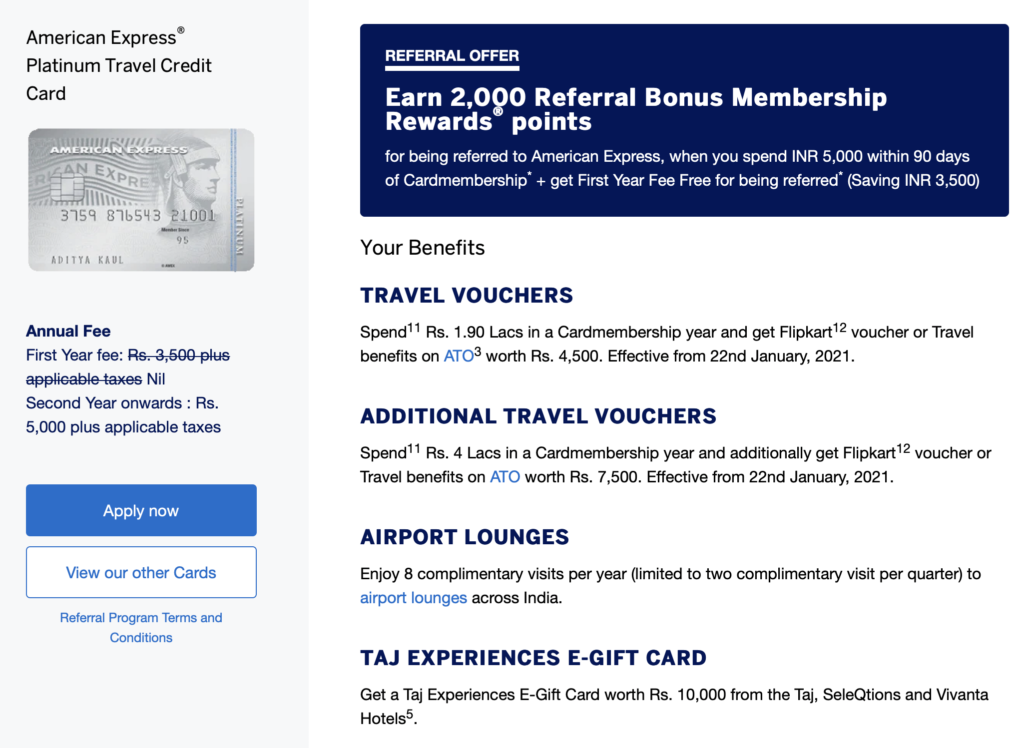

American Express Platinum Travel Credit Card

The American Express Platinum Travel Card is a one-of-a-kind product for those who like to redeem their rewards on travel. A mid-tier card offers many benefits for the price you pay for it. With a few exceptions, you earn Membership Rewards points for all your spending at 1 Membership Rewards Point for every INR 50 spent.

On top of that, you get bonus Membership Rewards points and travel vouchers during the year:

- 15,000 Membership Rewards bonus on spending INR 1,90,000 in a membership year

- 25,000 Membership Rewards bonus on spending INR 4,00,000 in a membership year (basically, a further INR 2,10,000)

- Taj Vouchers worth INR 10,000 on spending INR 4,00,000 in a Membership year

The Membership Rewards points earned can be used towards redeeming Taj Vouchers at INR 0.50 per MR, transferred to two hotel transfer partners or eight airline partners or even converted to Flipkart vouchers. So, on INR 4 Lakh spends, you get INR 34,000 worth of vouchers, which makes it an 8.5% return. You also get four complimentary visits to 11 lounges across India per annum.

Now, American Express is offering the card for the first year free for those who apply through this link. The best part is you also get 2,000 bonus Membership Rewards points on spending INR 5,000 within the first 90 days of getting the card accepted.

Get the American Express Platinum Travel Card for First Year Free,

along with 2,000 bonus Membership Rewards.

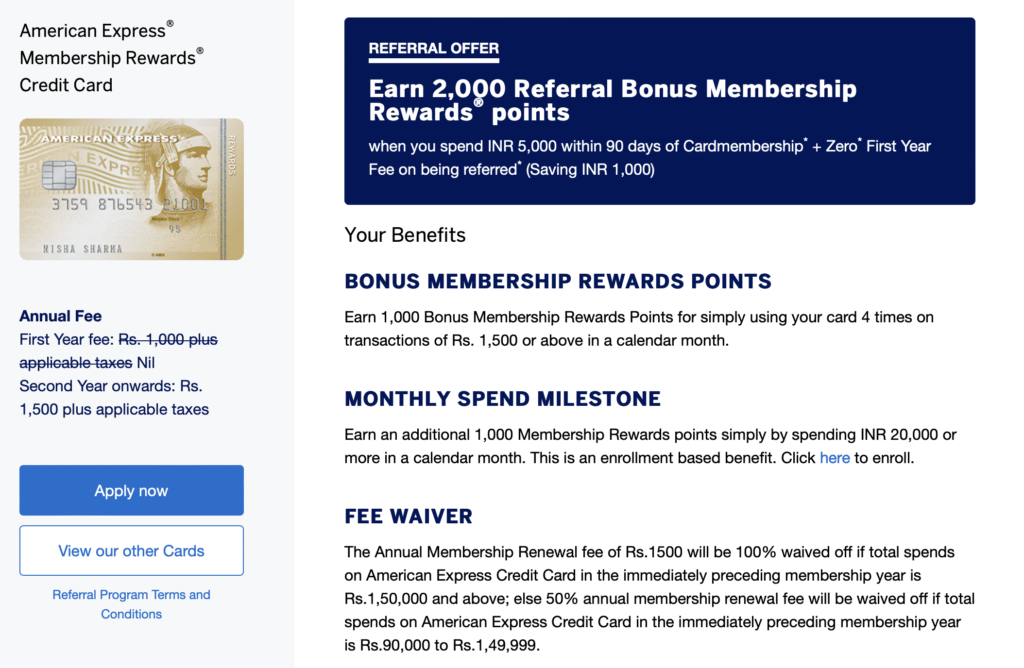

American Express Membership Rewards Credit Card India

This card is one of Amex’s entry-level cards, with a minimum annual income requirement of INR 4,50,000. If you already have another credit card, the chances of your application getting approved improve. Here is why you want this free Amex Card India.

On a typical day, on an average spend, you would get 1 Membership Rewards point for every INR 50 spent coming into your account. What makes this card worth considering is that you get 1000 bonus Membership Rewards points when you use your card for at least four swipes of a minimum of INR 1,500 in a month. That means you can earn up to 12,000 bonus Membership Rewards points in a year just for spending 72,000 rupees. Additionally, suppose you spend INR 20,000 per month on this card. In that case, you should also enrol for another promotion which gets you another 1,000 bonus Membership Rewards points (every calendar month, you are able to reach INR 20,000 spent on the card).

Get the American Express Membership Rewards Credit Card India for free.

The American Express Membership Rewards Credit Card India usually costs INR 1,000 + taxes for the first year, but American Express is currently waiving this fee when you apply here. Not just that, you get 2000 bonus Membership Rewards points when you spend INR 5,000 within the first 90 days of card membership. Additionally, your second-year fee is just INR 1,500 plus taxes, which is a reduced charge as compared to INR 4,500 plus taxes usually.

You need to be from the following cities:

- Agra [New]

- Ajmer [New]

- Allahabad [New]

- Ambala [New]

- Amritsar [New]

- Aurangabad [New]

- Ahmedabad

- Bangalore

- Bhopal

- Bhubaneshwar

- Chandigarh

- Chittoor [New]

- Chennai

- Coimbatore

- Cochin

- Cuttack

- Delhi/NCR

- Dehradun [New]

- Ernakulam

- Goa [New]

- Guntur [New]

- Guwahati [New]

- Hyderabad

- Indore

- Jaipur

- Jodhpur [New]

- Kanpur [New]

- Kolhapur [New]

- Kozhikode [New]

- Kurnool [New]

- Madurai [New]

- Meerut [New]

- Mumbai

- Pune

- Patiala [New]

- Raipur [New]

- Rajkot [New]

- Ranchi [New]

- Surat

- Thrissur [New]

- Trichy [New]

- Udaipur [New]

- Vadodara

- Vijayawada

- Vizag

- Ludhiana

- Lucknow

- Mysore

- Nagpur

- Nashik

- Trivandrum

Also, please remember, you can hold more than one Amex, so if you have any gaps in your credit card portfolio, you should look at plugging it now.

Ajay : Just to let you know – I tried applying for Amex Plat using your link above. I am getting the error that link has expired. Maybe worth checking it once.

@Rishi, this has been fixed. Thanks for letting me know. Please try again if you will.

Hi Ajay, I have applied for MRCC today :). I have been using Plat Charge and travel for four years…its 1 3rd card I applied for using your link. A little step for your articles and support to the community.

@Rags, thank you for your support. Enjoy the playing cards that come along, as well 🙂

I used your link and got dinged. This is the second time in a couple of years this has happened.

For some mysterious reason, Amex never issues me a card. Not even an entry level one.

My credit score is top notch, and I have used the Infinia and SBI Infinite, Axis Infinite, and Mastercard World Elite cards for years…

@SJ, it is between you and Amex; we have nothing to do with it because other people are getting their cards issued just fine

I ain’t blamin’ you at all! Just an update…

@SJ, Roger that!

Hi Ajay,

Worth calling out that only 50% of the bonus reward points at 190k and 400k milestones are auto-credited. We need to reach out to AMEX over call/chat support to credit the balance 50%.

Another (dare I say more egalitarian?) blogger would have acknowledged my comment before updating your blog post to fix the error I pointed out. Why has my comment not been posted at all? Because I pointed out a simple mistake? Its totally human to make a calculation mistake! But at least give some credit to your loyal readers or a simple thanks!

Guess that’s the difference between OMAAT and you.

@Wolf, guess you jump the gun too soon. While I won’t bother explaining myself about the timelines, I’ll be approving this one as well. I hope that makes the difference between others and me clear to you as well 🙂

Aye aye captain!

There’s still something unclear. Are the 1000 MR points a one time bonus or they keep giving you that every month you cross the 4X1,500 rs milestone?

It sounds too good to be true, and the literature is not very clear.

@Wolf, it has been clear to everyone who has been using the card for years now; else, why would we want to misrepresent it?

The 1000 bonus MR points one will get it monthly if we cross the 4 x 1.5k Rs milestone.

Also if in a month, we cross the 20k spending, we will get an additional 1000 bonus MR points.

So there is potential for getting 2000 bonus points in a month using this card.

There is no catch, it is exactly what you say it is..which is why it’s a fantastic card to have in the wallet.

Comparing LFAL to OMAAT is quite illogical. LFAL is more of an indian perspective to offers and information. OMAAT is not designed to deliver that indian perspective. So it can not be used in as is form like LFAL.

Are you sure your calculation is correct?

>That means you can earn up to 12,000 bonus Membership Rewards points in a year >just for spending 48,000 rupees.

Can you explain this better? Because as per my calculation, you have toswipe 4 times per month for Rs 1,500 each i.e. Rs 6,000 per month. That’s a spend of Rs 72,000 per year, not 48,000. And this should give you 1,000 bonus MR points for the whole year, NOT 1,000 bonus MR points every month. Correct me if I’m wrong.

@Wolf, The amount was an error and is fixed up now. And you are counting the points earned on the spending per se, while I am trying to say you will earn the following bonuses per month

– 4 txns of INR 1500 minimum per calendar month gets you a 1000 MR bonus

– spending INR 20000 in a calendar month gets you another 1000 MR bonus

Earlier the MRCC used to ask for a monthly swipe of 1000 x 4 to earn the monthly 1000 points. It later got revised to 1500 x 4 to earn the same points. Guess that’s where the error flowed from.

And yes, you get 1000 points every month, so it’s 12,000 points a year and if you amp up the monthly spend to 20,000rs, you get another 1000 points everyt month.

So total potential to earn on this card is 2000 points every month.

This is not at clear from their advertisement however. Did you get this verified by Amex?

Hi @Ajay,

The referral landing page does not talk about the milestone reward points, but only Flipkart or ATO vouchers. Could you please clarify?

@Mahadevan TS, refer to original product page. https://www.americanexpress.com/in/credit-cards/platinum-travel-credit-card/

Someone at work told me that the 15Lac ITR LTF was still running on this card so I called the CC and they said it is still running. When the agent came he said no such thing is running and you will have to pay 1500 p.a. instead which is the new offer running.

This is very lax of AMEX that their own agents dont know which offer is running or not.

When I had the YES Bank AMEX card they charged me twice for the same card “Joining+ Annual”, seems same weird logics are again coming on.

Hi, I just got this card based on your suggestion. I also have the HDFC Bank Regalia CC. Any suggestions on which one I should use where ?

Is there any way to avail the amex travel credit card for free for lifetime?

Which premium card to buy ? Thinking of HDFC diners black & Citi Prestige. I travel a lot & pay for Hotels. Airfare is paid by company. I got the Amex membership reward card life time free recently so do not wish to dump it now for Amex travel mentioned here . Also wanted to know whether on Amex Jet Platinum is the lounge access available in Delhi still ?

Would suggest the Amex Plat Reserve. While earnings are similar to the MR cars, you do get the advantage of status with the Taj, and one night free at a Taj hotel.

One night free is not part of the Taj Epicure plan that comes with Amex Plat reserve

Correct! However the discounts can be availed on f&b which is a good 25%

Eligibility criteria for MRCC is Rs. 6 lakhs annual income and not Rs. 4.50 lakhs according to Amex website.

I recently got Amex membership card in Hyderabad. As my salary was higher then 15 lakh per year, my renewal will be also free of cost. Let see in future, how this card would give me good rewards against the usage.

Got as LTF in TIRUPUR city

Hi Pradeep, can you please share how you got this card in Tirupur. I live is a third tier city and on contacting AMEX they said they do not serve this area yet and will inform whenever the services are available there.

Applied for card and i was said, they are not able to issue due to internal reasons. Next month i got call from them saying I’m approved for new gold credit card.

i rejected everyday for 6 days, then they offered it as LTF. i went for it, next day document collected, on 5th day i got the card.

it was good for me in 2ways,

1. LTF

2. Entry into Amex.

@Ajay/Shipra,

This is highly appreciated and I did manage to get the MR card through your link. Though I think you should also mention that AMEX will waive of 50% of the fee for second year on the MR card if the spend in previous year crosses 90k, but is below 150k.

Can someone please help me understand the execution of the line “Spend Rs. 1.90 Lacs in a year and get Travel Vouchers worth more than Rs. 7,700.”. The Amex travel vouchers available on the Amex rewards portal shows 5000 INR voucher against 12500 points, and spending 1.90 lacks gives 7500+3400=10900 points only.

The Amex Platinum Travel Card is something different. when you spend 1.9 Lakhs, u will get milestone points which when redeemed for travel vouchers it will be 6,000 INR/- . when u spend 4,00,000 INR , u will get another milestone points whose value when redeemed for travel voucher will be for 10,000 rupees. if u redeem these milestone points for catalogue rewards it will be 1 point = 0.5 INR / – . These Milestone points which u will get when you complete transactions are in addition to usual points which u will earn at 1 point for 50 INR /-

Ajay, I also think you should do a series on Credit Cards in India for first time users giving a basic idea of how to use them efficiently for regular use like Online Shopping, Domestic Travel and Fine Dinning. This will be a different audience who may not go for Luxury Travel (Business Class, Lounges, Star Hotels). Your review will be more authentic than some others online stuff as it comes from your vast experience in cards and miles.

You should do a series explaining how credit cards work in india. In the usa we are 100% protected against fraudulent charges. Most of my Indian friends parents don’t get credit cards because they are afraid of fraud. That’s what they told me. You can show why people should not worry and what protections they can use. This will help you sell more credit cards.