From time to time, Axis Bank goes after bad actors in their credit card portfolio to purge them. The last time I wrote about it, it was for suspected spending with specific gateways. Now, the Axis Bank Corporate Audit team has struck again, this time for Axis Bank Atlas Cardmembers.

Axis Bank goes after suspect manufactured spends on their Atlas credit cards.

Axis Bank has been generous with rewards for their credit cards, significantly ramping it up over the past two years and making market-leading products such as the Atlas Credit Card. However, with great power comes great responsibility, and Axis Bank is now out to weed out the bad actors who might have been gaming the system.

According to various reports, Axis Bank has locked out many users from their EDGE Rewards accounts since this evening. When logging into their EDGE Rewards account, these users will see their accounts zeroed out for EDGE Miles, and if there is a connected EDGE Rewards account, you will see them also zeroed out or blocked for now.

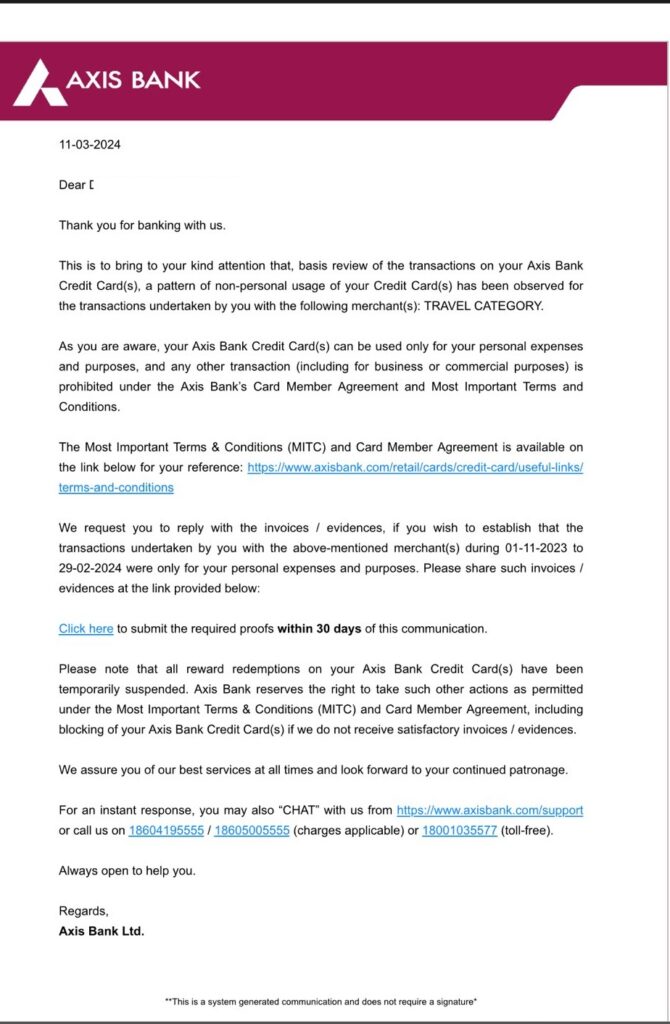

These suspensions have also coincided with people receiving emails from Axis Bank asking them about transactions made with certain transactions made with the “Travel” category from November 2023 – February 2024. The email looks as follows.

The transactions for airlines and hotels are separated; however, transactions made using OTAs such as Cleartrip show up as Travel.

What Axis Bank wants to reiterate for customers is that their cards are meant for their personal spending, and if they have spent on their cards for commercial expenses or manufactured spending to earn points, they will go after these customers. Axis Bank has given a 30-day notice period to these customers to collect proof that their spending was personal, not for “non-personal spend”, and send this back to the Bank to get their points unlocked again.

Unfortunately, many people seem to be caught off guard because they are not aware of what suspect transactions they made. It seems many innocent folks are also caught up in this audit. However, based on past experiences with people, Axis Bank should be able to unlock your accounts within two weeks of you sending over the information they requested.

Bottomline

Axis Bank has cracked down hard on spending that is not “personal spend.” It has blocked many customers’ Axis Bank Atlas Credit Card accounts from using the points generated until they can satisfy the bank about their spending and intentions. Customers have 30 days to react to the notice from the bank before their accounts are blocked for good.

What do you think of Axis Bank’s move to go after the bad actors? Have you been caught up in this clean-up attempt by the bank? Please share details in the comments section.

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

Axis has suspended my Axis rewards and forfeited all my points citing that I have used my card for non-personal use on Air France. I have emailed them air-tickets I have purchased on Air France for myself, wife and son and explained that this was for my son’s summer vacations though I only get a standard reply that this use was against the bank policy and is classified as non-personal use!

Am not sure how they can classify these as non-personal use? No point keeping the card if purchasing airline tickets and paying for hotels while travelling on holiday is classified as non-personal use!

I would suggest to stop using Axis cards since they do not want to give the reward points to customer and are just randomly suspending cards and customer is left with no recourse!!!

It is very suspicious of Axis Bank to be doing this just in time for the April 20th devaluation. I would not put it past this incompetent bank to be hoarding points in this manner. They know a lot of the high spenders and those with lots of points will rush to transfer their points before April 20th, so they come up with a cock and bull scheme to block accounts under these false pretences. Pathetic bank. They are definitely going to lose me as a Burgundy high-spending customer, including my family and everybody who I have any influence over.

Did any of you who are the victim of this move like me found a workaround? Will be great if you can share.

See 99 percent of us are genuine users who have been regularly paying our bills on time and have genuinely earnt and redeemed our points.

They had pulled this stunt last year for Axis Bank Magnus users only to downgrade their card that time, their points were blocked for no rhyme or reason now Atlas users are their new target it seems.

If they are accusing us of using our cards for any non personal transactions then the onus is on them to prove us in the wrong…

If this doesn’t get resolved soon then it is time to end our relationship with Axis Bank for good…

sad

But one thing is sure. This marks the end of my relationship with Axis. I better give these business to some other bank.

Agree with few other comments here. And customer care had been super unhelpful. They have no idea which particular transaction is being perceived as Non Personal Transaction in MCC of Travel Category. When asked they are so noob that they are citing Amazon Transactions as suspicious transaction.

Pathetic. At least they should identify specific transactions rather than generic “Travel” category. Never heard of such large scale audits by any card issuer. They should ideally do quality control at the time of sourcing (issue cards to metros/ tier 1 city residents only, specific income criteria, specific age bracket, holding other super premium cards etc). Instead they go mass market for their premium offering and then do a blanket suspension based on spends.

I was holding on to my Citi Prestige Card hoping Axis would take care of the premium customers. But I don’t think this attitude is going to help them retain the Citi’s premium customers. Already their fraud prevention and other policies are a nuisance. Is it worth holding the Citi Prestige card or time to close that account and move on?

Even getting upgrade from Magnus to Magnus for Burgundy is a nightmare. Despite following all eligibility criteria even the RM doesnt know how to go about it.

While definitely an inconvenience for genuine users, hopefully this exercise weeds out rotaters

there are no rotaters ….tthey are paying bills on time .they can be other control measures like max limit on points/cashback in a month

Hi Ajay,

a quick question – When you mentioned that Cleartrip shows up as Travel, do we get bonus miles on this as well ??

If yes, can we double dip with free cancellation, seat selection, meal, etc.

Thanks

What a stupid move. It unnecessarily antagonizes customers. As long as the bill is being paid, who cares. I don’t know what has happened to Axis Bank. They started giving me shit about their wealth program too

you are right ..they ran after me to get credit cards for month i took in november now it seems it is blocked

The worst part is that they have just mentioned the category in email and not the merchat name. Unable to decide that for which transaction someone should submit the evidence or invoice.

Hmmm, sad for those