The Indian Central Bank, the Reserve Bank of India, which is the overall regulator of all sorts of banking products in India, including Debit Card and Credit Card products, has notified a new set of orders which would affect the operations of MasterCard in India.

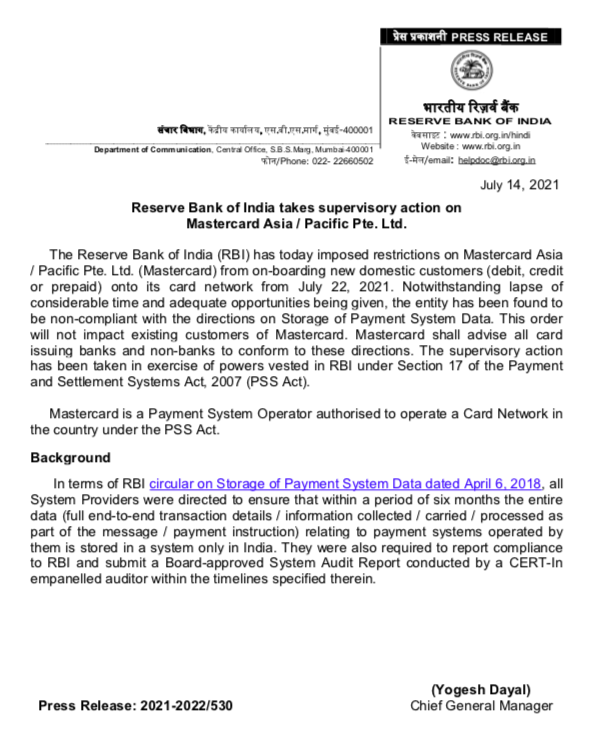

A new order to this effect was issued on July 14, 2021.

As you can read in the order, all Payment System Providers were notified to localise all their data in India. Now, MasterCard Asia Pacific Ltd, has been barred from issuing new debit/credit/prepaid cards in India from July 22, 2021, onwards. This move is exactly on the same lines as how action was earlier initiated against American Express and Diners Club networks in India earlier on, and only leaves card issuing banks with the option of Visa and RuPay for the time being.

Unfortunately, this will affect the business of many banks and financial institutions in India. Most banks tend to tie-up with just one network, unless you are massive like HDFC Bank and then you are partners with all of them. And with Amex and Diners Club, the catch was they were just credit card issuers, with MasterCard, it is a key player in the Indian Debit Card space as well. So while banks can take a timeout to issue credit cards with the other network (Visa, etc.), one won’t expect them to stop taking on banking business and issue ATM cards to these users. And Prepaid cards play a big role in the incentives economy.

Not just that, remember, HDFC Bank is still in the penalty box and barred from issuing cards to new customers.

MasterCard issued a statement in reaction to RBI’s directions. MasterCard said,

Mastercard is fully committed to our legal and regulatory obligations in the markets we operate in. Since the issuance of the RBI directive requiring on-soil storage of domestic payment transaction in 2018, we have provided consistent updates and reports regarding our activities and compliance with required stipulations.

While we are disappointed with the stance taken by the RBI in their communication dated July 14, we will continue to work with them to provide any additional details required to resolve their concerns.

What do you think of RBI’s new move to disallow MasterCard from issuing new cards in India?

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

Hi Ajay,

Just a small correction to the article,

SBI issues debit cards of various variants with either Rupay, Visa or MasterCard depending on the variant. I’ve also seen from my personal experience that an applicant can apply/request for a particular card network of choice.

Source : https://sbi.co.in/web/personal-banking/cards/debit-card

@Sai, thanks. Back in my days of banking with them, it was just MC. Will add appropriately.

Why do I feel like the regulator is clearing the playing field for Rupay? They better keep an alternative to Infinite/World Elite ready in that case!

Same here. Since Rupay is not equipped to compete, just ban the competition…

One would feel that way if they don’t understand why US and EU have implemented the data localization.

Agree on this. Canada has their own system called Interac.

Still everyone has to piggy bag on to Visa, MC or Discover, etc. network for international transactions.