Over the past few years, one of the banes of credit card issuers has been harvesting the signup rewards that the banks offer. One affected party has been Axis Bank Credit Cards, which have been the talk of the town ever since Magnus hit the headlines. However, now they are working to solve this issue.

Axis Bank introduces “once-per-lifetime” rewards language.

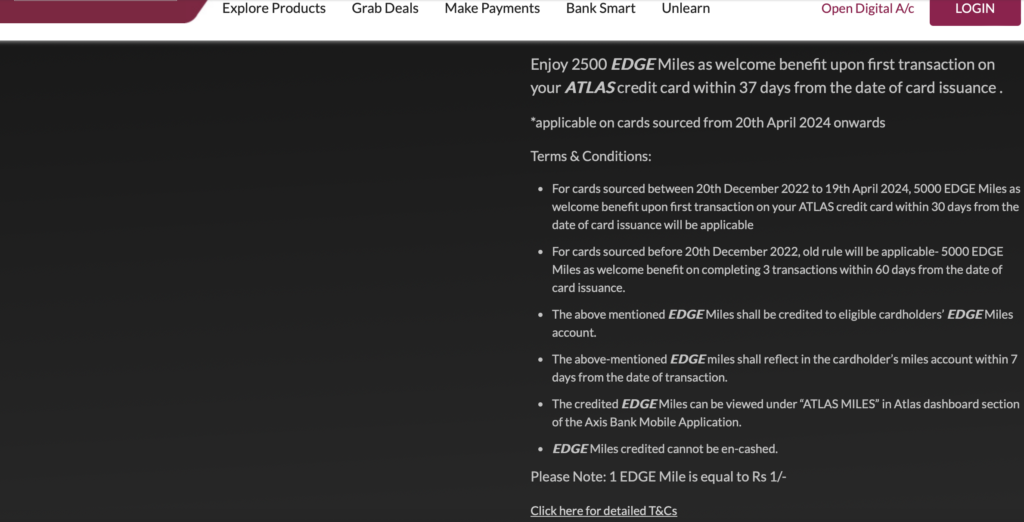

Over the past week, Axis Bank has introduced the “once-per-lifetime” language on the Axis Bank Atlas Credit Card webpage. It reads,

A cardholder is entitled to avail the welcome benefit for Axis Bank Credit Card only once. In case of card cancellation and subsequent re-opening of the same card variant, the welcome benefit will not be applicable.

Here is the screenshot of the current Axis Bank Atlas Credit Card micropage, which you can read towards the bottom of the page.

I used the Internet Wayback Archive, and this language has been added within the past month because, as of November 30, 2024, there was no such announcement on the website. However, the language is already in the Most Important Terms and Conditions governing Axis Bank Credit Cards.

Axis Bank has several credit cards with very lucrative welcome benefits, which has prodded folks to misuse the benefits over time. In industry parlance, this is referred to as card churning. As Axis Bank goes about organising its Credit Card business and cutting the leaking buckets out, the bank might have made this move. I don’t know if this is a significant change that the bank had to put out a one-month notification around, but the wheels have been put in motion around tightening the grant of rewards to customers.

This is not a new trend. American Express in the US was one of the prominent card issuers that introduced the ” once-in-a-lifetime ” covenant in the latter part of the last decade.

Bottomline

Axis Bank Credit Cards are fine-tuning their terms and conditions to ensure that they only grant welcome benefits on various credit cards once in a lifetime. This provision is already live in their MITC, which should help control the churning of their credit card products over time.

What do you think about the move from Axis Bank Credit Cards to offering only welcome benefits once in a lifetime per credit card variant?

(HT to X/@VGDKTK)

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

Hi Ajay

is there any point in continuing with axis magnus now? Requesting guidance please.

Neeraj

A is bank seems to have lost it. They send be unsolicited messages claiming that my balance may be low and implying possible operational restraints. The branch staff including the manager is clueless about how much balance is actually needed to be maintained. This has been going on for over a month now. !!