American Express offers a range of credit cards in India, apart from their flagship charge cards. At the entry level, American Express offers airline-agnostic credit cards for those interested in using their rewards for travel. Their offering in this segment is the American Express Platinum Travel Credit Card.

Unlike other card-issuers, who provide enhanced rewards on booking travel with your “travel credit cards”, American Express Platinum Travel Credit Card focuses on providing rewards which enable you to experience travel.

On an ongoing basis, the Card provides you with 1 Membership Reward (MR) point for every INR 50 spent on the Card. There are exceptions, though, such as spending on fuel, insurance, and utilities, which do not earn any MR.

If you shop via the Rewards Multiplier portal, Amex offers additional points. In this case, the points rewarded can go up to three times the usual points received for using the Card.

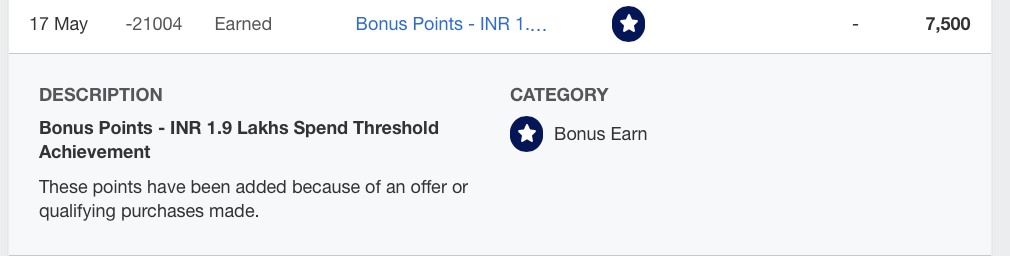

Amex Platinum Travel Credit Card does have more exciting offers like milestone benefits, which can be easily achieved and provide bumper rewards. When you spend INR 1.9 Lacs on the Card in a membership year, you are automatically credited with 7,500 threshold MR bonus points.

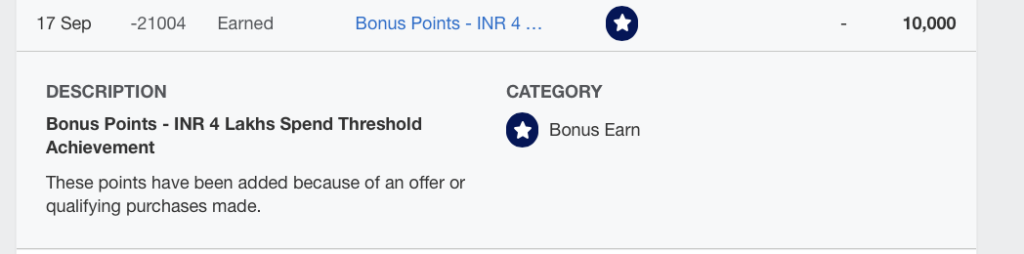

Additionally, when you spend a further INR 2.1 Lacs on the Card (a total of INR 4 Lacs in a membership year), you are credited an additional 10,000 threshold MR points and receive a Taj Hotels Gift Voucher worth INR 10,000.

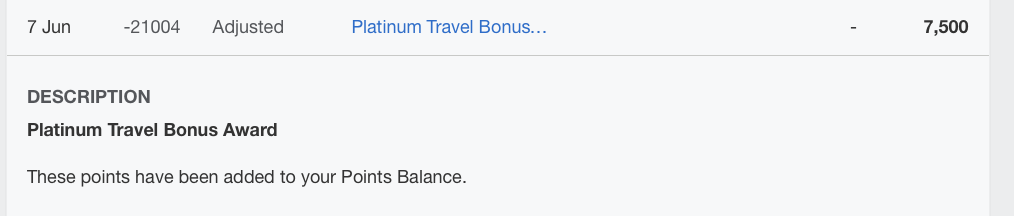

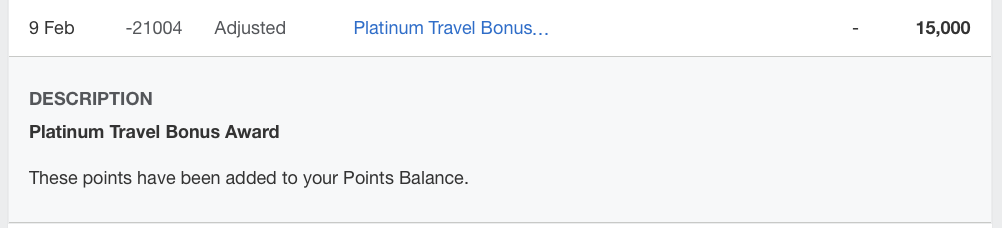

You can also call on the American Express Helpline or use the chat function to get yourself a further milestone bonus of 7,500 MR points on spending INR 1.9 Lac per annum and 15,000 MR points on completing spends worth INR 4 Lacs in a year on the Card.

Summing things up, on spending INR 4 Lacs in a membership year, you will then earn 8,000 Membership Reward points (calculated basis of 100% of the amount spent by you on eligible categories throughout the entire year) and 40,000 Membership Reward points as a bonus, totalling up to 48,000 Membership Reward points. When you redeem these MR points for Taj Vouchers, you get INR 24,000 worth of vouchers (at the redemption value of INR 0.5 per MR converted).

This is over and above INR 10,000 worth of Taj Vouchers, which you receive on spending INR 4 Lacs anyway. So, you get INR 34,000 worth of value from using this Card in a year (assuming you hit both spending milestones). Those INR 34,000 vouchers are usually good for two nights at most Taj properties across India.

But even if you don’t want to use the MR points for Taj vouchers, you can convert them into Marriott Bonvoy points at 100:100 conversion or 1000:900 conversion to Hilton Honors points and use them for hotel stays. Alternatively, you can transfer them to the frequent-flyer program of leading airlines with Asia Miles, Club Vistara, British Airways Executive Club, Emirates skywards, Etihad Guest, Qatar Privilege Club, Singapore KrisFlyer, and Virgin Atlantic Flying Club.

A recent change has made spending on this Card even more beneficial. Your Membership Rewards points no longer expire, which means you can accumulate even more MR points and then use them for a more extensive travel plan rather than using them on an annual basis. Not just this, the Card also has options towards spending these MR on booking air tickets using the Amex Travel website or converting them into Flipkart vouchers to purchase goods with them.

Amex also offers eight complimentary domestic airport lounge visits per year (limited to two complimentary visits per quarter) on this Card across nine cities, making it worthwhile for those who occasionally travel by helping their pre-flight experience.

In a nutshell, the Amex Platinum Travel Credit Card gets you benefits worth over INR 30,000 rewards every year, all of which are oriented towards travel. You can use the rewards for a family trip or getaways with friends every year or accumulate the rewards to plan one long trip every few years.

The American Express Platinum Travel Credit Card is available for INR 3,500 fee for the first year, and you get an additional 10,000 bonus MR points (on spending INR 15,000 on the Card within 90 days). Alternatively, you can get the Card through the Member Get Member programme. You get it free for the first year and a bonus of 2,000 MR points (on spending INR 5,000 on the Card within 90 days).

This article is published in partnership with American Express India.

@Ajay I am planning to apply using your referral link in the ongoing MGM. Could you please clarify the below?

1) The Amex website seems to suggest that the RPs can be redeemed only for Flipkart or ATO at a value of 30p/point. Is this the case? I don’t see a reference to other redemption options that you have listed.

2) I was under the impression the points could be used in the 18k and 24k catalog. Is that the case or not?

3) I already have a MRCC. If I get a 2nd Amex, can the points earned on both be combined and redeemed?

Thanks very much for your time and efforts.

The lounge access isn’t worth it. They won’t let you into their Delhi Lounge. Apparently it’s only reserved for Platinum card holders, and Plat Travel doesn’t count.

@Nate, nowhere did we indicate that access is for the Amex Lounge. Amex publishes a list of applicable lounges for access for this card.

@Ajay

Just to add, Amex offered me LTF MRCC Gold(which I was already holding) till I continue holding the Platinum Travel CC. Only 1 AF to be paid is a good thing!

Could please you expand on how to go about this? Thanks

“You can also call on the American Express Helpline or use the chat function to get yourself a further milestone bonus of 7,500 MR points on spending INR 1.9 Lac per annum and 15,000 MR points on completing spends worth INR 4 Lacs in a year on the Card.”

@David Rajan, what specific insight do you need? You just call Amex, ask them to review and see if any more points need to be added because you achieved the milestone.

AmEx does not post these bonus points without customer making the request. This helps AmEx profiteer from customers who might miss calling AmEx thinking this earning should be posted automatically / proactively by AmEx.

This card is indeed an amazing card if one is able to spend around 3.5 to 4 lakhs annually in a year.

And also if ones to redeem on Taj / Mariott, this probably gives the best value.

I think the greatest advantage AmEx has over other cards, is that the MR points usually don’t expire.

Even for the MRCC cards (unless one goes for the non FTO option) the points don’t expire.

Usually for other cards, the points have a validity for 3 years.

So this is where AmEx shines.

Just hoping that they keep trying to increase the ambit of card acceptance throughout the country.