HDFC Bank has been quietly watching from the sidelines, running a tight ship while a peer bank took over all the card spending from the high rollers (and the non-high-rollers, too). Now that the peer bank is calling it a day on their chequebook to write over rewards to customers, HDFC Bank has quietly removed one of the changes it introduced some time ago.

HDFC Bank removes SmartBuy capping on rewards

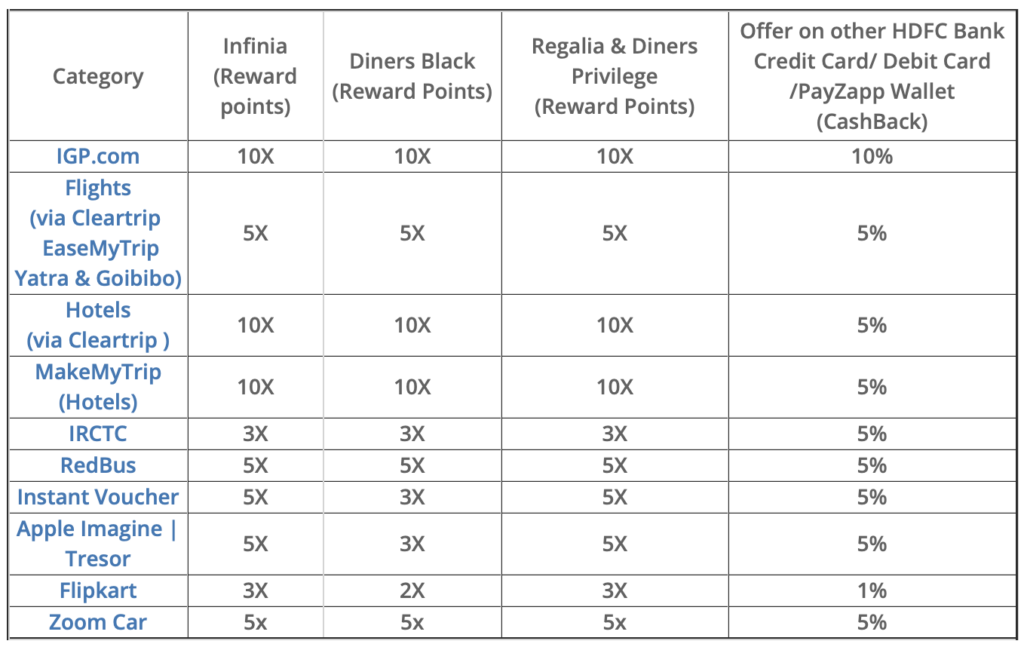

HDFC Bank’s Smartbuy portal is their assimilation of all the accelerated rewards or cashback that HDFC Bank offers on the use of their credit cards on this white-labelled portal. The Infinia, Diners Club Black, Regalia, and the Diners Club Privilege card get accelerated points in the following manner (as of August 1, 2023).

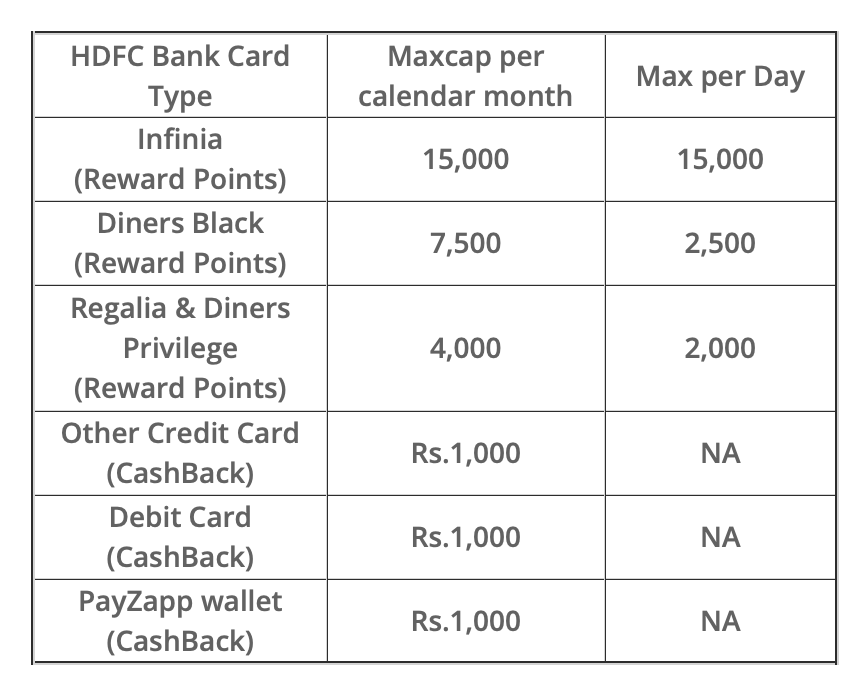

Previously, HDFC Bank used to cap the reward points that can be earned on accelerated transactions on a per-month basis, and at some point in time, they also introduced daily capping (perhaps to ensure one significant transaction did not make the customer all the points for the month). The daily capping limits were up to 7,500 bonus points for Infinia, for instance, and 2,500 points for Diners Club Black.

In an update published to the terms and conditions, HDFC Bank has now withdrawn the daily limits on the Infinia Credit Card. That means the following caps will now be applicable per calendar month only for Infinia (Daily limits still exist for DCB, DCP and Regalia)

This might be a move to encourage spending on the Infinia again from customers who are looking for a substitute for their credit cards from other banks.

Bottomline

HDFC Bank has removed the cap of 7,500 points on Smartbuy Rewards per day on the Infinia Credit Card, and now you can earn a total 15,000 Rewards Points bonus in one day by spending on the Infinia if required.

What do you make of the changes to the Infinia Smartbuy proposition?

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

Directionally a right move but with the monthly cap of 15k, it still doesn’t make sense to use Infinia for flight/hotel bookings (especially international) at 5x/10x for a family. One might have to plan the reservations to spread over a couple of months to get any meaningful rewards from such bookings.

15k per month at 5x means we can book flights for a maximum of Rs.90000/- which might suffice domestic flight bookings for a family of 4 but might be touch and go for flights to many international destinations. Similarly, hotel bookings at 10x translate to Rs.45000 for a similar family of 4 and this is way too less for stays at international hotels and might even prove tough for some domestic properties.

This makes us wonder if Infinia is really a travel card (attractive for travel redemptions but doesn’t want you to use the card for travel spending esp. international travel). Is this an opportunity for Infinia reserve?

Exactly.

15k was a few years back, but looking at 2023 ticket/ hotel rates, especially for international travel, 15k points/month is too less for family ticket/ travel booking. Most customers are forced to use more than one card during such bookings, which finally is a loss for infinia. The new Magnus will shine during such cases as spending more than 1.5 lahks in a month is more rewarding.

Very true. 1 lakh for flight tickets cannot suffice for a family going abroad. HDFC should make this at least double if not more. Or keep it 5x upto 15000 points and then 3x after that with a very high cap of say 75000 points.

Why so much differentiation when annual charges are same for Infinia and DCB.

DCB is a bad choice compared to Visa Infinia. Much lower benefits and not accepted widely in India.

and they sneakily introduce 3% service charge + GST on instant voucher purchase. lmao

Yes, pretty bad. But this is only on Amazon and Amazon Shopping. Effective devaluation is about 3% for Amazon and 2% for Amazon Shopping.

Right, move at the right time.

I hope they increase 10x categories by keeping the monthly cap at 15000.

There should be no cap, what’s the reason you say the 15000 points limit should stay?

@Vinay, If there will be no cap, the abusers will start abusing the Infinia just like they abused the Magnus. You want that?

Well if not no limit then it should be high 15k RP is too less and there can be a yearly limit to avoid people abusing it. So lets say at current value it is 15* 12 = 180k, so they can make it yearly 250k limit or even begin with a yearly cap for now and remove daily and monthly.

If the monthly cap is 15000 points, they can make it 30x or 60x with no additional benefit. It won’t matter, because you as a customer won’t get more than 15000 reward points.