HSBC Credit Cards has been the most aggressive credit card issuer in India recently, while the others are busy consolidating their books. So, they are firing all cylinders on the cards and rewards front. The newest offering is a bonus on transfer to Marriott Bonvoy.

HSBC Credit Cards offering a 40% Bonus on transferring to Marriott Bonvoy

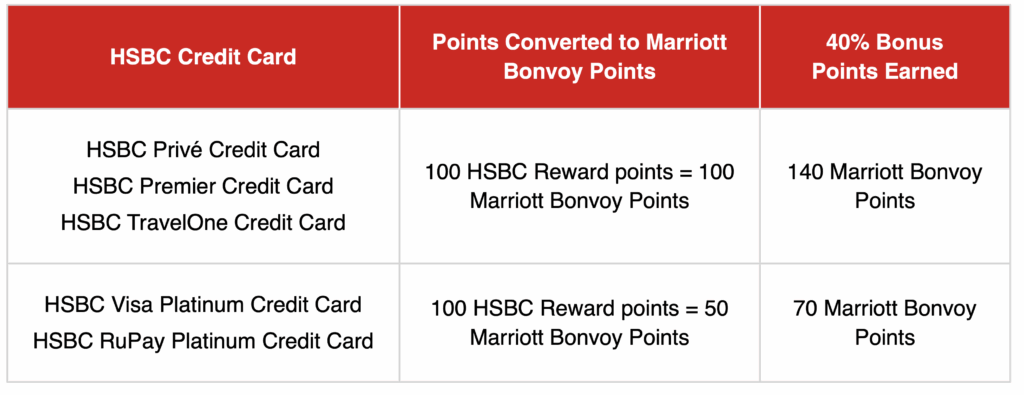

HSBC India has launched a limited-time offer for its cardmembers who are members of the Marriott Bonvoy programme. Between November 10, 2025 and December 10, 2025, cardholders of selected HSBC credit cards can convert their HSBC Reward points into Marriott Bonvoy points and receive a generous bonus of 40% extra Bonvoy points on top of the base transfer.

The bonus is capped — the maximum you can receive is 200,000 additional Bonvoy points per customer — so while the headline figure sounds lofty, understanding the mechanics is crucial for making an informed decision. The cap is on bonus Marriott points (200,000), not on transferred points. That determines how many HSBC Reward points you’d need to max out the bonus.

- For Privé / Premier / TravelOne (100 → 100 base): To get 200,000 bonus points, you need to transfer 500,000 Marriott points (40% of 500k = 200k). Because conversion is 1:1 from HSBC points for these cards, you need 500,000 HSBC Reward points.

- For Visa Platinum/RuPay Platinum (100 → 50 base): Each 100 HSBC points is equivalent to 50 Marriott points (base). After the 40% bonus, it’s 100 → 70 Marriott. But to reach the 200,000 bonus cap, you need to convert 1,000,000 HSBC points (because the bonus per HSBC point is smaller).

The conversion must be completed via the HSBC India Mobile Banking app during the offer period; web or phone requests will not be accepted. Once you convert, the transaction is irreversible, so you cannot transfer the points back to HSBC or switch to another partner. After the transfer is complete, the bonus Bonvoy points will be credited to your Marriott Bonvoy account within 30 days (although most people report receiving the bonus instantly).

Is it a good promotion?

So, when does this promotion become genuinely useful? If you already have a planned Marriott Bonvoy redemption in mind—say a high-category hotel stay or a transfer to one of Marriott’s airline partners—this bonus can meaningfully boost the value of your HSBC Reward points. Although you are better off transferring American Express points to Marriott, since these points are more valuable due to a high number of partners.

For example, if you only need a few additional Bonvoy points to complete a reward booking, converting them under this 40% bonus gives you more incremental value than ordinary transfer rates. On the flip side, if you’re converting simply because the bonus exists but without a clear redemption goal, you could lock yourself into a points pool whose value depends on how and where you redeem. The bonus is tempting, yet value extraction isn’t automatic.

Official Terms and Conditions Link.

Bottomline

This is a genuinely attractive short-term promotion for HSBC customers who already plan to use Marriott Bonvoy points — for topping up award bookings, for specific airline-transfer strategies that use Marriott as a bridge, or for large-value redemptions. The app-only requirement and 30-day credit window are straightforward constraints; the irreversible nature and the 200k bonus cap are the main reasons to pause and run the numbers first.

If you don’t have a plan for those Marriott points, treat this like window-shopping: the 40% looks tasty, but converting without a use-case can leave you “stuck” in a points currency whose future value depends on your redemption choice.

Apply here for HSBC Travel One / HSBC Visa Platinum / HSBC Live+ Credit Cards

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

I wonder how this compares vs using the same spend on HDFC Bonvoy Diners Club card?

For e.g. if I were to pay using HDFC vs using HSBC and converting the points

@Andrew, you can just do the maths