[Update: Read about Axis Bank’s changes to the Magnus Credit Card effective September 1, 2023]

Axis Bank launched a slew of upgrades to its credit card portfolio, and one of the best additions to the portfolio from that list was the Magnus Credit Card, which was launched in 2019. Unfortunately for the bank, just like many of their peers, they could not cash out on the potential of this launch with Covid hitting us in 2020, and the world saw a shutdown.

However, as Covid-19 ebbed, Axis Bank renewed its focus on this credit card and made it even sharper to appeal to the affluent/HNI category. I signed up for the card last year, and in this post, I wanted to shed some light on the finer details of the card and my experience with it.

One of the first things to note about the card is the metallic form factor, which is more akin to the Amex Platinum than the other metallic cards in India. The card feels solid in your hand and is a conversation starter. Also, no risk of the digits erasing over time since they are etched on the metal. The card used to be issued on the MasterCard platform but is now issued as a Visa Infinite Credit Card.

Axis Bank Magnus Credit Card Overview

Axis Bank’s Magnus Credit Card targets affluent/HNI customers. The card was curated to offer lifestyle benefits across travel, dining, movies and wellness to those who sign up for it. In 2022, Axis Bank added a new kicker to the card, offering 25,000 bonus EDGE Rewards points to those who spent INR 100K (INR 1 Lakh) on their card in a calendar month. Then, they added transfer partners as well. The overall combination made it one of the best cards for putting your spending on in India.

Axis Bank Magnus Credit Card Eligibility and Application

The Axis Bank Magnus Credit Card can be applied online/offline. Eligibility for the card is at an annual income level of INR 18 Lakh, both for salaried and self-employed folks. You can also apply for it on a card-to-card basis, providing another credit card statement where the minimum approved limit on your card is INR 5 Lakhs. The card is available to customers already holding a Banking Relationship with Axis Bank and those new to the Bank. To get started on your application, Apply Here.

On completion of INR 15 Lakhs spending during a membership year, the fee is waived for the following membership year.

Axis Bank Magnus Credit Card Joining and Annual Benefits

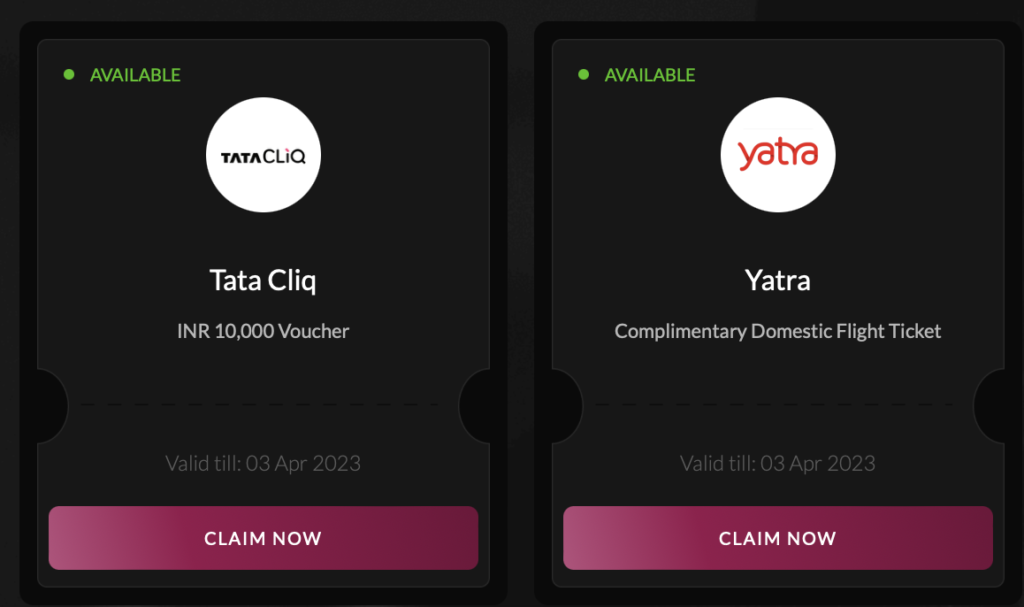

The Axis Bank Magnus Credit Card comes at a joining/renewal fee of INR 10,000 + GST (net INR 11,860). In exchange, the Bank provides the option between one complimentary domestic flight ticket with a value of up to INR 10,000 (including taxes) or a TataCLIQ voucher worth INR 10,000. The link to redeem is sent to you after your first transaction is registered on the card in every membership year cycle. You can claim your benefit up to 6 months after you receive the text message.

The TataCLIQ voucher converts into TataCLIQ cash, is valid for one year and sits in your account after you add it there. For your free ticket, you get one for Economy or Premium Economy, and you need to make the booking on Yatra.com. The ticket can be any amount, but the balance must be charged to your card for tickets more than INR 10,000.

Axis Bank Magnus Credit Card points earning

Magnus provides 12 EDGE Rewards/INR 200 spent on the card. Like everything else on Axis Bank Credit Cards, the spends are rounded down to the nearest INR 200, and you will be credited reward points for that. For instance, if you spend INR 1448, the points credited will be 84 EDGE Rewards. These points are usually credited as soon as the transaction settles or within a day or two. You can check the number of points earned using your customer ID with the bank here.

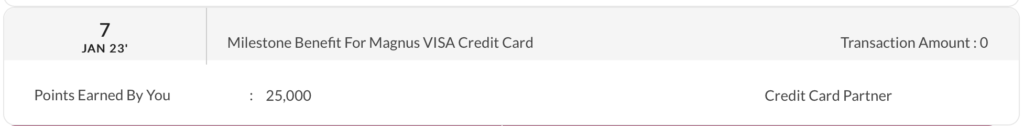

However, if you make INR 1,00,000 spend in a calendar month, Axis Bank also provides you with 25,000 bonus points (EDGE Rewards), which are credited to your account usually within 90 days of the closure of the month for which the spend was achieved. For instance, I made the first whole month of spending in October 2022, and the points arrived like clockwork in January 2023. Points for November 2022 also were credited in February 2023.

The 25,000 points monthly bonus is not a promotion but a full benefit of the card. The only spends that do not count for this benefit are wallet loads, and in the coming days, rent paid via credit card will also not count. Many people have an issue with the 90 days timeline. However, the bank is within its right to dictate the timelines for such a generous benefit. They might want to account for fraudulent practitioners doing all kinds of stuff to generate spending.

Apart from this, Axis Bank has a few other kickers in store as well where you can earn bonus points on your Magnus Credit Card:

- When you book travel from the Axis Bank TravelEDGE portal, you get 5X points for your travel spends. The base points post as the transaction settles, and the 4X Bonus points also get in quickly (it does not take 90 days).

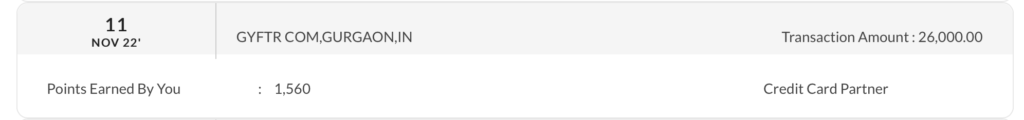

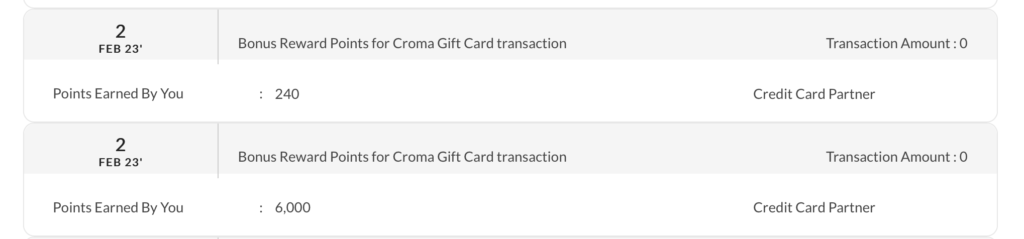

- When you buy vouchers using the GiftEDGE website, you get points as per the points advised at the time of purchase. Gyftr powers GiftEDGE, and you can buy over 100 kinds of Gift Vouchers there. The 1X points arrive per the usual settlement cycle, and the remaining points arrive within 90 days of the transaction posting. This is an area for improvement for Axis Bank, as the other card issuers running Gyftr white-labelled portals have their bonus points posted immediately. For instance, I had to gift something to a close family friend on his wedding, but we were not sure what exactly he would like since there was no registry, so we got him gift vouchers from Croma. The 1X points were posted quickly, and the rest were posted much later, as you can see below.

- You can also buy using the GrabDeals website, a white-labelled website offering all the deals and discounts on online purchases from Axis Bank. The bonus points earned from GrabDeals are limited to 10,000 per month. One of the sub-sections of this website offers vouchers as well from a different vendor called WooHoo. GrabDeals has some fantastic deals going on at times. For example, at the end of January 2023, they had 40X EDGE Rewards on offer for Marks & Spencers.

Remember, EDGE Rewards expire three years after accrual if not redeemed or transferred out.

Axis Bank Magnus Credit Card points burning

You can use your Axis Bank Magnus Credit Card EDGE Rewards towards many different use cases. The most basic one, offered for a long time, was to use them at a value of INR 0.20 per EDGE Rewards point. But I also mentioned that Axis Bank added transfer partners recently, and here is a list of the 19 transfer partners along with the transfer ratios:

- Independent

- AirAsia Rewards: 5 EDGE Rewards transfer to 4 AirAsia Rewards

- Club Vistara: 5 EDGE Rewards transfer to 4 Club Vistara Points

- Etihad Guest: 5 EDGE Rewards transfer to 4 Etihad Guest Miles

- SpiceClub: 5 EDGE Rewards transfer to 4 SpiceClub Points

- Star Alliance

- Ethiopian Airlines ShebaMiles: 5 EDGE Rewards transfer to 4 ShebaMiles

- Singapore Airlines KrisFlyer: 5 EDGE Rewards transfer to 4 KrisFlyer Miles

- United Mileage Plus: 5 EDGE Rewards transfer to 4 MileagePlus Miles

- Turkish Airlines Miles & Smiles: 5 EDGE Rewards transfer to 4 Miles & Smiles Miles

- Air Canada’s Aeroplan: 5 EDGE Rewards transfer to 4 Miles

- Thai Airways Royal Orchid Plus: 5 EDGE Rewards transfer to 4 Miles

- oneworld Alliance

- Qatar Airways: 5 EDGE Rewards transfer to 4 Avios

- Japan Airlines JAL Mileage Bank: 5 EDGE Rewards transfer to 4 Miles

- Qantas Frequent Flyer: 5 EDGE Rewards transfer to 4 Miles

- SkyTeam Alliance

- AirFrance KLM Flying Blue: 5 EDGE Rewards transfer to 4 FlyingBlue Miles

- Hotel Networks

- IHG One Rewards: 5 EDGE Rewards transfer to 4 IHG One Rewards

- Club ITC: 5 EDGE Rewards transfer to 4 ClubITC points

- Marriott Bonvoy: 5 EDGE Rewards transfer to 4 Marriott Bonvoy Points

- Accor ALL: 5 EDGE Rewards transfer to 4 ALL Points

- Wyndham Rewards: 5 EDGE Rewards transfer to 4 Wyndham Rewards Points

As you can see, Axis Bank has covered all alliances, domestic carriers and international hotel chains with a pretty lucrative transfer ratio, which makes it possible for Magnus to keep happy those who like to use miles and points to make their life comfortable as well. 5 of these programmes have an instant transfer. At the same time, the rest could take up to 10 working days for transfer.

Axis Bank Magnus Credit Card Travel Benefits

While the Axis Bank Magnus Credit Card intends to have you spend across the board, the niche it really specialises in is Travel. The Bank provides the primary and add-on card holders with unlimited lounge access on swiping the card across India. Not just that, the card comes with an unlimited-use Priority Pass in the box, which you can use for lounge access outside of India. On this Priority Pass, you also get free visits for eight guests in a membership year. This means you can have a +1 join you at the lounge eight times a year or have eight friends join you once a year.

Apart from these two benefits, Axis Bank also offers eight complimentary meet-and-greet services across Indian airports in a calendar year. You can use this Meet and Greet Service for Arrival or Departure at 29 Indian airports. The service needs to be booked at least 48 hours before departure online. You can also bring co-passengers, although you need to declare it upfront, and it gets deducted from your quota of 8 services per annum.

Delhi Meet-and-Greet by Encalm Hospitality

I recommend that you book the Meet and Greet a day or two before the final closure of the timeline because placing your request too far also means it goes very low on the priority of Aspire Lifestyle. These folks run the concierge service for Axis Bank. They confirm the service usually on the day of travel or, at best, one day prior. In a recent case, when I was flying out from Delhi Airport in December 2022, I’d placed a request about 15 days earlier, and I did not get a message confirming the service until 5 hours before departure. At this point, I had to call them, and they missed the request, though they did not admit to it.

Other lifestyle benefits offered by Magnus

Some other benefits offered on the Magnus Credit Card are in the entertainment and wellness category. In partnership with Bookmyshow, Magnus cardmembers are offered 5 Buy-One-Get-One-Free tickets every month on their card for both movies and non-movies categories, up to a limit of INR 500 for the free ticket. Axis Bank also tied up with EazyDiner, where you can get up to 40% discount on your meals twice a month and up to 3000 off once a year on your meals.

Exclusions

Fuel pump spends are not granted reward points on the Magnus. However, they are instead given a 1% rebate on the fuel surcharge. They still count for the milestone spending monthly and annually as well. Further, Insurance spends are capped at INR 100K for granting points for now per transaction. Rent transactions have been excluded from milestone coverage effective March 5, 2023. Forex Charges are at 2%+GST, which is lower than some of the other players in the market.

Bottomline

Overall, the Axis Bank Magnus Credit Card, with its very lucrative rewards structure, is an excellent card for those who routinely spend over INR 100,000 in a billing cycle. The card comes with INR 10,000 worth of annual vouchers, which recoup the cost of the card every year. In addition, you get 12 EDGE Rewards/INR 200 spent, apart from the potential of earning 300K Bonus points just by spending INR 12 Lakhs on the card in a year (INR 100K per month gets you 25K Bonus points). Add that up with the handsome list of transfer partners, and you have a card grabbing all the right eyeballs these days. You also get an unlimited use Priority Pass, domestic lounge trips and meet and greet services.

Do you already hold the Axis Bank Magnus Credit Card? What has been your experience with the card?

Apply Here for the Axis Bank Magnus Credit Card

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

One question. Can I book Indigo flight using the Magnus reward points? I dont see a mention of Indigo but they mentioned Vistara, Air Asia etc.

In my experience , axis is not completely crediting Points for transactions done on grabdeals partners though i have abided by the TnC..i got the Zomato ones but not of jack &Jones and M&S ones ! No idea how to pursue and what to do !

Hi Ajay, Great article as always. Just one question? Is there a daily or monthly cap on reward points on insurance spending? Thanks in advance.

Just experienced the fact that Axis, unlike other banks, levies forex charges (2% in case of Magnus) on foreign currency refunds which have been initiated by the customer (eg. refunds on cancellation of international tickets, other purchases etc.).

Hi Ajay

Axis CS told me today that Fuel expenses will not be considered for milestone benefit for Rs.100,000. I am a little confused after reading your piece. Is this another poor Customer Service from Axis Bank.

@Subrata, here is the latest update from Axis Bank, which clearly denies the point that you were told. https://www.axisbank.com/docs/default-source/default-document-library/25k-edge-rewards-tnc.pdf

@Ajay

Go to https://grabdeals.axisbank.com/home. After that,

“Our Partners” tab has 10000 ER limitation which can be earned

“Our Partners -> “Gift Edge” tab also has 10000 ER limitation which can be earned

“instant Voucher” has no limitation on ER which can be earned

“Travel Edge” has no limitation on ER which can be earned

Is that correct understanding?

Hi Ajay, thanks for the detailed post. What do you think of infinia vs magnus?

Regards,

Tanmay

Ajay.. I got the card today. If I spend Rs 1L before 30 th April then am I eligible to get 25000 points for April ?

@Krishnakumar, they changed the T&C recently to give you the points even for spends in month of issuance. So you should get it.

Good article. But I feel your thumbs up to the card is a bit measured, but I would hasten to add, in your usual style. I think it deserves a much stronger recommendation, given the high reward rates with the monthly bonus, grab deals, gyftr and travel edge combined. Just a small correction. Insurance points are still accruing. I made a payment towards general insurance and have already received the points. The per transaction cap of 6000ERs continue, I think. The Mar’23 exclusion of insurance were not applicable to Magnus.

I applied for Vistara Infinite and was approved in December 2023. If I apply for Magnus now, will the short period have any bearing on my approval chances or on my credit score?

Card approved in Dec 2023? Are you a time traveler? How are things in the future? 😉

Wanted to confirm that insurance payments will continue to count against the milestone benefit of 25K / month post March’23 onwards.

Is any of the transfer partners disproportionately beneficial? Since I use miles rarely, it’s quite hard to determine the value.with in india travelling.

Thanks for the write up Ajay. Just applied for this card through the link post here. I had applied for Axis Vistara card last December based on your recommendation and already qualify for the fee waiver for first year. Just wondering, which card to retain (or does it make sense to retain both) in the following year? I am a SQ Gold for the next couple of years at least.

Also curious what kind of spends should one continue to do on Citi Prestige? Forex spends probably given the 2x rewards? Any tips/advice would be greatly appreciated.

Thank you once again.

@Manish, Axis seems to be out to impress under new CC leadership, which is making all these aggressive moves compared to a few years ago. So let’s visit this question a year later. On Prestige, I put my forex spends nowadays, but no more.

Thanks for the lovely article on the details for Magnus Card. I have two questions:

1. Is this better than the Citibank Prestige card in terms of the benefits (Seems like this is 10000 rupees lesser)

2. Are there any credit cards remaining where we get points by paying insurance premiums. Since Magnus card also stops it from March 2023

Thanks

B

SC ultimate gives rewards on all spends incl, including Insurance, fuel, wallet load etc. service is not great, but I didn’t face any issues reaching out to service in the last one year.

this has changed since April 23. no points on fuel. insurance, govt related utilities including NPS etc, educational institutions and even supermarkets will now earn only 3 points per INR 150/-

@Bhas V, Insurance spends on Infinia has a limit of 5K points per day @ 5 Points/INR 150 spent

Considering I spend Rs 1 lac in a month.

So will I get 25000 + 6000 points which can be transfered to many airlines @ 5:4 so number or air miles will be 24,800.

Please clarify.

@Sid, yes you are correct on that. However, your 6K will come instantly, and the 25K will come after 60 days or so, unless Axis changes their timeline to post them earlier. Hope this helps.

Spends on electricity bills issued by the corporations belonging to the state govts eligible for reward points?

Such worse card it was they promised 25000 points for 1 lakh spend I’m spending from two months nothing got benefitted to me only very few points don’t waste ur yearly charges with this shitty service

@Pradeep, if you read the T&C, it would also tell you the points come in 90 days, not immediately. So wait a few more days to start seeing your points.

@Ajay – great article as always. I hold Magnus since Mar 22 and had a small question. If I qualify for renewal fee waiver on spending Rs. 15 lakhs till Mar 23, am I still entitled to receive the renewal benefit (domestic ticket/ tata cliq voucher) or is that benefit only available on payment of renewal fee?

@Puneet, I’ve heard from people you get it. I don’t have a personal datapoint

I have been using Magnus since 7 months, I receive my bonus in 15 days of spending 1 lac.

Only 5x and 10x edge rewards took 3 months but I received with no cap .

@R, are you sure you are getting your bonuses in 15 days? Or are you tracking it wrongly because a month is never mentioned in the posting comments? Because we are all waiting for the spend bonus for November 2022 to post right now.

Yes, the milestone bonus is received in the same month.

I have some fixed spends in the first 5 days, I notice the credit of my milestone before even the ninth ends.

I noticed Delay only in 5x and 10x

@ R, you are counting prior months’ bonuses as those which have come up that month. That is what I feel. As I mentioned, the last credit done (as I showed in the article) was for October 2022 spending credited in January 2023.

Is any of the transfer partners disproportionately beneficial? Since I use miles rarely, it’s quite hard to determine the value.

Hello Sir,

Thanks for great info.

How about earning compare to Diners Black?

@Pravin, much better, obviously.

Thank You 🙂

Is there any limit on points (i.e.10000) on buying gift vouchers through GYFTR using Axis bank Magnus card

I have the Vistara Infinite card and Infinia. Would the Magnus be useful for me? Also, what will happen to the CV points if Vistara merges with AI? Thank you for your reply.

@Ajay, how can I tell you if a card will be useful for you or not? You need to figure that out yourself. As for what will happen to CV when Vistara/AI merge, I don’t think even the airlines have started thinking on those lines yet.

Nice

I think we can add one more feature of the card.

Forex markup is 2% plus GST.

This is quite useful for some people.

@Arjun, yes, but many cards are now offering lesser than the usual 3.5%++ FX charge; anyhow, added it.

Which one would it be? Vistara infinite offering gold membership on vistara or this?

@Saurav, vistara cc for the gold tier, this one for the points. How about both

Magnus might come across as a great product, but Axis’ customer service is dismal and terrible! I pity Citi customers who will migrate to this bank. The speed at which people are jumping to this card will run away at same speed as soon as it is devalued (a certainty)! One of the worst customer service.

@anshul, I think Axis currently has the mandate to spend to gain market share, and hence, that day should be a while away. Think of them as how Citi was back in 2013. As for Citi customer service, it degraded as well if you noticed recently.

I have an Infinia metal version mainly for airmiles and lounge access which I got six months ago with joining fee waived as an upgrade to my DC-Intermiles card. The downgraded points ratio and limited transfer partners with Infinia is tempting me to consider Magnus due to its lounge access, meet n greet, bonus points as well as many transfer partners. What do you advise?

Also, do these unlimited Priority Pass offerings by Infinia/Magnus qualify us to have free access to the sleeping pod lounges in Dubai International airport akin to the regular ones? What’s your experience?

@ Swamy, there is space for both Infinia and Magnus in the wallets of many. Since you already have a fee waiver on Infinia, there should be no problem adding this to your wallet and paying the 10K++ per annum (which you will, anyways, hopefully, get a waiver on in the second year if you do the 1L spend per month).

As for sleeping pods in DXB, while I have never used them if you read the T&C, they sound exactly the same as regular lounge visits so no problem. https://www.prioritypass.com/en/lounges/united-arab-emirates/dubai-international/dxb12-sleep-n-fly

Thanks Ajay.. I just applied for Magnus using the link.

Amazing card indeed, best in India at least till the current offers last.