In times of the CoronaVirus Pandemic, the global aviation industry is one of the biggest sectors to suffer as travel comes to a virtual standstill. With this pandemic being looked at as a bigger cause to worry than even the 9/11 attacks and the global financial crisis, airlines around the world are gasping for breath. And unfortunately, with them, the airframe makers too.

Airbus this morning reported their Q1 2020 results and there are so many indications of how this is going to play out in the future for aviation.

Airbus Orderbook sees positive growth y-o-y

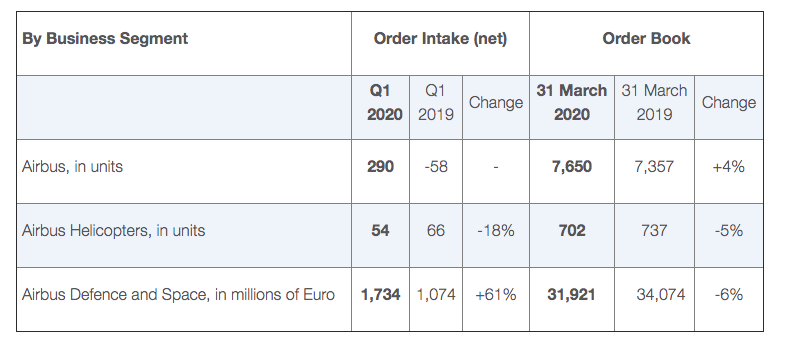

Net commercial aircraft orders totalled 290 (Q1 2019: -58 aircraft) with the order backlog comprising 7,650 commercial aircraft as of March 31, 2020. Airbus Helicopters booked 54 net orders (Q1 2019: 66 units), including 21 H145s, 15 UH-72 Lakotas for the US Army and 2 Super Pumas.

Airbus Defence and Space’s order intake of Euro 1.7 billion included military aircraft-related services, new contract wins in telecommunications and in connected intelligence. Also included is the Phase 1A demonstrator contract for Europe’s Future Combat Air Systems programme.

Airbus Revenues Decrease y-o-y on the back of fewer aircraft deliveries

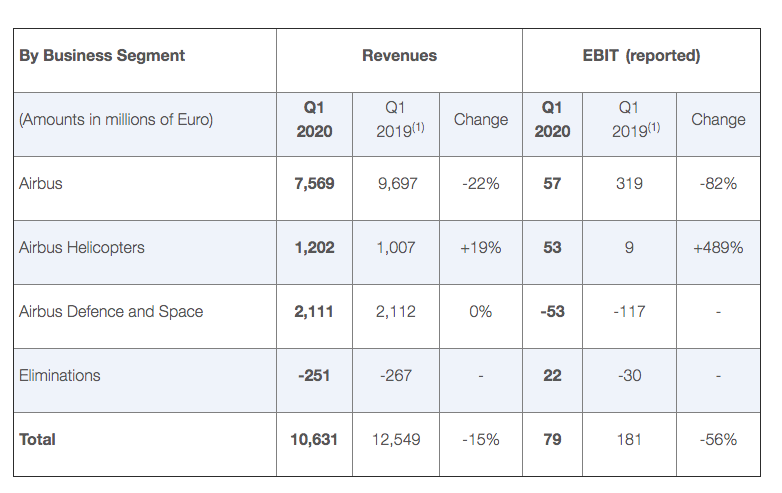

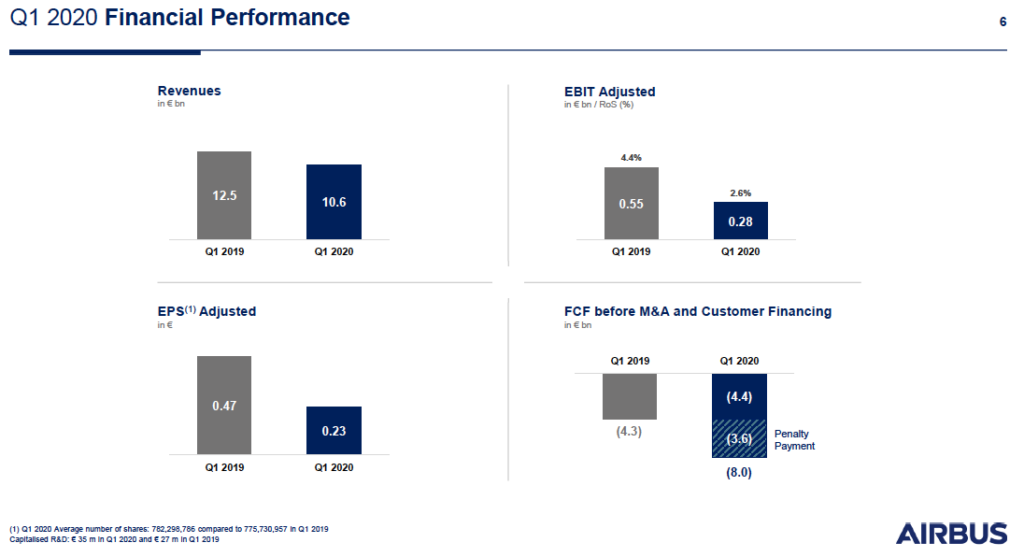

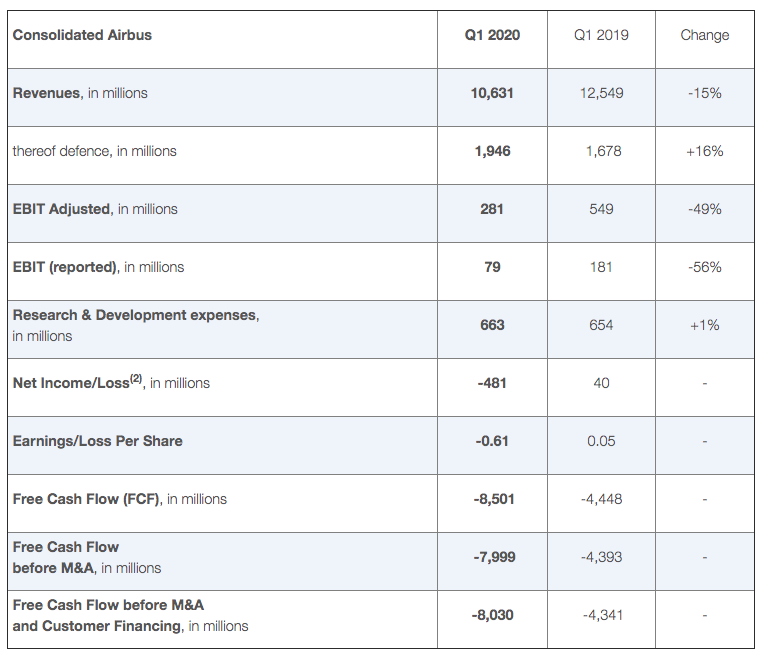

Consolidated revenues decreased to Euro 10.6 billion (Q1 2019: Euro 12.5 billion), reflecting the challenging market environment impacting the commercial aircraft business with 40 fewer deliveries than a year earlier, however, partly offset by a better mix and more favourable foreign exchange environment.

A total of 122 commercial aircraft were delivered (Q1 2019: 162 aircraft), comprising 8 A220s, 96 A320 Family, 4 A330s and 14 A350s. Airbus Helicopters delivered 47 rotorcraft (Q1 2019: 46 units) with its 19% increase in revenues reflecting the favourable delivery mix and growth in services. Revenues at Airbus Defence and Space were stable year-on-year. One A400M transport aircraft was delivered in the quarter.

Around 60 aircraft could not be delivered due to the COVID-19 pandemic. As announced in early April, due to the COVID-19 situation average monthly aircraft production rates are being adjusted to 40 for the A320 Family, 2 for the A330 and 6 for the A350. This represents a reduction of roughly one third compared to pre-crisis average production rates. On the A220, the Final Assembly Line in Mirabel, Canada, is expected to return to a monthly rate of 4 aircraft progressively.

(Most of the revenue for an aircraft comes in when the aircraft is delivered to the customer)

Airbus EBIT Adjusted for the group on the back of lower aircraft deliveries.

Consolidated EBIT Adjusted for Airbus Group, a performance measure and key indicator capturing the underlying business margin by excluding material charges or profits caused by movements in provisions related to programmes, restructurings or foreign exchange impacts as well as capital gains/losses from the disposal and acquisition of businesses – declined to Euro 281 million (Q1 2019: Euro 549 million), mainly driven by Airbus.

- Airbus’ EBIT Adjusted of Euro 191 million (Q1 2019: Euro 463 million) mainly reflected the lower commercial aircraft deliveries and associated costs, partly offset by favourable foreign exchange effects.

- Airbus Helicopters’ EBIT Adjusted increased to Euro 53 million (Q1 2019: Euro 15 million), reflecting the favourable delivery mix and growth in its services business.

- EBIT Adjusted at Airbus Defence and Space decreased to Euro 15 million (Q1 2019: Euro 101 million), reflecting the lower business performance, including in Space Systems. Due to the severity of the coronavirus pandemic, the incremental impact on the business is being assessed, and the restructuring plan at Defence and Space will be adjusted accordingly.

Consolidated EBIT (reported) was Euro 79 million (Q1 2019: Euro 181 million), including Adjustments totalling a net Euro -202 million. These Adjustments comprised:

- Euro -33 million related to A380 programme cost;

- Euro -134 million related to the dollar pre-delivery payment mismatch and balance sheet revaluation;

- Euro -35 million of other costs, including compliance costs.

The financial result includes a net € -245 million related to Dassault Aviation financial instruments and € -136 million from the full impairment of a loan to OneWeb, which filed for Chapter 11 bankruptcy proceedings in late March 2020. The consolidated net loss was Euro -481 million (Q1 2019 net income: Euro 40 million).

Airbus focussed on liquidity.

Given the current COVID-19 environment, various measures were announced in late March 2020 to protect Airbus’s financial liquidity and continue to fund its operations. These included securing a new credit facility amounting to Euro 15 billion, withdrawing the 2019 dividend proposal and suspending the voluntary top-up in pension funding. In addition, a Euro 2.5 billion bond was issued, partially terming out the Euro 15 billion credit facility, and settled on April 7, 2020. In coming quarters, the Company will continue to focus on cash preservation and will be reducing cash outflows. Besides reducing expected 2020 capital expenditure by around Euro 700 million to around Euro 1.9 billion, the activated measures also include the deferral and suspension of activities which are not critical to business continuity and to meeting customer and compliance commitments.

Airbus CEO Guillaume Faury said,

We saw a solid start to the year both commercially and industrially but we are quickly seeing the impact of the COVID-19 pandemic coming through in the numbers. We are now in the midst of the gravest crisis the aerospace industry has ever known. We’re implementing a number of measures to ensure the future of Airbus. We kicked off early by bolstering available liquidity to support financial flexibility. We’re adapting commercial aircraft production rates in line with customer demand and concentrating on cash containment and our longer-term cost structure to ensure we can return to normal operations once the situation improves. At all times, the health and safety of Airbus’ employees is our top priority. Now we need to work as an industry to restore passenger confidence in air travel as we learn to coexist with this pandemic. We’re focused on the resilience of our company to ensure business continuity.

The 2020 guidance was also withdrawn in March. The impact of COVID-19 on the business continues to be assessed and given the limited visibility, in particular with respect to the delivery situation, no new guidance is issued.

Bottomline

As you would see, a 49% drop in core Airbus profitability (driven by the commercial aircraft division) shows how much the business is impacted due to the CoVid-19 pandemic. Airbus expects deferrals of aircraft in the near future but expects defence sales to do better than commercial aircraft.

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. Even though the amount you enter has to be in INR, you may use an international card to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

Leave a Reply