British Airways is one of my preferred carriers from a very functional perspective. I travel with them often enough to value their network and connectivity across the western hemisphere for me, and the fact that oneworld has some great carriers helps me with the decision to stick to Avios as my primary currency for oneworld. It also helps that British Airways allows for a lot of redemption options with partner carriers online, so you don’t have to call them for much. The surcharges suck, but what the heck.

British Airways First Class Boeing 787-9

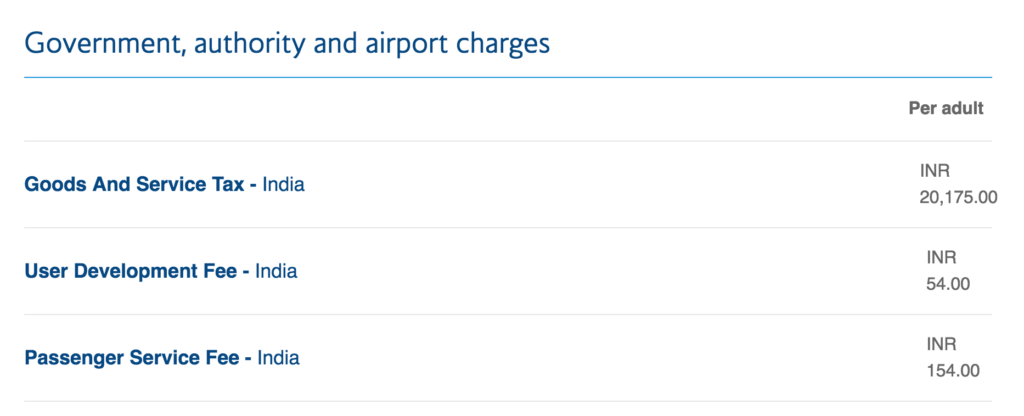

However, it seems British Airways’ IT systems are not keeping up with the latest taxation rules in India. Last year, India switched to applying Goods & Services Tax. For airlines operating out of India, the following tax applies on tickets:

- 5% of the fare on Economy Tickets

- 12% for all other fare classes, including Business Class, First Class and Premium Economy.

British Airways overcharging GST on Award Tickets for Partner Airlines

Now, the last time I ended up booking an Avios redemption for myself was before the new system kicked in. A few weeks ago, I was helping someone book a ticket on Avios for a partner carrier, where I noticed that there was a discrepancy with the pricing. In the sense the price was high, and I figured it was one more surcharge from British Airways. The schedule did not work, so we did not proceed with the booking, and the discussion went away.

Except till now, when I was trying to book a ticket for my self. British Airways had some availability on CX I was waiting to book as I could find some seats. So I went ahead to process the ticket when I found some availability, but the quote of money left me dumbfounded again.

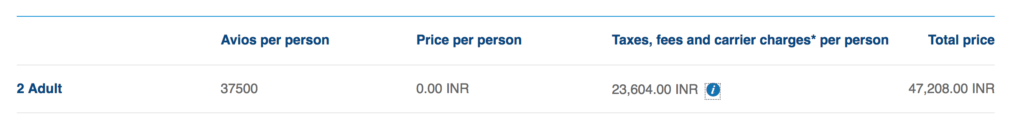

Here is a Mumbai to Hong Kong quote in Business Class for a redemption ticket. That INR 23,600 amount per head got me curious to click the button to know more. That is the price an economy ticket was available after all for the day, so I could actually buy a revenue ticket for this 4.5-hour ride as well rather than head out in J Class.

It turned out, British Airways wants to charge 37,500 Avios plus INR 17,500 taxes plus about INR 6100 as surcharges for one J class ticket. That makes a total of 37,500 Avios plus INR 23,600 as money.

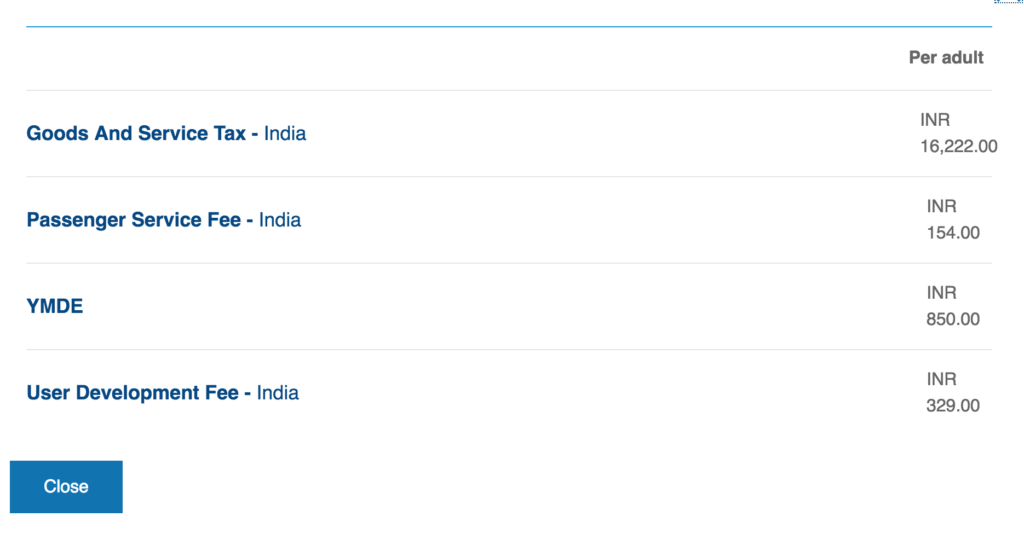

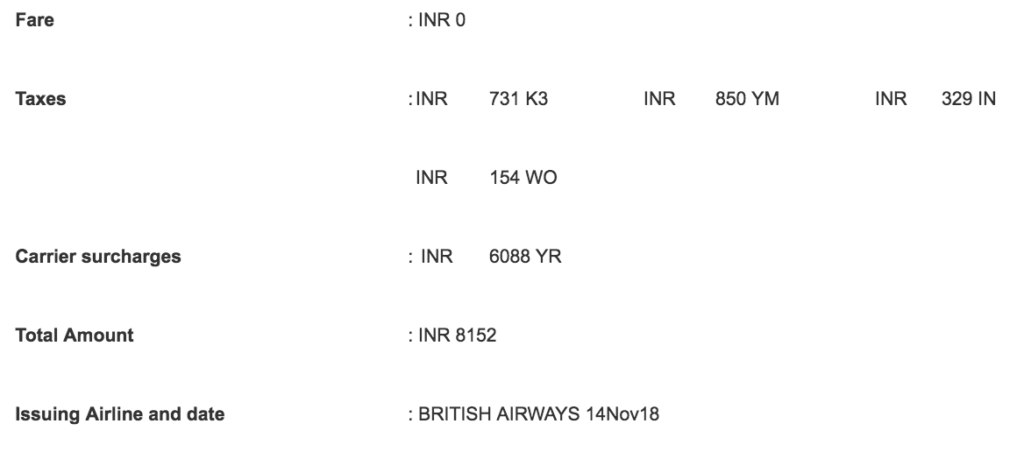

At first, I did not think much about it, just like the last time, until I realised the GST amount charged on this ticket looked entirely out of whack. See, British Airways is zeroing the fare in this case, and the 16,222 INR amount then looked like it was charging a GST on a full fare ticket. Sure enough, replication on the Cathay Pacific website confirmed my notion. The amounts almost matched. Here is how much BA wanted for a one person one-way from India. The carrier Surcharges match.

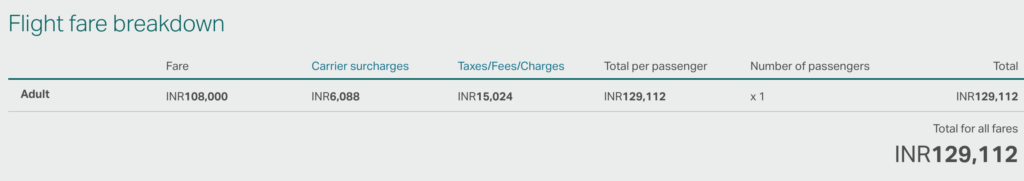

But given the fare was 0 in this case and I was paying with miles Avios, the cash component was supposed to be zero in this case. This is indeed not me asking for special treatment; this is how everyone indeed treats redemption tickets. For instance, a Jet Airways ticket on the same route in Business Class has only 27 Rupees as GST.

Having figured out something was wrong, I decided not to ticket this ticket online. Calling British Airways, however, got me the desired results. At first BA Executive Club, the Gold Line could not ‘find’ the desired tickets. When I told them it was available online, they ‘refreshed’ and availability was there in 30 seconds. They asked me why I was not booking online if I could see the seats open, and I told them I was finding the GST too high somehow.

Having figured out something was wrong, I decided not to ticket this ticket online. Calling British Airways, however, got me the desired results. At first BA Executive Club, the Gold Line could not ‘find’ the desired tickets. When I told them it was available online, they ‘refreshed’ and availability was there in 30 seconds. They asked me why I was not booking online if I could see the seats open, and I told them I was finding the GST too high somehow.

Luckily the agent was competent and seemed to have known of the issue because she put me on hold without contesting me for a minute, and manually computed the taxes to come back with a more reasonable approximately INR 8,100 per passenger to me. Out of this, INR 6,100 is anyways the carrier surcharge, and the rest of it is a small amount towards taxes and other stuff.

While it did take about 20 minutes to ticket this reservation, including multiple rounds of validation manually, it eventually worked out, and I got this in the mail a while later.

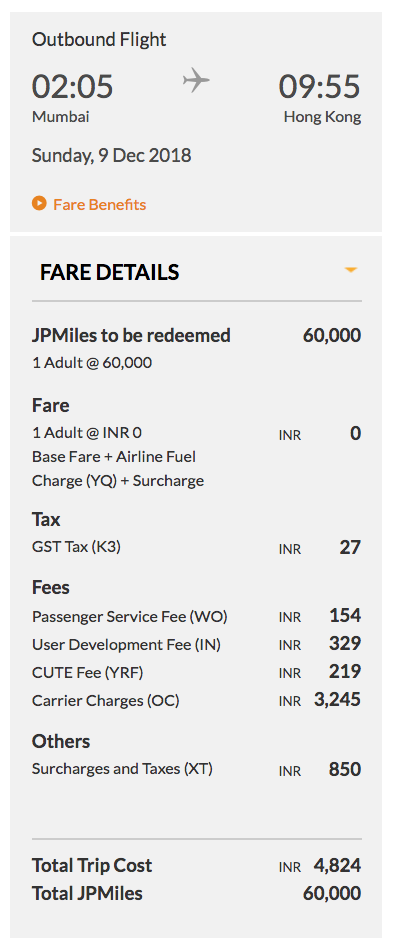

Mission Accomplished. The bottom line is, British Airways has a bug in their IT somewhere which is erroneously pricing full fare taxes for Zero fare tickets. This issue is not specific to Cathay Pacific but other partners too. Here is a JAL ticket for next year, which has INR 20K as GST, which is wrong again.

Bottomline

While reward tickets are a great idea, it is almost the best of ideas; you should always be careful of the amount you are paying to make sure you are getting the right tickets and the most value for your miles. I know of at least ten people who have complained to me within the past week who say miles are worthless because they don’t book them right. I’d highly recommend using the services of an award booker, such as our own to research and book your award tickets if you are not sure of what you are doing yourself.

Have you noticed any issues with the GST being charged by British Airways award travel where flights originate out of India? I’m wondering if the Government of India is happy with all this extra revenue they are getting from BA?

This issue still exists! I’m looking at Bangalore – Kuala Lumpur on BA awards and it lists 22k Avios for Biz but $162 USD for GST lol!

very much helpful info, God bless you!

I was so disappointed to see the high taxes out of India awards on avios, thanks again!!

Dear Ajay,

I paid taxes of Rs 36052 using AVIOS for JFK-LHR-BOM on BA First for travel in June 19. Now when I checked again for the same dates,the taxes are Rs19870 for the same sector.

When I contacted BA Executive, I was told that “depending on the booking class the taxes are calculated..”( Which may not be true as it is an Avios booking- so the booking class has to be the same ,unlike a revenue booking). The BA agent could not help. What is the solution..??

I saw a BOM-ORD oneway redemption in Y on BA for 29250 Avios+£227. Seems to be too high, could this also be due to the tax goof up?

Ajay – Thanks for this info. As a frequent flyer of oneworld alliance, this is quite helpful as i was planning on using my avios. Glad you cover extensively on Oneworld and Indian airlines.

There was a 3X miles offer from Emirates when you book a flight from India to US, which i luckily ended up seeing on last day and utilized it. It will be helpful, if you can include Emirates related info too, for the readers.

P.S. I visit your every site every day! Thanks for all you do!

@Kartheek, thanks for your comments. We do keep Emirates in our coverage. This time it was just a judgement call not to put out the deal given paucity of time.

I noticed this after the GST system kicked in as well. I also thought this is more fees and indirect devaluation of sorts of Avios. Didn’t dig deep and went ahead with revenue tickets.

Hope they fix it unlike Hilton who took a good 8 months to fix their broken GST calculation system.

@Amex Guy what was the case at Amex. I am not sure. Tell me more!

You mean at Hilton?

They were calculating GST on every room at 28%, even when room cost was way below 7500. It was not even a uniform error. For example, Hilton Garden Inn in Lucknow was applying it fine, but no Hilton in Bangalore was. But more often than not, they applied it all at 28% even though the website had a box explaining the GST tiers.

Escalated it several times, took them a long time to fix. Usually in that period, I had to call in to book, they would put me on hold and talk to hotel, and then confirm on the correct GST.

@Amex Guy, I won’t be worried about what they show on the website actually. What they do on the front office on the ground is what counts. So always check your invoice 🙂