The Reserve Bank of India, India’s banking regulator, has made a surprise move to HDFC Bank, which is India’s largest private-sector bank, ordering them to stop sourcing new credit cards for the time being.

RBI orders temporary halt on HDFC Bank Sourcing new Credit Card Customers

In an order issued on December 2, 2020, the regulator has linked the move to incidents of outage in its digital banking platform over the past couple of years. The most recent outage was on November 21, which occurred due to a power failure at the bank’s primary data centre.

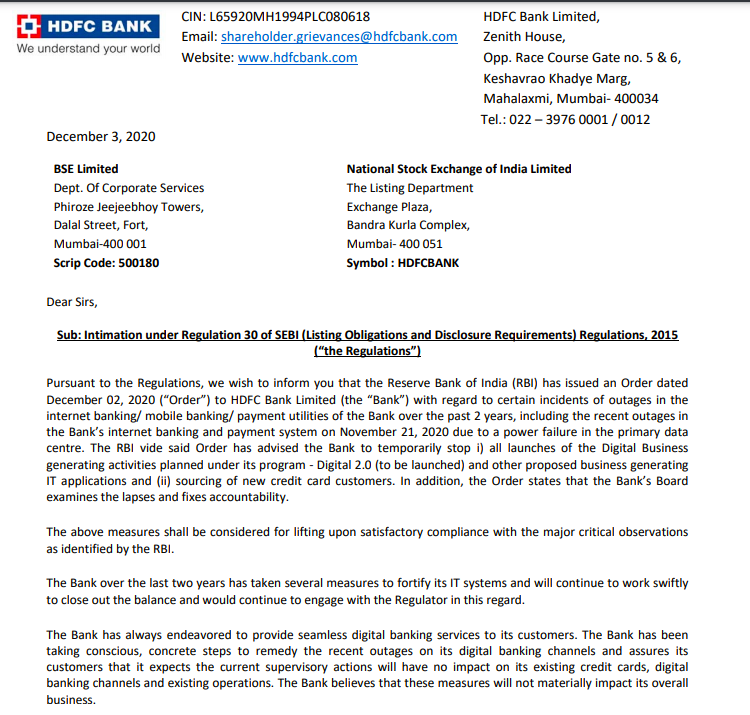

The Reserve Bank of India has advised the bank to stop the launch of all-new digital business generating activities under Digital 2.0 (a programme not yet rolled out by the bank), and also halt sourcing of new credit card customers till further review. Here is the filing by HDFC Bank this morning to the stock exchanges.

RBI wants HDFC Bank’s Board to examine the lapses, fix accountability and RBI will consider lifting their orders upon compliance with significant critical observations by RBI.

The Bank has apologised to the customers for the outage in a statement issued by the MD of HDFC Bank.

— HDFC Bank News (@HDFCBankNews) December 3, 2020

Impact

HDFC Bank states that this order will not have any impact on existing 14.9 million issued credit cards, so there is no reason for anyone with an existing HDFC Bank Credit Card to panic about their cards or points or anything. Everything continues as normal. However, as India’s largest credit card issuer, this might impact the plans of the Bank along with co-brand partner IndiGo, who were collectively sourcing cards for the Ka-Ching Credit Cards under a free offer, and, if this is not quick, might also impact the launch of the Emirates co-brand Diners Club Card that is in the works for the coming year.

Bottomline

HDFC Bank will not be able to acquire new credit card customers for the time being as per a new RBI order which instructs them to stop sourcing applications till further review.

What do you make of the new RBI order to HDFC Bank?

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

So much for their Digital 2.0, where Digital 1.0 means to download form from their website, print it, and send it to Chennai!!! No process to even swap Credit Card to another variant, asking to cancel and re-apply!! No transparency in any process or rewards. They can’t even write tnc’s properly without going U-turn and changing them just after going live for so many times.

They’re far behind any other issuer as far as anything digital is remotely concerned, and top it with an extraordinarily pathetic and non-existent customer service.

I agree with you completely.

Well done by the RBI to haul up these boffins. If they had pointed out their glaring deficiencies in customer care as well, that would have been a well-rounded notification.