The global airline industry body, International Air Transport Association (IATA), is holding its 80th Annual General Meeting in Dubai this week, and it says the industry is not making nearly enough money. But the profit outlook is rising, they said.

Airlines around the globe have raised their profit forecast for 2024 as the revenue across the airline industry came close to USD 1 Trillion, and new records are being set for the number of travellers taking to air travel. IATA expects 5 billion people taking to air travel in 2024.

IATA expects the airline industry will make 3% profits in 2024

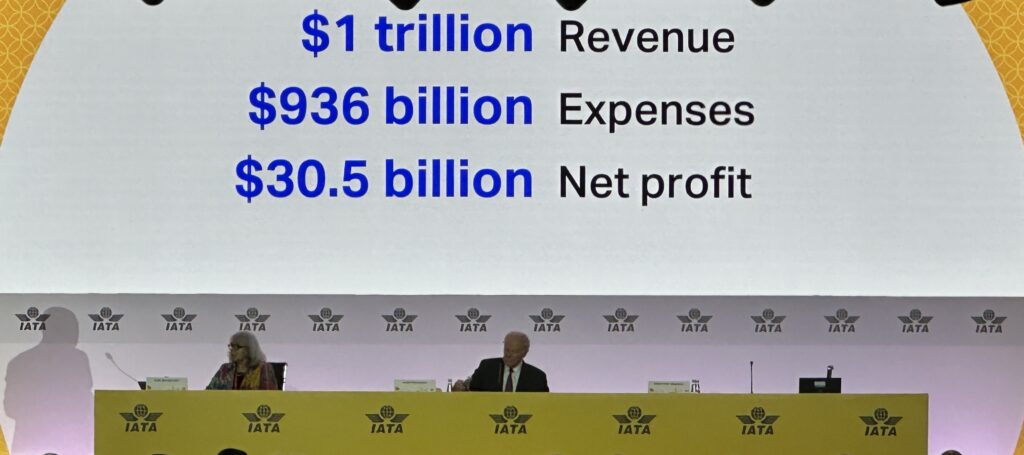

IATA released a fresh forecast of industry-level profits, and the profit aggregated across the industry expected in 2024 is pegged at USD 30.5 billion, moving up from the USD 27.4 billion profit projection in 2023. Airlines worldwide have to manage supply constraints of new aircraft and other components, geopolitical challenges, and labour costs.

Willie Walsh, Director-General of IATA, said,

For 2024, we expect record revenues of almost USD 1 trillion. However, expenses will also be at a record high of USD 936 billion. Net profit will be USD 30.5 billion.

He added,

Unfortunately, that’s not a record and represents a net margin of just over 3 per cent. But considering where we were just a few years ago, it is a major achievement.

Walsh was referring to the pandemic, which sunk the industry in a USD 140 billion loss across carriers.

Walsh said that ‘flying remains good value for money’. In his words,

About 77% of the 6,500 travellers we recently polled in 15 markets said as much. That’s not surprising, considering that the real cost of air travel has fallen 34% over the last decade.

However, Walsh explained that for all the value airlines create, they can only retain USD 6.14 as profit per passenger (which is about INR 500). He compared that to being the cost of one espresso in the hotel where the AGM is being held in 2024.

Supply-side troubles haven’t gotten worse.

Walsh mentioned that the industry needs to celebrate the hard work of the people who brought the industry back from the brink.

We deserve to celebrate the hard work that has brought our industry back from the brink while acknowledging that we remain squeezed between a fiercely competitive environment downstream and the upstream supply chain’s lack of competition.

The best thing that I can say about the supply chain exasperations of the last year is that they appear to have not gotten worse.

The number of aircraft deliveries scheduled for 2024 is expected to be 1,583, which is 11% less than the expectations published just months ago that anticipated 1,777 aircraft would join the global fleet in 2024. Airlines are deploying larger aircraft as a mitigating strategy, IATA said.

At the end of the summit, it was announced that IndiGo will be the next host airline for the summit, and they will host the summit in Delhi in June 2025.

Bottomline

Per IATA, airlines around the globe will make a profit of an aggregate of USD 30.5 billion in 2024, which is up from earlier estimates, but when divided across the number of trips, just turns up at USD 6 per passenger. IATA expects that the supply chain troubles across the industry haven’t gotten worse, if not better, at the moment.

What do you make of the profitability of the aviation industry?

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

True, but not the full picture.

Due to their Sale & Leaseback model, airlines are in essence an asset-light business model. As a result, they are akin to hotel chains and even banks. High turnover, but low capital employed.

Profit as a percentage of turnover will be in the low single digits by design. That expense figure hides the capital cost and margins therein (which are now captured by the aircraft leasing co.’s)

Hence the correct metric for airlines should be ROCE (Return on Capital Employed). That’s my $0.02

Your thoughts, Ajay?