HDFC Bank had last year restructured the award redemptions for the HDFC Bank Club Miles and the HDFC Bank Regalia credit cards, where they limited the number of points you could use for only up to 70% of the cost of your travel redemptions. The rest 30% at the minimum had to be paid with the credit card. Now, this change is coming to the super-premium category with the Infinia & Diners Club Black credit cards.

However, a new rule is coming in effect on July 25, 2020. HDFC Bank has notified a change, that says that from here on, only 70% of the value of a ticket would be redeemable on points and that at least 30% of the value of the ticket would have to be paid for using the Infinia or Diners Club Black Credit Card itself. The new rule comes into effect on July 25, 2020. This information has also been sent out to members today.

For example, if you wanted to book a ticket for INR 5,000, as of now, you can redeem 5,000 points from your Infinia/DCB account and get the ticket issued. Come July 25, 2020, you would be only able to use 3,500 Reward Points out of your Infinia/DCB card account (equivalent for INR 3,500), and the rest would have to be paid using the card.

Convenience Fee to go up

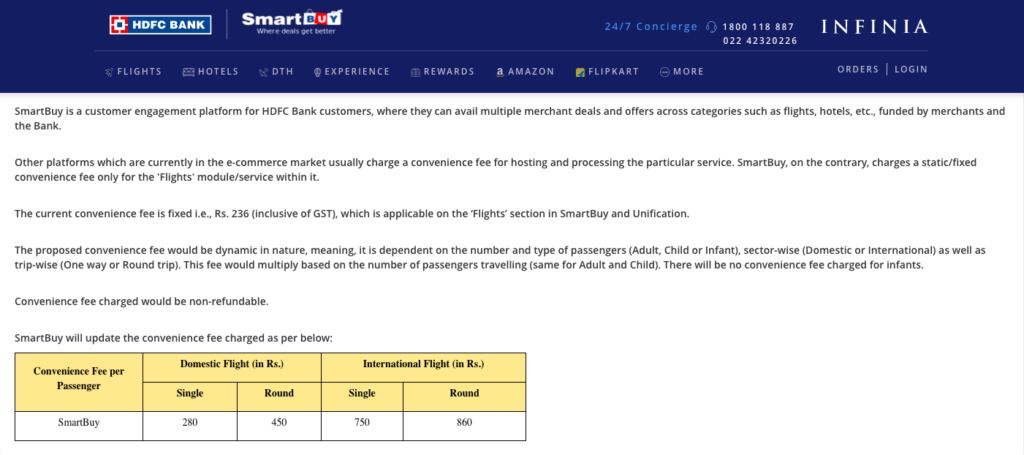

Till so far, HDFC Bank Smartbuy portal offered the unique ability to book tickets on the cheap because there was just a fixed convenience fee of INR 236, whether you book one-way or round-trip, and whether you book one-person or five on the same ticket. HDFC Bank will hike this fee up in the coming days. There is confirmation on the Infinia website, also on the Diners Club website, and Regalia website.

Like you can see, the new convenience fees will be:

Like you can see, the new convenience fees will be:

- Domestic Single: INR 280

- Domestic Round Trip: INR 450

- International Single: INR 750

- International Round Trip: INR 860

If you are a DCB or Infinia customer, how does this affect your usage strategy?

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. Even though the amount you enter has to be in INR, you may use an international card to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

Hey Ajay,

Hope you are doing well !

I know that my comment and query is being made on a post that is old and since then, a lot of changes have been made on this card.

I’m a longtime follower of LFAL and I have also used LFAL for receiving the AmEx MRCC using the link provided and that process has been very smooth and I had received it back in April of this year before the RBI sent it’s regulations.

Thanks a lot for that !

Regarding the Infinia card, I understand that the reward points can be transferred in a 1:1 ratio to various airline programs such as Club Vistara, KrisFlyer and InterMiles.

Are there any other airline / hotel partners where we can transfer these points to

these programs for HDFC ?

Also is there any fee that is charged by HDFC when we transfer the Reward Points to these loyalty programs ?

Like for example American Express, charges Rs 250 + GST to transfer MR points to a

loyalty program.

Also last year, I believe HDFC had made changes where we can redeem up to maximum of 70% on the travel bookings (Flights,Hotel and experiences) using Reward points and the balance amount would need to be paid via Credit card.

So in this scenario would double dipping still be possible and we can earn the points

after entering our frequent flyer number ?

Thanks in advance and keep up the good work Ajay !

I only collect points to convert into miles. If they touch that, the card will be surrendered without a second thought. Both Citi and now HDFC seem to be working towards driving people away.

Such a good card now will loose its customer as they are changing huge benefits they are decreasing from last 2 years now no use of having these cards go for Amex card or standard chartered ultimate card

Closing Infinia card and cancelling all travel cards till we see travel without quarantine drama. Its worthless to hold cards when they keep on reducing benefits and charging yearly fees and travel is very risky now.

I guess better to convert my 1.5 L points to krisflyer miles. Whats next, limit on number of points to be redeem in every month.

Unpredictable credit card. Every month something or the other is changing

1) Being a DCB holder with 2 Lakh + points.

First the devaluation news now this one… Never expected this.. Hope they bring the 100% redemption back post once things get better!

2) Ajay the ratio of points transfer from DCB to Avios,Vistara is still 1:1 right?

3) Will wait for few months.. If nothing seems coming back as before it will be best to take an Amex..