The day is here when Axis Bank has rolled out changes to the entire suite of Axis Bank Credit Cards. Since most of the LiveFromALounge readership would be interested in what changes with the Axis Magnus Card, I thought of putting together a quick note about what is in store for Magnus card members from September 1, 2023, onwards.

A recap of changes announced earlier

As a recap, in July 2023, Axis Bank announced changes to the Magnus Credit Card. Here is everything they had told then:

- Higher Annual Fee: The first key change is the fee. For new customers who want to have the Magnus Credit Card and are onboarded on September 1 or after, the fee will be INR 12,500 plus GST. Old users continued to keep the INR 10,000 plus GST fee.

- Fee Waiver condition goes up:

- New users who sign up for the card on or after September 1, 2023, will get a fee waiver for the next year if they spend INR 25 Lakhs on the card in the membership year.

- Existing users who will have their card renewal after September 1, 2023, will get a fee waiver for their card if they spend INR 15 Lakhs on the card in the following membership year. However, the renewal after September 1, 2024, will also be subject to a renewal fee waiver only after INR 25 Lakh is spent on the card in the membership year.

- Change of Welcome Benefit: For customers who are onboarded after September 1, 2023, the new welcome benefits will be vouchers worth INR 12,500 from one of the following brands:

- Luxe Gift Card

- The Postcard Hotels gift voucher

- Yatra gift voucher

- Monthly Benefits of 25,000 EDGE Rewards on INR 1 Lakh spent to be discontinued: One of the significant pull factors for the card, and one that was encouraging a lot of unethical spending, was the card’s insane offer to award cardmembers 25,000 bonus points every month on the back of just INR 1 Lakh spend. This feature was launched in February 2022 and disappeared effective September 1, 2023. 25K ER points for customers who achieve their monthly milestone in August 2023 will receive their points within 90 days.

- New Rewards Earning Structure: Magnus will continue to offer 12 ER points for every 200 INR spent on the card, up to INR 1.5 Lakhs spent, effective September 1, 2023. Once your spending crosses this milestone, you get 35 ER points for your spending above INR 1.5 Lakhs on the card. This is intended to be the new gamification for the card. I’ve included details below on how this will work.

- Government & Utility Spend is not going to be awarded points or counted for spend threshold: The card will stop granting points and any spend waivers on Government and Utility Spends:

- Utilities: MCC Codes 4814, 4816, 4899, 4900 (Phone services, Computer Network/Information Services, Cable/Satellite and Other Pay Television and Radio Services, Utilities–Electric, Gas, Heating Oil, Sanitary, Water)

- Government institutions: MCC Codes 9222, 9311, 9399, 9402(Fines, Tax Payments, Government Services Not classified elsewhere)

- TravelEDGE Earnings to be capped: One of the most generous features of the card was the offer to grant 5X EDGE Rewards on travel bookings using the AXIS Bank Travel EDGE portal, effectively granting 60 ER points for every 200 INR spent. Effective September 1, only the first INR 2 Lakh spent in the month on the TravelEDGE website will count for the 5X rewards. Beyond that, you get 35 ER points/INR 200 spent at TravelEDGE (2X bonus, roughly).

- Mileage Transfer Ratio to be changed: Effective September 1, 2023, EDGE Rewards transferred from Axis Magnus Credit Card or any credit card that has a Magnus relationship in the customer ID to an air miles or hotel points conversion partner will move from 5:4 to 5:2 conversion. If you open a Burgundy Relationship with the bank after September 1, 2023, you can continue with the 5:4 Ratio.

- Mileage Transfer to be capped: Effective September 1, 2023, per customer ID (including all sorts of EDGE Rewards points), only conversion of 5 Lakh points per annum will be allowed in a calendar year. For the year 2023, this limit is going to be between the period of September 1 – December 31, 2023. From 2024 onwards, the whole year will count.

- Cool-off period introduced: Axis Bank has also introduced a cool-off period for points transfer. You can only have one membership number linked to an account for a transfer partner. If you change it, you cannot change it again for at least 60 days. This is to curb mileage brokers and people selling their points.

More details emerge around Axis Bank’s Accelerated Rewards for Magnus.

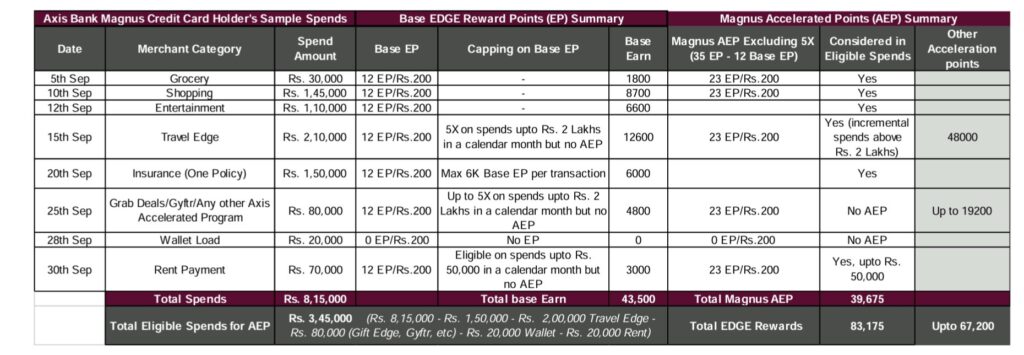

Earlier on, it was known that Axis Bank would award 12 points/INR 200 spent on spending up to INR 150K in a calendar month and 35 points/INR 200 after that milestone is hit. We have more details about how this will work via a new document uploaded to Axis Bank’s website this evening. The offer applies to all Axis Bank Magnus customers (with Burgundy and without Burgundy).

Axis Bank states that the customers are eligible for up to 35 EDGE Reward points/INR 200 only on eligible spends over and above INR 150K made on Axis Bank Magnus Credit card through Dipping the card / Tap & Pay at POS machines and Online spending on website or Mobile/Tablet/Desktop Apps in a calendar month.

The EDGE Reward Points will be credited to the customer’s EDGE Rewards Account in 2 parts:

-

- 12 EDGE Reward points (Base Points) per Rs. 200 will be credited in T+15 days for all eligible spends in the calendar month. Base Points calculation formula [Eligible spends per transaction * (12 EDGE Reward Points/Rs. 200)].

- Post completion of the calendar month, the accelerated EDGE Reward Points will be credited in 45 days from the evaluation month end date. The accelerated EDGE Reward Points will be calculated per the following formula:

- Eligible Spends = Total Spends in a calendar month (subtract) INR 150K (subtract) Spends on Exclusion list (subtract) Spends on TravelEdge up to INR 200K (subtract) Rental Payments beyond INR 50K

- On the amount arrived at as Eligible Spends, the differential 23 EDGE Rewards/INR 200 will be credited within 45 days of the calendar month end.

- Basically, all the opportunities where already a multiplier is offered, will be discounted from the Eligible Spends for the 23 bonus points/INR 200 spent. This would include TravelEdge spends, Gyftr (GIFTEDGE) spends and Grabdeals spends.

In a nutshell, the following spends will be discounted to arrive at Eligible spends:

- Wallet loads/payments (MCC 6540)

- EMI transactions

- Incremental spends on Rental Payments/Transactions (MCC 6513) over and above INR 50K in a calendar month will not be considered for Accelerated Reward points.

- From September 1, 2023, spends on government institutions (MCC: 9222, 9311, 9399, 9402) and utilities (MCC: 4814, 4816, 4899, 4900) will not be eligible for Base and Accelerated Reward points.

- Transactions which are reversed/cancelled/refunded.

- Any kind type of Fees & Charges for eg: Joining / Annual Fees, Forex markup, GST/VAT, DCC, Fuel Surcharge, Late Payment fee, Debit Interest, Rent Surcharge/Fee, Cheque bounce fee and other fees & charges mentioned in the MITC document.

- Cash withdrawals

- All spends on Travel Edge (Upto INR 200K in a calendar month), Gyftr and other Axis Bank accelerated offer portals.

They tried and explained this with an example to show what works and what does not work.

The Magnus / Burgundy Combination

The Magnus + Burgundy Priority Banking services that the Bank aims to now expand upon, will have a new entitlement limit for their points transfer effective September 1, 2023. As per the document referred to above,

- Magnus card holders can transfer EDGE REWARD points to any of the 19 partners at 5:2 conversion ratio. (capped at 5 Lakh EDGE REWARD Points per calendar year)

- Burgundy customers with Magnus Credit Card can transfer EDGE REWARD to any of the 19 partners at 5:4 conversion ratio. (capped at 10 Lakh EDGE REWARD Points per calendar year)

This is clearly to encourage customers to get one more hook to sign up for Burgundy if they are still sitting on the fence about the proposition. Additionally, while the Magnus for Burgundy proposition is intended to be revealed on Monday, September 4, 2023 by many accounts, it seems that the new “Magnus for Burgundy” proposition will be free of cost to the customers in terms of any applicable joining fee, and the bank will offer an INR 5,000 voucher to them for signing up for the card, instead of the INR 12,500 voucher that will be offered to customers who won’t go for the Burgundy proposition. It also seems that Magnus will go back to the MasterCard issuance list via some of the imagery I’ve seen recently.

Bottomline

Axis Bank has revealed more details of their Magnus Credit Cards’ changed T&C effective September 1, 2023. Effective September 1, 2023, the first INR 150K of eligible spends will get 12 ER/INR 200 spent and beyond that the residual amount of eligible spends gets INR 35/INR 200 spent. The Eligible spend is basically, total spend, less any spend that earns multipliers, all ineligible spend such as fuel, government and so on, and fees and charges etc. Additionally, the bank seems to have made a new addition to the T&C, enhancing the capping for the transfers in a year to go up to 10 Lakh points per calendar year for Burgundy Magnus customers. I know it sounds a lot, but in a few days the dust will settle.

What do you make of the new Magnus changes and methodology notified today?

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

I am not seeing a 5:4 redemption ratio in spite of having a burgundy account. not sure if it is with me only? or with everyone?

You missed a big one.

“Spends up to Rs. 50,000 in a calendar month will be considered for Total Eligible Spends. Any amount over and above Rs. 50,000 in a calendar month will not be considered in calculation of Total Eligible Spends”

If you by a camera for 2 lakh, and stay in a hotel for another lakh, and all this spending is done after you’ve spent INR 1.5 L on the card, you’ll only get the enhance points for INR50,000 for each category…

All you’ll get is 17,500 additional points for one lakh (INR 50,000 per category), and not 61,250 points for the whole INR 3.5 lakh…

This card is toast. Axis took a simple proposition, albeit unsustainable, and converted it into a rigmarole nobody understands…

@SJ, honestly, that is a mistake there. That 50K is for rent, and not for all product categories. I hope they revise the T&C soon to rectify this mistake.

I hope you’re right.

I am just amazed at the poor quality of the communication and messaging from Axis Bank. No customer facing person has the whole picture about Magnus. Each person comes up with his own interpretation….

Ajay, thank you so much for explaining these things in layman’s terms, really appreciate it 🙂

Back to good old Infinia for me. I will keep the Magnus for another year as I got the renewal fee waiver, and use the meet & greet service next year, and then give up the card.

Thank you Ajay for sharing this, please do share your thoughts post Monday announcement on Burgundy proposition.

Sad, gift edge and travel edge should have been double whammy as they already devalued giftedge from 10x to 5x