A few months ago, I wrote about how ICICI Bank Credit Cards and Amazon India got together in October 2018 to launch the Amazon Pay ICICI Bank Credit Card. The only way to get them is to wait for Amazon to offer it to you, so I was only too glad to see the invitation pop up on my Amazon screen over the weekend.

While I did not need yet another credit card in my wallet, I did pursue the opportunity to get the card for so many reasons. Mostly curiosity.

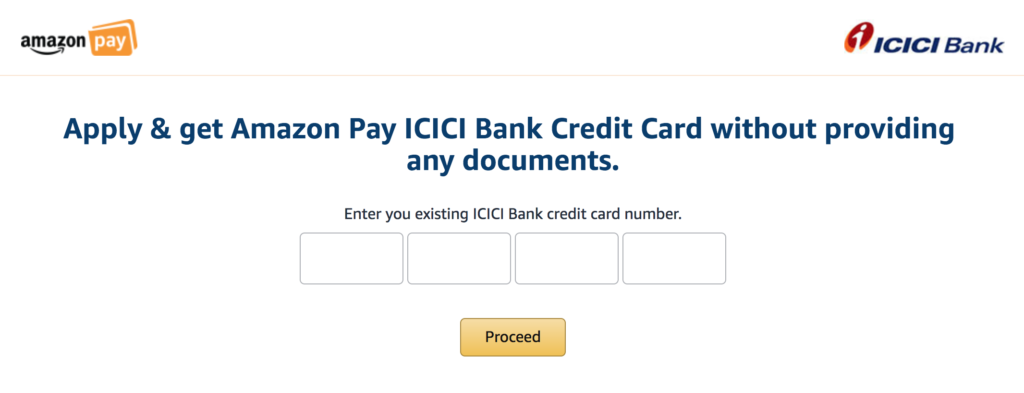

- As an existing ICICI Bank Credit Card holder, I was not going to have to go through the process of having ICICI Bank pull my credit history one more time. It is just another card which shares my credit limit from my Jet Airways ICICI Bank Sapphiro Credit Card now.

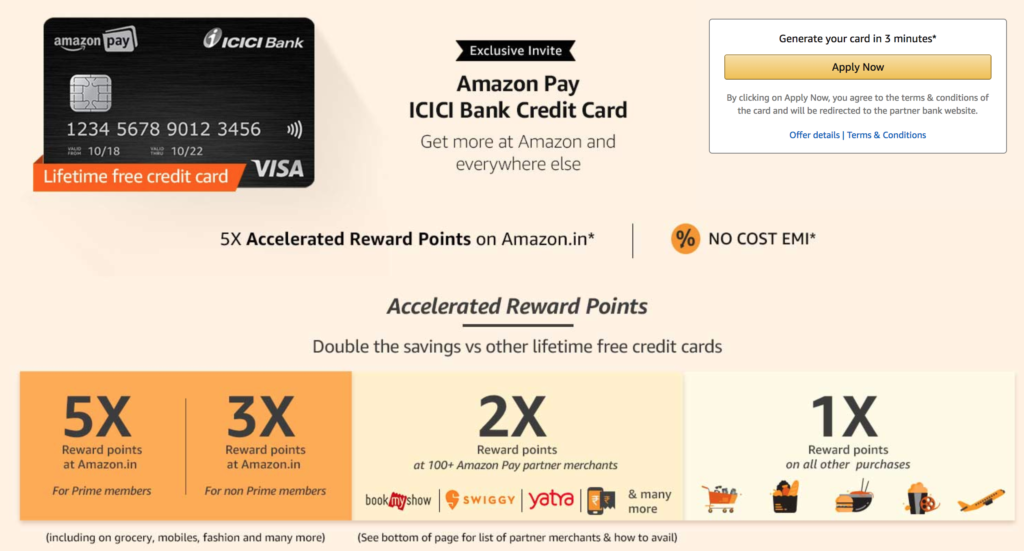

- As an Amazon Prime member, I am going to get 5% of my Amazon purchases back as Amazon Pay money, although I already have the HDFC Bank Diners Club Black, which gets me 33% when I use SmartBuy.

- For various partner purchases, such as at Swiggy and BookMyShow, I get 2% back as Amazon Pay money.

- The card is lifetime free anyways and comes with a plastic card as well.

Here is the link I clicked to head to the website where the Amazon Pay ICICI Bank Credit Card was offered, and you can check out as well if you are invited.

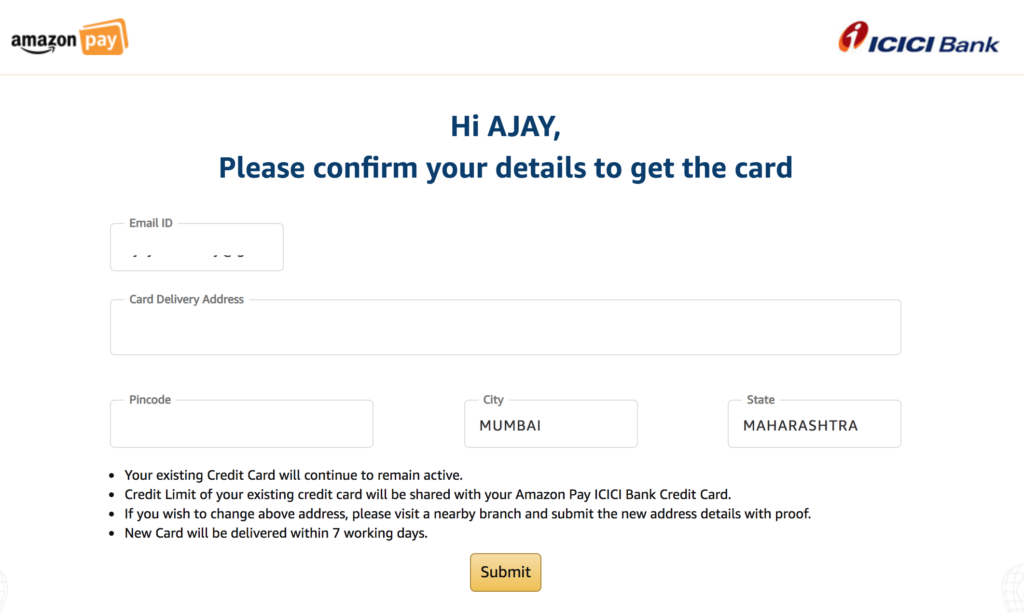

I had to go through a process to validate my mobile phone number and then my existing ICICI Bank Credit Card details. And in a couple of seconds, I was presented with the details of the existing credit card for confirmation.

Once I confirmed the details, I was shown a screen telling me about the new credit card number, and informing me about the new credit card showing up in the mail within a few days. The card also showed up in my ICICI Bank website Credit Card section within a couple of minutes. I could immediately use the card towards online purchases as well.

Have you applied for the Amazon ICICI Bank Credit Card? What has been your experience with the card so far?

1) I am Amazon Prime Member

2) I had not completed full KYC on Amazon

3) I am not having an ICICI savings account or any other credit card issued by ICICI.

4) Not a big spender on Amazon App.

5) My location was Delhi

6) I am holding Citi Cashback credit card and Amex MRCC Card

But the invite was not available for me during Jan-April, 19. However, one fine day, suddenly the invite button was available and I quickly applied for the same. Here’s the brief process that was followed:

1) After clicking on the button, I had to provide few details like name, address, date of birth, PAN, residential address, employer name etc., and was displayed the following message “Thank You for applying for Amazon Pay ICICI Bank Credit Card.

your application is under process. The Executive will call you within 5 days to schedule an appointment & will visit at the below address within 7 days.” Though, the process did not ask for details of any other existing credit cards.

2) Received a call on April 29 at around 11:30 am from ICICI and a verification visit was scheduled next day at my residential address between 12-1pm.

3) Executive reached my residential address at around 4pm on April 30. He scanned my original aadhaar and pan card, clicked my photo and entered few other KYC details, all done from his backend ICICI app on his mobile. Thereafter, I received an SMS from ICICI and was also asked by the executive to send an SMS ‘AMZ YES’ to the number 9215676766 from my mobile to complete the application. I was also asked to sign a physical one pager form which was basically acknowledging that I have read all the terms and conditions of the card. There was no furnishing of photocopies or photographs. Also, I was not asked to furnish any income documents nor were they scanned.

4) Soon, in the presence of the executive, I received an SMS that my application form was successfully completed and sent for further processing. Similar status was being displayed on the Amazon App. I was told by the executive that there will be no further verification/visit at the office address. I remember that, while filling out the details on the Amazon App during the initial application process, I had the option to choose the visit at either my residential address or office address. I had chosen my residential address.

5) Status remained the same for next 48 hours or so.

6) On May 02, at around 4:45pm, received an email and SMS that my card has been approved. After about half an hour, I got an SMS with details of user id with which I can login to see my card details etc.

7) On May 04, at around 11:15 am, I received the physical card at my residence through blue dart (Had received an SMS in the morning from bluedart that card was out for delivery).

Following are few other details of the approved card:

1) Received the credit limit of Rs. 3,03,000/-

2) There is visa branding (but there is no mention of visa variant i.e., whether it is classic, gold, platinum, signature etc.) So I assume, its just a normal visa credit card.

3) Successfully added the card on the Cred App on 06 May. Cred initiated a token credit of Rs. 1 to the card and it was credited on the same day to the card.

4) The leaflet that came along with the card specifically mentioned that credit limit will be shared with the existing ICICI credit card, if any.

So, the invite became available to me and the card got approved despite not having ICICI savings account or ICICI credit card.

Hope the above information will be useful to others.

I got an invite too but don’t hold any cards from icici. I spoke to Amazon and they gave me a number and said me that there is no necessity for holding a card with icici also I asked him about getting 5x for EMI and he said we will continue to get it. So can any one confirm that? Only reason to get this card is 0 EMI for all purchase and 5x for EMI or I don’t want this card. Please advice.

Don’t Get this Card, if you convert transaction into Emi, they will take away the reward points earned on that transaction

Ajay,

Could recheck if it is sharing the credit limit with you other cards? When I check, I am seeing a separate credit limit for this card compared to my other ICICI Credit Cards.

I also got offer, applied. The process is very simple, I like it.

Since it is LTF card, I am planning to cancel my current ICICI HPCL credit card, which I’m holding it for low annual fee reason.

Same here.. With diners black, 1% does not sound exciting

.

But i assume 10x is not here to stay always. Then 5% on Amazon is good.

Moreover, i tend be in dilemma if i should use it where diners is not accepted considering i also have icici jet rubyx amex & visa.

I still am unable to extract 1re for each jp mile.

In terms of rupees, icici Amazon visa gives me 1%. While icici jet gives me 1.5% approx (considering value of jp mile @0.5rs per mile).

I’m still preferring icici jet over icici amex. Let’s hope i learn to get 1re per mile.

Saw it. Not very useful for diners card holders. Smartbuy, + 3.3% on everything is a better deal than anything ICICI is offering here.

Alternately, the Stanchart ultimate card also gives 3.3% on everything + Visa infinite benefits.

You can’t compare with DCB or SCB Uptimate.

1) They are super premium cards while ICICI Amazon card is entry level one.

2) Both the cards comes with high fees.

Depends on your spend areas and how much you spends. As many experts says there is no perfect credit card. All comes with their pros and cons.

We have to decide what value we are able to extract from them.