Magnus so it is not for only 30 lakh TRV.

@Vishal, Everyone who is a Burgundy got that email. I sense they will evaluate whether the criteria are met or not once the application is sent to them and then decide the fate, not sooner.

🙁