In 2020, IndiGo, India’s largest domestic airline, added a new lifestyle product to their stable of offerings, a co-brand credit card. IndiGo created a new SBU inside the company, called 6E Rewards, where the airline generates and sells points. However, the loyalty programme is not available to all flyers of IndiGo. It is only available for those who have, and spend, on IndiGo’s co-brand credit cards. IndiGo tied up with HDFC Bank and MasterCard to launch their first card in February 2020, and in December 2021, launched the second card, this time with Kotak Mahindra Bank on the Visa platform. The airline already has a member base of 200K folks who are members of the 6E Rewards programme.

Since I already held another card from HDFC Bank, the bank did not approve me for an IndiGo co-brand card back in 2020, but when Kotak launched the card, I jumped in. In December 2021, the IndiGo website showed me the option to apply for a Kotak co-branded credit card. Since I’ve already been holding on to a Kotak card for a while, it was basically going to flip my card into the newly launched product. After a bit of trial and error, where the IndiGo website did not tell me if I had successfully applied or not, I got a message a few days later that my card was on its way.

IndiGo and Kotak officially launched the co-branded card in mid-December 2021, in a quiet corner of the Delhi Airport tarmac, with frequent distractions of aircraft landing and taking off. IndiGo’s CCO Willy Boulter and Kotak Bank’s, President – Consumer Assets, Ambuj Chandna, were present at the occasion.

Kotak IndiGo Ka-Ching 6E Rewards XL Credit Card

The Kotak IndiGo Ka-Ching credit cards come in two variants, the regular and XL versions. Here are the prices and benefits of the two versions:

- IndiGo Ka-Ching 6E Rewards Credit Card

- Joining and Annual Fees: INR 700 + GST

- IndiGo’s Joining Benefits: 1 Complimentary IndiGo base fare waiver worth INR 1,500 when you make at least three transactions in the first three months of the card setup + 1 IndiGo Prime worth INR 899 (Priority Checkin, Priority Baggage Handling, Complimentary Meal on board, Choice of Seat)

- Other Brands Joining Benefits: 30% Discount on BAR at Accor Hotels in India (up to 3 Nights), INR 1000 worth Discount on (dine-in) spends worth INR 1500 at least at Accor restaurants in India, a Budweiser voucher worth Rs. 250 and 30 days free trial on Lionsgate Play

- Ongoing Benefits: INR 150 as convenience fees for booking on the IndiGo website

- Earning Rates:

- Rewards on IndiGo Spends: 3%

- Rewards on Merchant Spends (Includes Dining, Grocery & Entertainment): 2%

- Rewards on Other Category spend (Wallet excluded): 1%

- Feature Partners: up to 15%

- Fuel: 3% (Indian Oil)

- IndiGo Ka-Ching 6E Rewards XL Credit Card

- Joining and Annual Fees: INR 1500 + GST (Initial offer/ usual is INR 2500 + GST)

- IndiGo’s Joining Benefits: 1 Complimentary IndiGo base fare waiver worth INR 3,000 when you make at least three transactions in the first three months of the card setup + 1 IndiGo Prime worth INR 899 (Priority Checkin, Priority Baggage Handling, Complimentary Meal on board, Choice of Seat)

- Other Brands Joining Benefits: 30% Discount on BAR at Accor Hotels in India (up to 3 Nights), INR 1000 worth Discount on (dine-in) spends worth INR 1500 at least at Accor restaurants in India, a Budweiser voucher worth Rs. 250 and 30 days free trial on Lionsgate Play

- Ongoing Benefits: INR 150 as convenience fees for booking on the IndiGo website

- Earning Rates:

- Rewards on IndiGo Spends: 6%

- Rewards on Merchant Spends (Includes Dining, Grocery & Entertainment): 3%

- Rewards on Other Category spend (Wallet excluded): 2%

- Feature Partners: up to 20%

- Fuel: 4% (Indian Oil)

- Two Lounge Access per quarter

I signed up for the XL version, which arrived in mid-December 2021. I did not want to write a review right after receiving the card, because I wanted to go through the whole product flow for a few weeks. Otherwise, it would be just another reproduction of the features.

The card comes in a vertical card format, which seems to be the card design that all Indian card issuers seem to be falling over each other these days to issue, from the more millennial BNPL issuers to the big banks. But hats off to the bank for this unique colour, which looks solid on hand, but has a pattern when you shine a light on it. I loved it. Unfortunately, there is no box as such for the card. All you get is a blue envelope with a letter inside and the card stuck on it.

In terms of the fee, I have been charged INR 1,500 + GST for the fees at the moment, however,

How the product works is, Kotak is responsible for the card and the associate features on the banking end, but IndiGo controls the customer experience in terms of the rewards programme. So Kotak issues the card and is responsible for ensuring you get a credit line, and collects the money. But the real action is at the end of IndiGo. And that is where I wanted to spend some time in this review.

6E Rewards: Earning

I think IndiGo’s technology stack on this product is still a work in progress, and they are fixing things as they are going along. For instance, when I received the card, I could not access my IndiGo 6E Rewards account for a while. All I saw was this screen. Even now, on the mobile app, I only see this.

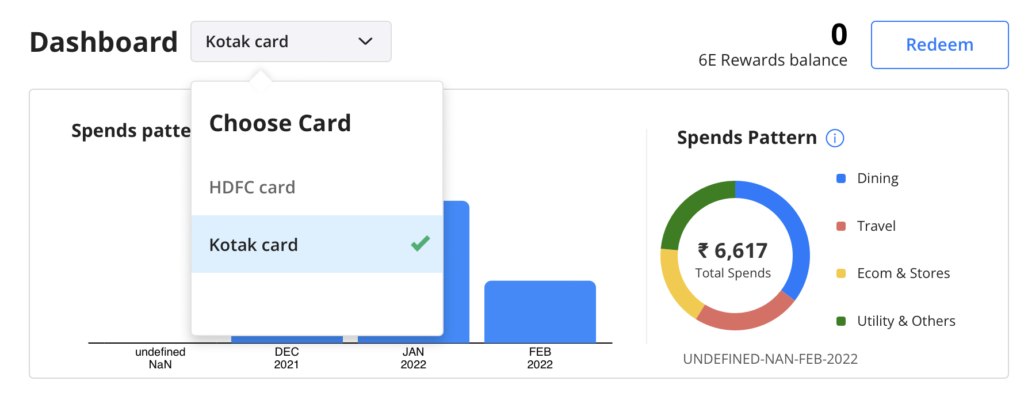

On the website, however, I see a different screen, one for the HDFC Bank issued card and one for the Kotak issued card (you can have both if you like).

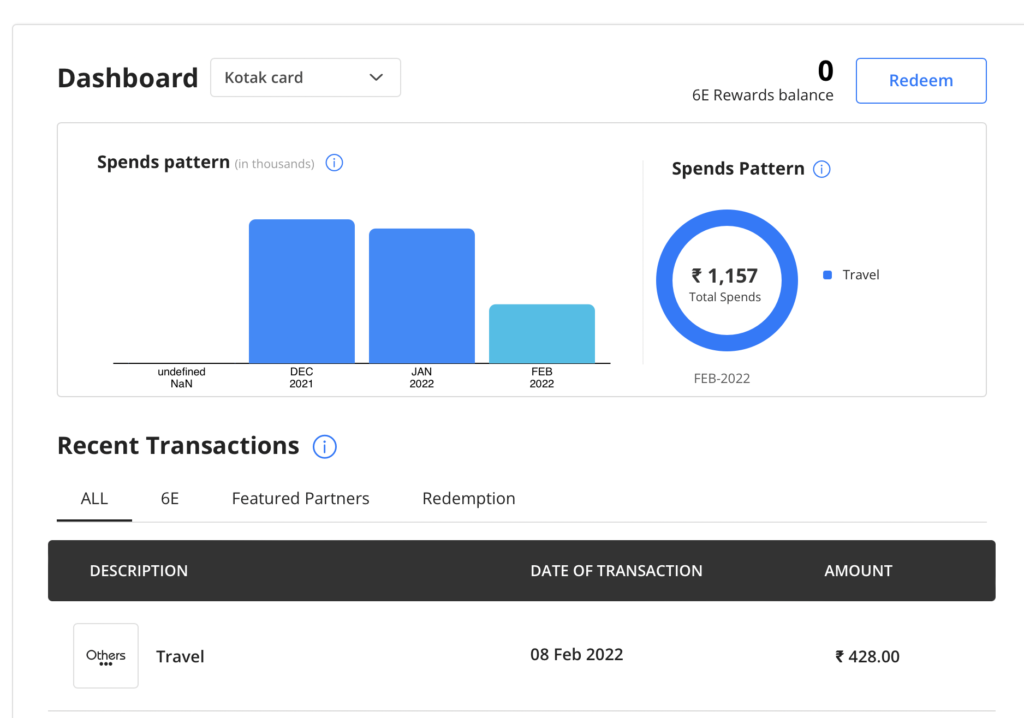

There are a couple of things of note that have come through over the months. Firstly, the rewards fulfilment process is generally very slow. I really don’t know why it takes 90 days to put any points in the account, especially when the data for each card account is being sent over frequently. For instance, my account, as of March 12 has been synced up till February 8, 2022, and there are zero points that have been added to the account, yet.

Similarly, I’ve still not received the activation benefits while I’ve completed 90 days of having the card so far. And while I received the Accor vouchers, they are only valid for 3 months. Take note, these are all things noted in the T&C, but when one is competing, let’s say with an ICICI Bank Amazon Pay Credit Card, these things matter because 90 days is an awful lot of time to provide rewards in a world of instant gratification. I’m told this is being worked upon, but for now, if you sign up, expect to get your points in 90 days, no less.

Once the reward points come in though, they are valid for 24 months and expired or used in the order in which they are earned, using the FIFO method. However, for bonus 6E Rewards earned due to payment at partners such as IndiGo, Accor Hotels etc, you get only 6 months to redeem the points. Each point is worth INR 1, and you can redeem it for booking tickets on IndiGo, at the payment page of IndiGo.

Earning points with the feature partners is another part that is left to IndiGo to compute and update. Kotak just needs to classify transactions properly and pass them on to IndiGo. Once transactions are sent to IndiGo 6E Rewards, their computers and people will classify them per feature partners or not. So, for IndiGo flights, Accor stays or dining or transactions at BoAt, for instance, the data needs to be passed on to IndiGo and then you need to wait.

One thing to note is, that you cannot earn points for any sort of IndiGo tickets that are not booked directly through the B2C website of IndiGo. The following IndiGo ticket categories earn you no points:

- group bookings

- bookings made under a corporate login

- bookings made under an agent login

- bookings made under a small and medium enterprise login

- advance payments made to IndiGo for corporate/agent/SME tickets

IndiGo also awards you points after you have flown the flight, not just when you book the tickets as per their T&C.

Lounge Access

In terms of Lounge Access, the Kotak card’s XL Variant provides 2 Lounge trips per quarter and a total of 8 per year for free. The lower end variant gets no Lounge privileges. But by virtue of being on the Visa network, the following 33 Lounges in 23 Cities are accessible. Kotak puts out a much smaller list on its own website.

While I frequently pop out my Amex or my Priority Pass, I tried using this card on some of the lounges I head to during my travels. The Terminal 2 Lounge at Delhi Airport declined the card, but the Dehradun Bird Lounge accepted it.

Bottomline

While IndiGo is lining up a fantastic rewards programme for those who sign up for a credit card via HDFC Bank/Kotak Mahindra Bank, for now, the execution is not in step with the great programme that has been lined up by the airline. They need to cut down on the timelines to credit reward points and the other associated rewards to customers.

However, at INR 1500 + GST, the product is excellent value for the first year, offering INR 3,899 worth of benefits on IndiGo itself, plus other benefits such as an INR 1,000 discount on dining at Accor restaurants and a 30% Discount at Accor partner hotels in India. It is all in all, a tempting proposition. Additionally, a 2% reward rate is great (on all spending), plus the bonuses on some propositions such as IndiGo, dining and Accor in itself make it a great proposition for me.

What has been your experience with the Kotak IndiGo 6E Credit Cards?

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

Did your points arrive yet, and has the service quality improved/turnaround times resolved or fixed?

I agree I do not get any otp only so unable to apply only!

I am trying to apply for this card since past two weeks but Indigo’s site is not working properly. When I put in my OTP, it says OTP entered is not valid.

On rare occasion, when it accepts the OTP, It show an error on the next step when you fill in your name, DOB, email ID, etc.

Such a disappointing experience.

Did you get the welcome benefits? I went through an entire 15-day ordeal which involved getting contact details of top indigo execs, a threat to go the RBI ombudsperson and a lot of back and forths to get some of the benefits.

@Ajay – can you please reconfirm the earnings rate @ Indian Oil? Unable to find any mention of it on the Kotak website.

@Aayush https://livefromalounge.com/indigo-6e-rewards-indian-oil/

Thanks for the review, I always find it interesting how much less rewarding cards outside the US are for consumers. Hopefully over time competition improves the value proposition.

Quick question … You mention that “Each point is worth INR 1, and you can redeem it for booking tickets on IndiGo, at the payment page of IndiGo.”.

Do you know if you need to have enough points to cover the entire ticket cost, or can you use part points and part cash? If partial payment with points is allowed, any minimum number of points?

@Jason, yes. partial payment is allowed. I don’t know if any minimums exist though, since, I highlighted how my points have yet to arrive.