Jet Airways and ICICI Bank have been issuing co-branded credit cards since 2012. Over this five year partnership, this has been a card that I have used very well, enough to request new plastic over a period of time. Here is a detailed review of the Jet Airways ICICI Credit Card.

The Card is issued in two variants, American Express and Visa, and is the top of the line variant of the Jet Airways ICICI Bank Credit Card Association.

Onboarding and renewal benefits

The credit card comes with a great proposition to start you off. In the first year, you get 10,000 JP Miles and a Jet Airways Economy Class domestic ticket code to get your relationship on this card started, on first swipe of the card.

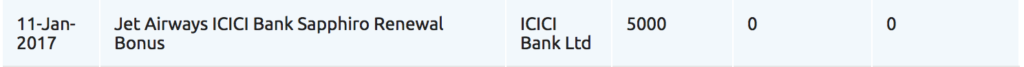

On renewing your card, you get 5,000 JPMiles credit to your JetPrivilege Account, and another Economy Class ticket.

Renewal JPMiles

JetPrivilege Benefits

Every time you want to book a Jet Airways ticket, you use the code JTICICI and get 5% off on the base fare of your ticket. You also get your JPMiles’ validity extended for two years.

Additionally, you get dedicated check-in even while you’re travelling economy (from Mumbai, Delhi, Chennai, Kolkata, Hyderabad and Bengaluru) and excess baggage allowance of 10 Kgs in Premiere and 5 Kgs in Economy (except for Deal/Light Fare Choices).

Spend Benefits

The Jet Airways ICICI Bank Credit Card comes in two variants like we mentioned before. The American Express variant has the following earning structure:

- Domestic Spends: 5 JPMiles/INR 100

- International Spends: 7 JPMiles/INR 100

- On JetAirways.com: 10 JPMiles/INR 100

The Visa variant accumulates at the following earning structure:

- Domestic Spends: 4 JPMiles/INR 100

- International Spends: 5 JPMiles/INR 100

- On JetAirways.com: 8 JPMiles/INR 100

When I applied for the card back in the day, I requested for both the variants to be issued. With Amex having the better mileage earnings structure, I am able to get miles when I want. However, if Amex is not accepted, there is the Visa variant as well. Both my cards share their credit line, so for the Bank, they don’t have a double down exposure on me.

You can accumulate a maximum of 60,000 JPMiles against your spends in each anniversary year. When this cap is reached, a JPMiles Uncapping Fee of ₹ 7,500 is levied to your Credit Card account. If you pay the fee, you get further miles. If you don’t, the customer care reverses the fee and stops the ability to earn miles for the rest of the year.

Lounge Access

ICICI Bank has recently partnered with DragonPass, which is another Lounge network similar to Priority Pass. Via this membership (worth USD 99) which is comped to the Jet Airways ICICI Bank Sapphiro Credit Card Members, one gets two lounge trips abroad and two spa visits in India free of cost per annum.

Here are all the airports in India where one can access spa using DragonPass:

- Delhi

- Ahmedabad

- Goa

- Lucknow

- Hyderabad

- Bangalore

- Mumbai

- Pune

- Raipur

With the Visa card being issued on the Signature Platform, one also gets two free lounge visits per quarter at the following airports: Delhi, Mumbai, Chennai, Bangalore & Hyderabad.

The Amex variant comes with unlimited visits to various lounges in India: Chennai, Kolkata, Mumbai, Ahmedabad, Pune, Goa, Delhi.

Amex had beautiful private lounges called Altitude in Mumbai and Delhi, but with airports moving around and these lounges not gaining scale, they shut them down in 2015.

Free Movie Tickets

ICICI Bank has had a long-standing deal with BookMyShow, where various cardholders get free tickets. In case you hold this card, you get to Buy one, Get one free ticket across India, with the ticket price capped at INR 400, which is pretty good in my experience. I manage to get free tickets every month using this card.

Annual Fees

The Fees for the first year is INR 5,000 plus applicable taxes, however, under the high-flyer offer, you get it for INR 2,500 plus taxes for the first year. You still get the 10,000 JPMiles and free base fare ticket as well. For the promotion, apply here. This promotion is valid only through December 31, 2017.

Remember, if you are JetPrivilege Platinum, you get to hold the card for free.

Value Assessment

As one of India’s biggest airline, Jet Airways’ ticket can be used very well if planned the right way. In various instances, I’ve used the ticket for a value of up to INR 8,000 as well. This recoups the value of the card fees for me. Additionally, the bonus miles accrue depending on your spend.

Overall Assessment

I’d think if you are Jet Airways’ regular, this card is a good card to have in your pocket to maximise your spends with the airline. The benefits on offer justify the price point. Even if you just looked at the startup miles, you get JPMiles at INR 0.25 per mile in this case, if you apply now.

Bottomline

The use case of this card is pointed towards those who want to deepen a relationship with Jet Airways/Jet Privilege and are willing to put money on the table in this regard. I may love the airline or hate them sometimes, but for me, they are the best full-service option out of Mumbai right now.

Have you taken on the Jet Airways ICICI Bank Sapphiro Credit Card? What has been your experience with the card?

Hi Ajay

I wanted to know how the JPMiles earned are credited to our JP account. As in, do we have to raise a request to redeem the JPMiles earned on these cards or they are automatically credited to our respective accounts?

@Ameya, they are automatically sweeped into your account.

Thanks a lot Ajay!

Just received an email from ICICI.

Fuel: 0 JPMiles per Rs. 100 spent

Insurance and Utilities: 1 JPMile per Rs. 100 spent

This shall replace the existing programme with effect from June 18, 2018.

Just used the Dragon pass for O2 spa at Delhi airport. The staff at the spa were absolutely clueless about this tie up and flatly refused to entertain me.

I had to call up Dragonpass who then conferenced in O2 head office and got it sorted.

What finally was honoured is a 20 minutes foot massage.

Much hype for pretty much nothing, I would say!

Hi Ajay what do you mean by ‘ 2 Cards for the Price of one’? Do you mean to say that if we apply for both Amex and Visa varients, we will be charged for only one or are you referring to free add on card for other family member?

@Vishal, both variants for one fee.

One more disadvantage I find with this card is the delay in crediting JP miles to your JetPrivilege account. It tat almost 30 days after the credit card bill gets generated.

Have held this card for over a year or so now. Never got communicated by the bank about tie up with dragon pass. Will definitely be trying the spa next week. Any idea which spa in the mumbai and delhi airport will accept this card?

Have u used the spa access? Also how is icici wealth management? They automatically upgrade u?

Just a query-

Which one you think is better between HDFC Signature and ICICI Saphhiro?

I am tempted with the dragon pass just a lil bit. But else HDFC seems better in every aspect (don’t care about movie as already have 2 Visa Signatures)

ICICI is better. One side benefit is that this card automatically makes you a ICICI Wealth customer. If you have other relationships with ICICI, like a savings account, you get a dedicated wealth management line instead of the usual low end customer care. Also, in Visa Signature movie tickets are capped at 250, whereas in ICICI it is 400/-.

For HDFC, I have the DCB, which is what I use more. I don’t use ICICI, since I don’t want the miles, but one free air ticket, BMS tickets, some miles and wealth management customer care are enough perks to offset the annual fees.

HDFC

+Less fee

+Priority pass

-No Points for wallet loading, Fuel and etc

ICICI

+Amazon Super Value Day, You can get Rs.600 cashback for Rs.3000 spend on every month