Many moons ago, Air India decided to be the best in the co-branded credit cards business, and they made a headline offer to customers who couldn’t resist it. The offer was, tonnes of Air India Miles on your spend, an ability to straight up match your status to Air India (and hence Star Alliance) if you already had status with another airline, a free upgrade voucher, and Silver/Gold status with Air India if you spent a lot of money on the card.

And then, the shoe dropped. While SBI Cards handles the issue of having their partner GE sell out on them in India, Air India also went ahead and devalued by moving to a pseudo-revenue based accrual system (They intend to go revenue-based fully). The card features changed earlier this year, where they made it mandatory to spend at least INR 5 Lakhs on Air India (amongst a total spend of INR 10 Lakh per annum), to be able to get the Air India Gold Status.

They also made the earning of bonus points much more difficult, essentially devaluing the card to a large extent. I haven’t even use the card at all this year basically. Oh, and the status match option got killed. You of course know the rules where you could only transfer points in multiples of 5000 only.

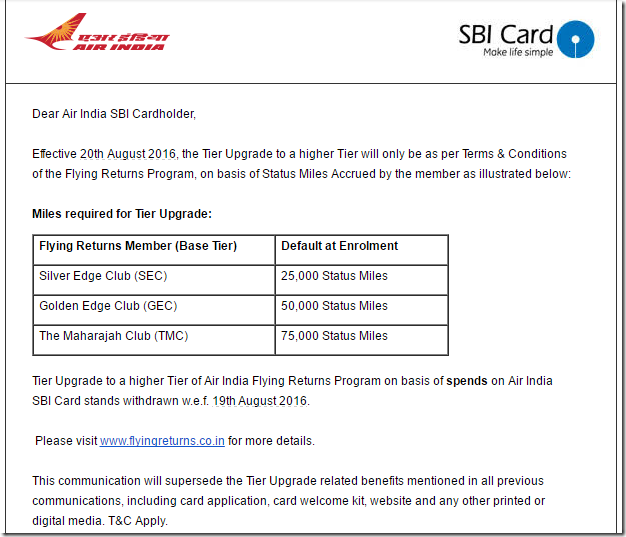

It turns out now, Air India and SBI Cards have joined forces to remove the last feature of this card which was any good. You basically can’t earn any status on the airline at all, even if you are a high spender on the card. SBI Card will be withdrawing this feature as of 20th August 2016, from when, you’ll only be able to earn status if you earn enough miles on the airline.

Here is the email that went out to Air India SBI Signature Card members.

So, if you are closing in on the requirements and would like to have the status, perhaps it is a good idea to move fast and make your spend count before 19 August 2016. Or else, I’d just ask for my fee back.

Personally, I haven’t put any of my money on this card and it has been sitting in my wallet unused all this year. I’m still wondering which other SBI Card even comes any close, so not moving my butt on getting it transitioned. But, now I guess I will.

This is another negative development for this card. How are you guys dealing with it?

Join over 5000 people who check-in daily to find out about the best in travel.

Free emails (once-a-day) | RSS Feeds | Facebook Updates | Twitter | Instagram

Which SBI Card do you recommend trading down to? I don’t see the point of continuting with this any longer. I will of course make sure that I transfer my points out to Air India miles before I lose them all!

Stay away from this card, or SBI Card in general IMO.

Had achieved annual spend of Rs 10+ Lac prior to their initial benefits policy revision on 11 April 2016; was accordingly promised by CC executive that AI Flying Returns account upgrade to Gold Tier would be honoured as spend had already accrued prior to policy change. Now 4 months and several conversations & escalations (upto CEO’s desk) later, the upgrade to Gold Tier isn’t being honoured.

Horrendous customer service; no comparison to Citi or Amex. Cancelling the relationship right away.

Ditto.. In fact I was even assured on email it was honored, but then recanted… CEO’s office is most clueless.. Quite apathetic service levels..

Getting a status was highly unlikely as it is due to the air india spends integrated into the milestones in the past round of changes. Was good while it lasted. Still value for scoring some easy tickets for non frequent travellers by hitting the 5l milestone plus the lounge access.

I already cancelled my AI signature card in May since it was up for renewal. The latest move makes that decision a no-brainer….

Ajay I am looking for a new card to move my payments to. I already have HDFC Diners rewards. Have you updated you excel which showed the cash value of various cards?

To be honest, the withdrawal of status feature based on spend does not impact me too much. I wasn’t planning to spend 5 lacs on Air India tickets anyways. I agree, its time to cancel this card.

Why dont you people try the SBI SIGNATURE CARD… The regular one. You could earn 50000 bonus RP on reaching 5lakh spends, which is in addition to the regular reward points that you can earn on this card. Additionally you get 2 Free BookMyShow vouchers every month without any T&C attached. I have earned 18000 rupees on this card this year and redeemed it for paying my card outstanding. You also earn 5x reward points on Dining, super market, grocery and International spends.

@Vinod, simply said,the card does not stack up to the original AI card. The card offers 50K points yes, but each point has a cash value of INR 0.25 and can only be transferred to Jet Airways, so not as attractive as I’d like my cards to be.

Thanks Ajay.

Unapologetic SBI may soon see too many cancellations on this card. It is no more worth a fraction of its original proposition. Will junk at time of renewal and shift to another SBI Card (any suggestions?) to avoid any credit score disturbances.