Myth: One must be a frequent flyer to earn miles

Fact: Everyone can earn miles by simply spending money on credit cards that offer miles

If you are new to point and miles, one of the first questions that will come to your mind is how to earn air miles. Most people (including me a few years ago) believe that the only way to earn airline miles is by travelling on a plane, however, this is not true. Not all of us are road warriors and the easiest way to earn miles is by spending on cards that offer miles. Lets take a look at these JPMiles Cards for Beginners.

Ajay and I keep multiple mileage earning cards and stack up a neat pile. Check how we earned over a million miles last year. One question that we get a lot, then, is which credit card to get if you’re starting into miles and points. From friends to family, everyone has asked us this question at some point in time.

Evidently, also, a lot of us want to earn JPMiles. A key thing to keep in mind is that JetPrivilege allows family members to pool in JPMiles. Then, given our own experience, it becomes a smart move to get more than one mileage earning credit card in the family.

The next question is why should I pay for a credit card? The answer to that is simple. The free credit cards earn you points which get valued at 5 to 20 paise and can’t take you much further than buying a revenue ticket with them. Or buy a toaster with those points. Forget earning JPMiles on the fast track. But for a modest amount of fees, you can get your money’s worth and more with these JetPrivilege/Jet Airways Credit Cards for starters.

To see how quickly the miles add up, I headed up to the Credit Card Portal of

JetPrivilege, where one can easily check out how the various credit cards issued in partnership with JetPrivilege or Jet Airways can mint you miles, and also apply for those credit cards.

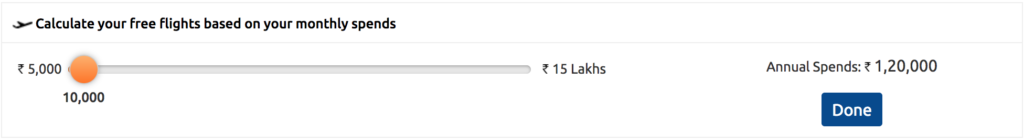

I analysed the cards with a modest spend of INR 10,000 every month, however, based on your spending you can always adjust the slider and get a clue on how quickly can you come close to those redemption flights.

JPCardsExpenses

For example, I’m initiating my parents into miles and getting them to apply for ICICI’s Rubyx, HDFC Signature, HDFC’s Platinum and ICICI’s Sapphiro credit cards (all co-branded). Therefore, for a total fee of INR 7,250, we will have access to 4 free ticket codes. Plus, very soon grocery spends, shopping and other daily spends will soon start generating miles for the entire family.

Here are the 5 co-branded cards for beginners that will earn you JPMiles without the fee

burning a hole in your pocket.

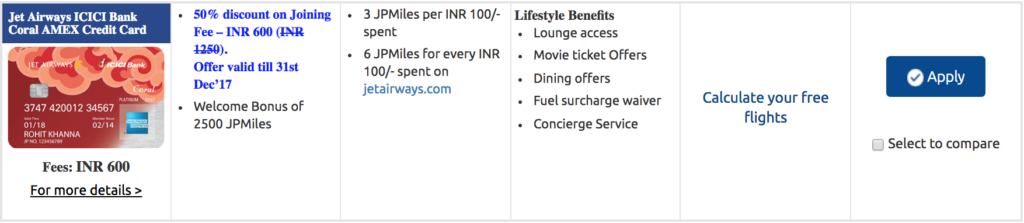

1. Jet Airways ICICI Bank Coral AMEX Credit Card

For just INR 50 (plus taxes) per month, you can be welcome to the world of JPMiles. ICICI Bank is offering a 50% discount until December 31, 2017, on this credit card, so you get it for INR 600 fee for the first year.

Let’s assume you use this card to pay for your groceries, shopping, dining and cabs and spend INR 10,000 every month. At the end of the year, you’ll earn 3,600 JPMiles. Add up the welcome bonus of 2,500 JPMiles and there with 6,100 JPMiles you have enough for a redemption ticket between Mumbai-Goa, Mumbai-Udaipur, Delhi-Amritsar and Bangalore- Colombo sectors. That should be INR 4000 or more of value at current ticket prices. Apply Here.

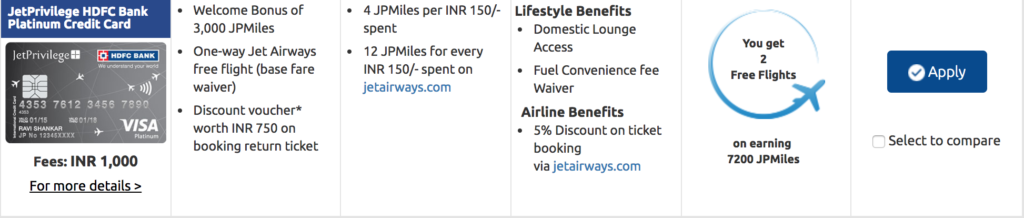

2. JetPrivilege HDFC Bank Platinum Credit Card

With a fee less than INR 100 per month this credit gets you 1 assured free ticket every year just for signing up. Like Ajay showed here, the value of that ticket could easily go up to INR 7000 upwards.

This card also gives a welcome bonus of 3,000 JPMiles and 4 JPMiles per INR 150 spent. So, let’s assume you spend INR 10,000 every month on this credit card to pay for your day to day expenses. At the end of the year, you will have earned 6,200 JPMiles including the welcome bonus.

Combining the one-way free ticket code along with the JPMiles earned you will be able to get an economy return ticket on a number of sectors. Apply Here.

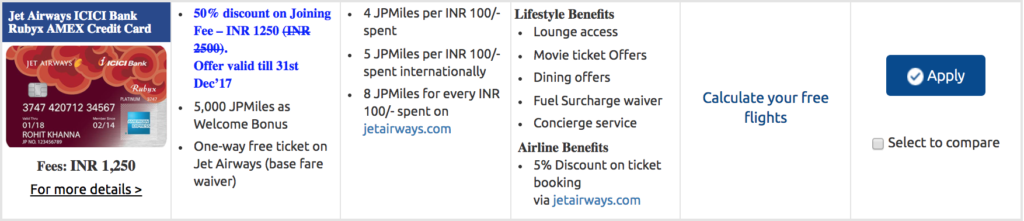

3. Jet Airways ICICI Bank Rubyx AMEX Credit Card

With a subsidised first year fee of INR 1,250, this is another card where JP is offering a 50% discount until December 31, 2017. This card comes with a one-way free ticket and a welcome bonus of 5,000 JPMiles and a higher mileage earning rate than the cards mentioned so far.

For the modest spend of INR 10,000 every month, you’ll end up with a free ticket code along with a total of 9,800 JPMiles at the end of 1 year. That’s brings you close to a redemption of an economy return ticket or a one-way business class ticket on sectors such as Mumbai – Goa, Delhi – Amritsar or Delhi – Udaipur. Apply Here.

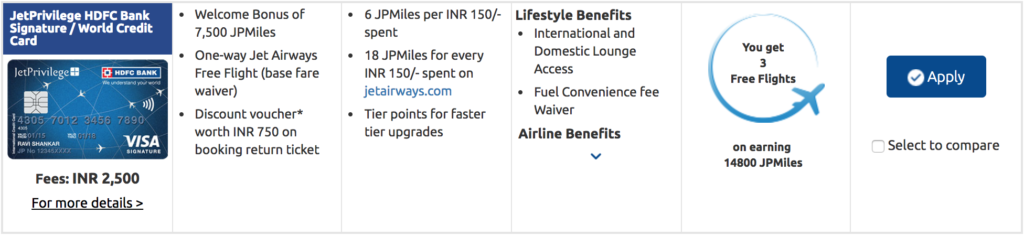

4. HDFC Bank Signature Credit Card

If travel takes you outside India then, for an annual fee of INR 2,500 and taxes, this is a good card to consider. Not only does it give you a one-way free ticket but comes with a rich welcome bonus of 7,500 JPMiles. With an earning of 6 JPMiles for every INR 150 spent, a spend of INR 10,000 per month will earn you a total of 12,300 JPMiles in a year including welcome bonus. That is good to get you an economy return ticket on a lot of domestic sectors and Premiere on some.

The beauty of this card is also in the Priority Pass that comes along with this card and provides 5 free visits in over 1000 lounges worldwide.

TFS Lounge at Mumbai CSIA Airport Terminal 2

This card also makes sense if you want to accelerate your run for JP elite status. Every INR 2 lakhs that you spend on this card gets you 1 tier point qualification towards JP status.

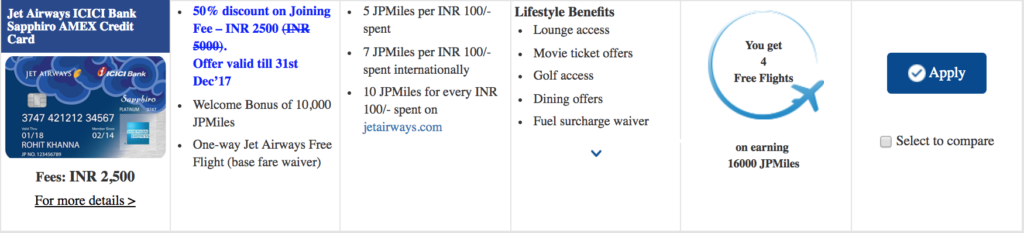

5. Jet Airways ICICI Bank Sapphiro AMEX Credit Card

Another card to consider in the beginner’s portfolio is the Jet Airways ICICI Bank Sapphiro credit card that is currently going at a 50% discount on the joining fees. It comes with a one-way free ticket and a generous bonus of 10,000 JPMiles, which is good enough to redeem an economy return ticket all by itself.

It also gets you 5 JPMiles credit for every INR 100 spent. An annual spend of INR 1,40,000 combines with the bonus will equal to 17,000 JPMiles. That’s a free economy return ticket on over 90% of Jet’s domestic sectors or a free return ticket from India to Kathmandu or Colombo.

Those are some of the cards I think you should consider for your family’s mileage earning. Given some of those are time-limited offers, maybe a good idea to apply now.

Which of these mileage earning cards you like and are getting in the family?

Happy New Year Ajay Sir & Shipra Madam 🙂

Great Article 🙂

I am following it!!!

In older days HDFC World card was giving 5 Domestic / International Lounge Access through Priority Pass membership now restricted International!!!

I think HDFC devalued their HDFC World card program cutting down lots of benefits

Does HDFC world signature card not give priority pass access to lounges now

Shipra/Ajay

HDFC has done away with points on using their cards for e-wallet loading, EMI transactions(since July 17) and fuel (since April 2016).Still worth considering?

Also premier miles is a decent card which i think deserves a mention.

@Neil, since this was the post about best JPMiles cards, we skipped on adding Citi.

Hi Ajay/Shipra,

So I am considering HDFC signature card, would prefer your views on same

My most travels are for Business ones and hence not airline committed.

But tempted with JetAirways Diners also.

Had just couple of queries to get an idea:

1. When redeeming the miles, there are carrier charges + other taxes. Assuming say I am using 15k miles for Ahmedabad-Dubai route, I think I would end up paying around 3k? For a 10k ticket. Worth using same?

2. Just one small help- travelling to Mumbai-singapore-bali return in Feb. Booked tickets on online portal (used premiremiles)

Travelling for my honeymoon.

Want to know , anyway you can think I can bag a free or discounted upgrade?

Used to be silver tier member, now just a blue as wasn’t travelling in Jet from 2-3 years much.

Sorry, forgot to mention reason more tempted for HDFC signature is free international lounge access compared to ICICI.

And as am preferred HDFC customer, I think might get fees waived off also, though I think better to pay and get joining bonus.

@Priyansh, worth of miles is different for different people. I almost exclusively use miles for close in tickets when ticket prices are high and I still have to travel, or when I have to fly long distance and it works better to use miles over cash. It still works better to use miles at 3K over a 15K ticket I’d assume (never seen 10K fares round trip to DXB). As for upgrades, Jet Airways would offer you an upgrade at a discount closer to the date of check in.

Thanks.

Sorry, was talking about one way fare, as I am assuming it would take 3k in carrier charges and taxes for one way.

And yeah, will probably go for one of HDFC Signature or HDFC Diners.

Thanks a ton

What about the diners club jet card that gives 30K JPmiles and 15 tier points? that is Silver straight away, isn’t it? And 30k points for Rs. 10k is not bad either. And lounge access.

Big spend, but good best returns of any miles card out there today for the Indian market.

https://www.hdfcbank.com/personal/credit_card/jetprivilege-hdfc-bank-diners-club

@VK it is a good card but not for beginners. I don’t think someone starting into miles and points would like to dip into a card with INR 10000 of fees and know how to use it. So lower category cards first!!