A couple of weeks ago, I flew down to Delhi to get you everything you needed to know about the SBI Card and Etihad Guest partnership. The online application link for the credit card also went live on the same evening, and with all the marketing buzz around the card, a lot of people did apply.

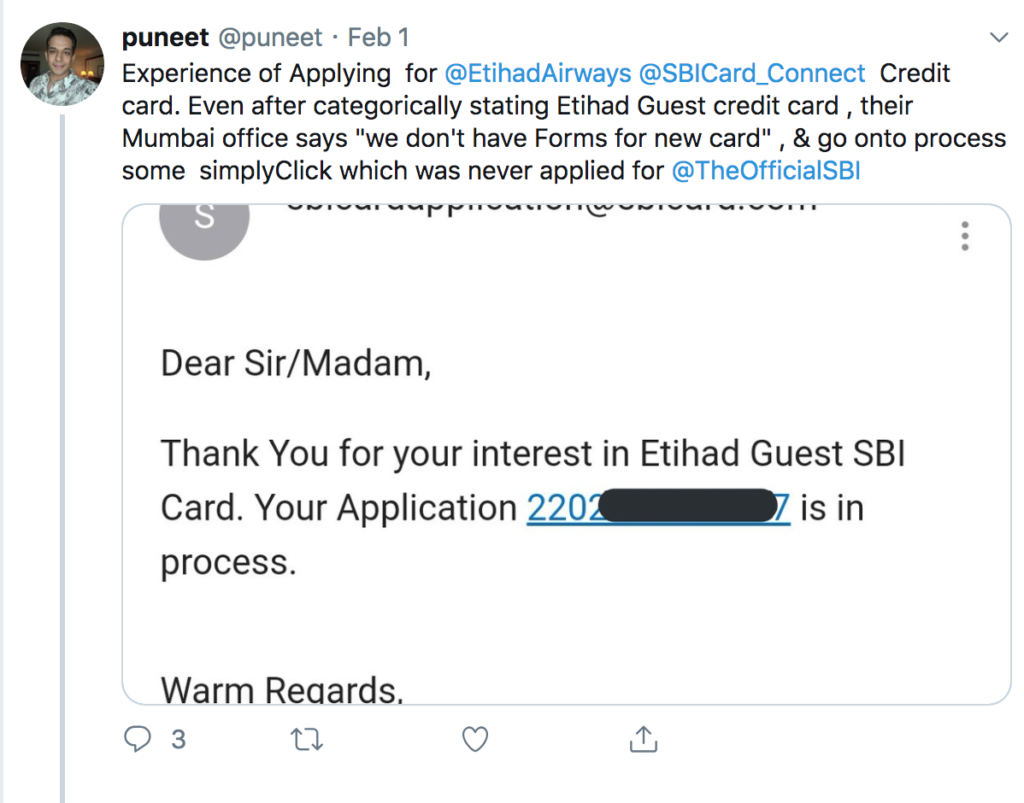

SBI Card has been very quick in responding back, issuing cards in a jiffy. However, they are sending out the wrong cards to people. This was the first instance I heard about it.

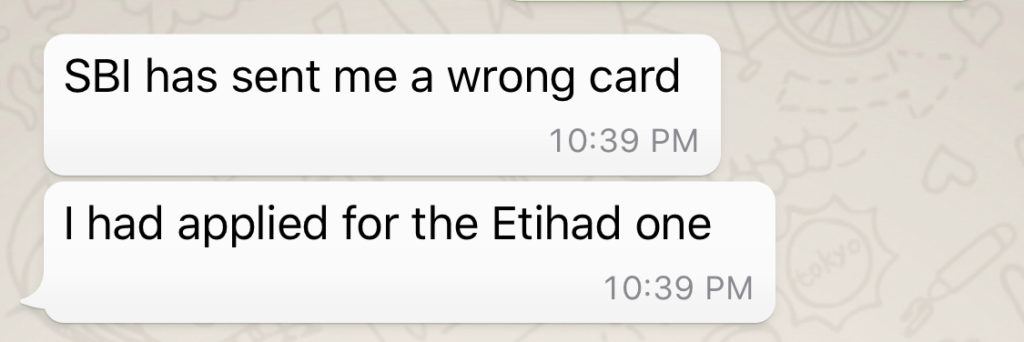

And then yesterday, I heard of at least 3 more instances. Here is one that arrived on WhatsApp.

It seems SBI Cards was not entirely ready to launch the card and they did anyway. So a lot of people are receiving other credit cards. Nothing new, as they’ve done this in the past with the Air India SBI Card as well, where they generated new Flying Returns account numbers for people who already had one. And while these are teething troubles, unfortunately for Etihad Guest, they will get dragged into this without any fault of theirs.

How to fix this? Unfortunately, there is only one way around this situation. Call SBI Cards or Tweet to them about this and ask them to swap for the Etihad SBI Card. Don’t close the credit line yet. Make a complaint and make the swap happen.

Have you applied yet for the Etihad Guest SBI Card? What has been your experience so far?

Is this a perpetual gold tier with Etihad tie up ? I have a lot of miles accumulated in Etihad and I do spend significantly on the SBI Etihad but seems like neither Etihad is aware nor SBI about the status refresh. It was ato degraded to silver

@Mohan, current literature says this:

• You will be upgraded to Gold Tier on first card transaction

• The current Tier will be valid for 6 months

• You can retain the Tier for another 6 months when you complete 1 return flight or 2 tier segment on Etihad within 6 months of card issuance.

• You will be downgraded to base Tier incase no Etihad Flight booked with 6 months of card issuance

Dear Ajay,

Thank you for highlighting this to us. We tried contacting you on your twitter handle, but haven’t received a revert yet. Can you DM us your contact details, so that we can get in touch with you & understand the issue further? Our teams have already been notified, and are looking forward to contact you. We can be reached on twitter @sbicard_connect. Alternatively, you can call us on 1800-180-1290, or 39020202.

We look forward to hearing from you soon.

Regards,

SBI Card Customer Support

Dear SBI ,

I applied for this card in January. Since then , I have received atleast a 100 calls , all asking me to repeat my Personal , bank , etc. details , and telling me the same thing – your card has been approved. But , the same process is repeated on an alternate day basis. Just got off the phone with yet another call. And guess what , I have to send photocopies of documents , AGAIN , for the Nth time. Each person I speak to guarantees that he/she is unlike the others , and would ensure my card is made.

Extremely disappointed.

Completely different topic ; any info if citibank india is working on new credit card?!?

Completely different topic ; any info if citibank india is working on new credit ?!?!

“Nothing new, as they’ve done this in the past with the Air India SBI Card as well, where they generated new Flying Returns account numbers for people who already had one”- This thing is common with all the banks. I had applied for Jet Privilege (ICICI, HDFC) and Club Vistara (Axis bank) cards. They did the same thing and generated new JP as well as CV account numbers for me. It was a lengthy to and fro conversations with all three to send new cards with my old JP/CV numbers which I had used in applications.

All 3 banks said their systems are not that advanced to make new cards correctly in the first go…. hard to believe!

I had a similar situation, got approved for Etihad Guest SBI Premier and received SBI Simply Save Card. Simply Crazy people.

Applied for SBI Etihad got a SBI SimplySAVE but with a huge huge huge HUGE limit almost equal to my AXIS CC of 10lac “Highest limit I got currently”. What that means is if I get this closed and get the Etihad CC my cibil will go down the drain.

So do I take the bullet and close SBI SimplySAVE or bear the Rs.500 and apply for the Etihad one later with a split “Etihad being co-branded”.

That’s Kickass limit but does it make sense to keep such for a person with many cards who isn’t anyway going to overuse his most limits?

I don’t remember all benefits of simply click but doubt there are many.

P.S- Have seen SBI giving highest limits most times. Even for me, took couple of years for HDFC/Citi to reach 3.75 while SBI gave me 4.2 when best limit on my other cards was around 2.

Be careful with SBI. I’ve had bitter experience in the past with my Prime card. I’d asked for the Mastercard variant but was issued the Visa variant. Had to escalate and mail/talk to them and had it resolved after over a month of back and forth with them.

Then on the renewal, I was slapped with the renewal fee though I’d done the spend requirement for waiver. It was then I found out that my Visa card was closed (not swapped) and technically I hadn’t done the spend required for waiver. Again had to escalate and got it reversed after two months. Thus, my Rs 3580 was blocked for two months and more importantly, there is a CIBIL hit for card closure.

Ouch.

What is worse is these companies continue to get away with such gaps and almost act surprised that you’re demanding what you were promised in the first place.

Considering SBICard is not directly managed by SBI Bank…I am really surprised with these issues. They should be ahead of the game. I think they get the margins and achieve the profit by doing average service to Indian Customers. So they are going with an attitude if “sub kuch chalega” in India.