American Express is on a spree of making changes to their cards. We first reported the changes on the Platinum Travel Card, and now there is another important change coming up on the Amex Gold Charge Card.

Back in the day, American Express used to offer 1000 Membership Rewards for 4 transactions of INR 250 per month. In 2013, they changed the policy and offered the same rewards but raised the amount per spend to INR 1000 per transaction.

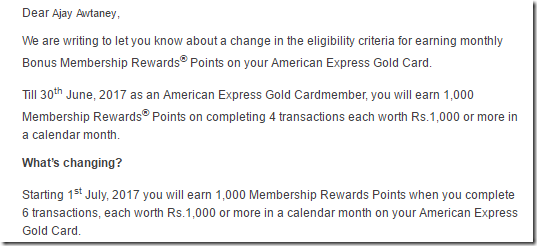

Now, this is changing again. With effect from July 1, 2017, there will be a higher bar for Amex to get you these points. As per a new communication from Amex,

Amex will also offer a new option to pay 12000 Membership Reward points to pay for a statement credit of INR 5,175 which is the full fee of the Amex Gold Card.

Err, I don’t think I like what I see. Essentially American Express is devaluing the MR proposition by asking for more to be able to earn the same number of points.

What are your reactions to the changes coming up to the MR earning on the Amex Gold Charge Card?

Hi Ajay, any idea whether this will apply to Membership Rewards Credit Card which had similar features?

Amex is simply not attractive in india compared to other cards. Amex is still not accepted in many establishments making it mandatory to have a Visa or Mastercard with you. Most of the cards dont give you lounge access unlike mastercard which has generous lounge privileges as of now.

Strangely they have launched a gold credit card which has the same benefits of a gold charge card but without the annual fees.

i am planning to opt out in the next couple of months.

All card companies in India are degrading by the day. Amex and Citi used to be top of the class and differentiated from the domestic joker banks but they are also going in same direction now. They want to all take customers for a ride and keeps going down to the age old saying that “loyalty is non-existant” in Indian market. All these cards (especially from Amex) are becoming worthless by the day