In 2020, IndiGo, India’s largest domestic airline, added a new lifestyle product to its offerings: a co-brand credit card. IndiGo created a new SBU inside the company, called 6E Rewards, where the airline generates and sells points. However, the loyalty programme is not available to all IndiGo flyers. It is only available to those who have and use IndiGo’s co-brand credit cards. IndiGo tied up with HDFC Bank and MasterCard to launch their first card in February 2020, and in December 2021, launched the second card, this time with Kotak Mahindra Bank on the Visa platform. The airline had a member base of 300K folks before abandoning the effort to take this further.

In October 2024, IndiGo launched the BluChip programme, which, unlike the 6E Rewards programme, is a full-blown loyalty programme, and not just a banking points programme (which was a novel take, honestly). Now, IndiGo has been adding partners that grant BluChip points. Swiggy was the first, PostCard Hotels and EazyDiner came next, and now, they have a bunch of co-brand card partners. Kotak Mahindra Bank was the first one. From there, the strategy is simple: get the banks that were ex-partners of Vistara and bring them in. So far, we have IDFC First Bank and SBI Card from the Vistara stable switching over, and now we have the big one, Axis Bank.

IndiGo and Axis Bank tie-up to launch BluChip co-branded credit cards

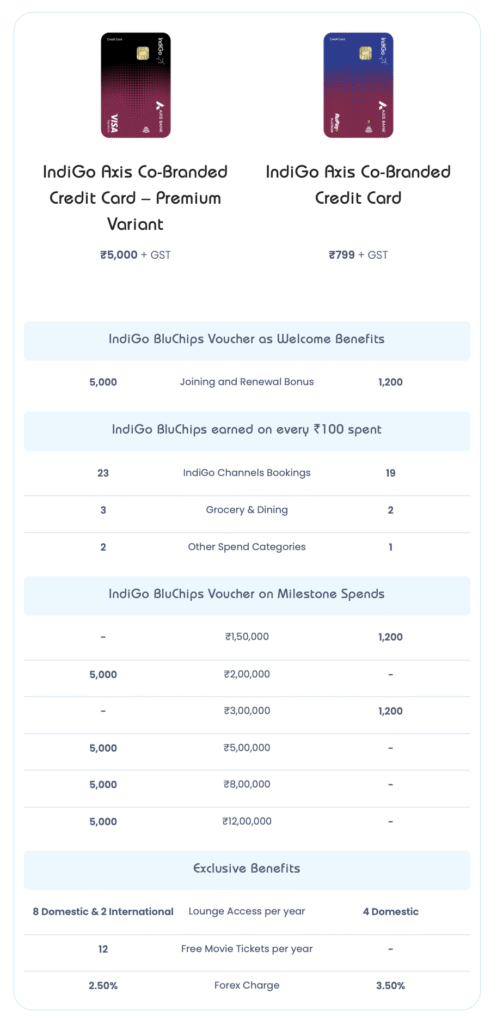

IndiGo and Axis Bank have partnered to launch co-branded credit cards. The cards, available in two variants: IndiGo Axis Bank Credit Card and IndiGo Axis Bank Premium Credit Card, have been crafted to reward spenders through IndiGo’s loyalty program, IndiGo BluChip.

The collaboration aims to enable earning of rewards on everyday purchases and travel-related expenses. Both cards offer IndiGo BluChips on eligible transactions, with accelerated earnings for spends on IndiGo via direct channels. Customers will also enjoy welcome and renewal benefits, milestone rewards, and a suite of lifestyle privileges including lounge access, entertainment offers, dining discounts, and reduced forex markup depending on the chosen card variant.

IndiGo Axis Bank Credit Card is priced at INR 799++ and targets the retail segment. This card offers a compelling mix of travel and lifestyle benefits, along with accelerated rewards across key spend categories. IndiGo Axis Bank Premium Credit Card, priced at INR 5,000++, is designed for affluent customers seeking superior travel and lifestyle benefits. The cards will be launched on RuPay and Visa networks.

Here is a detailed comparison of both cards. Remember, IndiGo is counting the points earned by members on flying the tickets into the points earned on the card as well.

Neetan Chopra, Chief Digital and Information Officer, IndiGo, said,

Neetan Chopra, Chief Digital and Information Officer, IndiGo, said,

IndiGo is committed to continuously enhancing the value proposition to our customers, especially our loyal frequent flyers, and our partnership with Axis Bank is an important step in this direction. We are excited to launch these co-branded credit cards, which convert everyday spends into IndiGo BluChips and combine IndiGo’s convenient, reliable service with Axis Bank’s extensive banking network. With premium lifestyle benefits, we are sure that these co-branded credit cards will make our customers’ experience with IndiGo even more rewarding.

Arnika Dixit, President & Head – Cards, Payments and Wealth Management, said,

We are delighted to announce our strategic partnership with IndiGo, bringing together the best of banking and travel to elevate our customers’ experiences. With the launch of our co-branded credit cards, we aim to offer unmatched value to both casual travellers and frequent flyers. These cards are designed to deliver exclusive travel benefits, accelerated reward earnings, and seamless access to privileges that make every journey more rewarding. This collaboration reflects our commitment to innovation and customer-centricity, and we look forward to empowering our cardholders with more freedom, flexibility, and convenience across segments in the skies and beyond.

Bottomline

IndiGo and Axis Bank have come together to launch an Axis Bank platformed co-brand credit card with earning currency being IndiGo BluChips. These credit cards should interest Axis Bank customers who frequently use IndiGo. The premium version has the most payoff potential.

What do you think of the new IndiGo Axis Bank Credit Cards?

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

Ajay ji,

Which of the 4 Indigo Co Brand cards is having best value ?

Can you do a comparison?

@Anuj, I’m planning to do that. Look out.

probably none considering that bluchips are extremely worthless at this time, best to find a travel card that rewards for metal neutral or a transferable currency one

As always, thanks for the updates Ajay.

Quick question – have you been able to value th blue chips – the program is v confusing. Never have been able to fig out what’s the appx value benefit.

@Nishank, 0.42-0.45 is the minimum to look out for. People get 1 INR sometimes.